Investment Thesis

Wall Street loves a story. And the story we have been focused on is just how big an impact Disney+ (NYSE:DIS) will have on Netflix (NASDAQ:NFLX). On the one hand, I suspect the impact might be smaller than many envision. There is indeed plenty of space for these two giants (and couple more).

On the other hand, and perhaps most important, we don't actually need to know beforehand which company ends up holding what market share.

Even if Disney is playing catch-up to Netflix, investors are nevertheless substantially better off investing with Disney rather than Netflix. Here is why.

What Can We Expect From Disney+?

One of the most meaningful numbers that Disney shared was an expectation of its global subscriber number reaching approximately 75 million by 2024.

Now, here is the bad news; 2024 is a long way off. Investors are not likely to be so patient. Now, onto some good news. Presently, investors are not being asked to participate in this potential as Disney's valuation is not pricing in much in the way of success.

Moreover, Disney's Q2 2019 earnings call was decidedly tight-lipped when it came to offering up any further insights surrounding its Disney+ platform. Any specific questions from analysts were, in fact, diverted and pointed towards Disney's Investor Day.

But there was one thing which did percolate, and that was that there was a surprisingly large amount of content going to be on the platform from the get-go. Rather than a slow ramp-up which many had been expecting.

In part, it helped that Disney was able to exploit part of its license agreement with Netflix to temporarily bring back some films from Netflix's streaming service.

Why Disney's Business Model Is Superior?

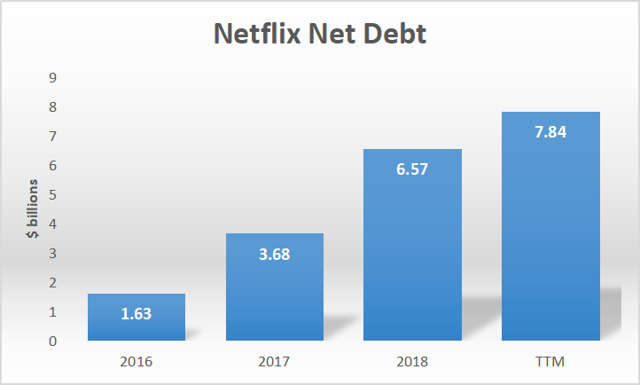

Moving on, let's put the spotlight on Netflix. Netflix proudly boasts of spending huge sums of capital on content. The latest figures for 2019 come in at approximately $15 billion. The problem for Netflix is that every time Netflix resources the debt market, it is continuously putting its balance sheet in a perilous position.

Since 2016, up to the trailing twelve months, Netflix's revenue has increased by 88%. While in the same time frame, its debt load has increased by 380%. And similarly, its interest expense has increased by 280%.

Now, every Netflix shareholder has heard this argument countless times. Why would it be any different now? Well, the answer is again coming back to Disney, in how it funds its direct-to-consumer platform.

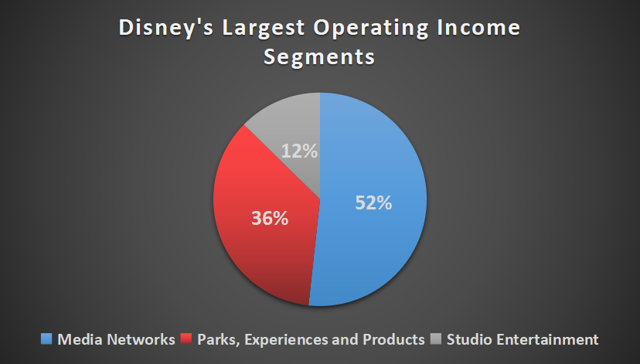

In anticipation of launching its DTC platform, Disney has shuffled around its segments slightly. Nevertheless, we can still ascertain the biggest contributors to its operating income.

Source: author's calculations, SEC filings

Highlighted in red, you can see that approximately 36% of Disney's operating income is being derived from its Parks, Experiences and Products segment. A self-sustaining unit which is growing at approximately 15% per year. And what is most pertinent here is that it is not dependent on financial markets.

Valuation - Disney Has A Large Margin Of Safety

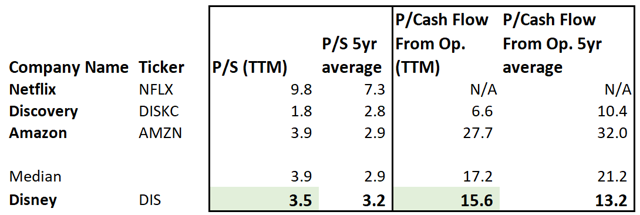

Source: author's calculations, morningstar.com

As the table shows, Disney's valuation has uncertainty hanging over it, as investors remain unsure as to whether Disney's DTC platform will indeed be a success or not. As such, investors are only willing to pay 15.6x, despite the fact that Disney's operations will be the most diversified it has ever been.

I have included in the table Amazon (AMZN) which is obviously not a pure play competitor to Disney, but Amazon Video is still a significant peer in the space. For similar reasons, I have included Discovery (DISCK).

Finally, one aspect is clear, with Disney, investors are only willing to pay roughly the same as they have been willing to pay historically. Despite the fact that Disney is arguably on the verge of its biggest pivot in years.

What's more, if we look at Netflix's valuation, we can see that not only are investors happy to pay more for its revenues than they have historically, but we must also acknowledge the fact that investors have very little idea of what Netflix's long-term operating margins are likely to be.

The figure which Netflix offers investors as a guide is 13% operating margin. But this figure is based off aggressive capitalization of costs. Ultimately, we have very limited insight into how Netflix's margins will in reality fall.

The Bottom Line

Netflix is playing a dangerous game by continuously taking on debt which is no longer being translated into rapid revenue growth as it once was.

Disney has a lot more to prove, but investors are evidently not being asked to pay a lot for the potential that it ultimately succeeds.

Disney is cheap. Netflix is priced beyond perfection. The choice is clear.

Author's note: If you enjoyed this article and wish to receive emails of my latest research, please click "Follow" at the top of this article.

Do you seek diversification? Off-radar investment ideas?

If you're looking for investment ideas with both known and unknown names which are selected for their solid free cash flows yield, then sign up for a two-week free trial with Deep Value Returns today!

Note: I'm always invested alongside you in my Top 5 Picks.

Seeking Alpha guarantee: Cancel within 14 days and don't get charged.