With downward pressure on interest rates building over the last several weeks, preferred stock issuers took the opportunity to introduce ten new securities during June. As the month came to a close, the average market price for all U.S.-traded preferred stocks was $25.27, up $0.08 per share over the last month but right where they were twelve months ago.

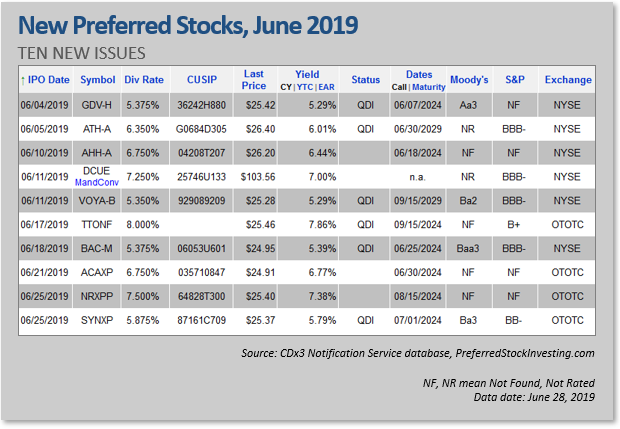

June’s new preferred stocks

June’s ten new preferred stocks are offering an average annual dividend (coupon) of 6.5 percent, an average current yield (which does not consider reinvested dividends or capital gain/loss) of 6.3 percent and an average Yield-To-Call (which does consider reinvested dividends and capital gain/loss) of 6.0 percent (using June 28 prices).

Note that I am using the IPO date here, rather than the date on which retail trading started. The IPO date is the date that the security’s underwriters purchased the new shares from the issuing company.

A special note regarding preferred stock trading symbols: annoyingly, unlike common stock trading symbols, the format used by exchanges, brokers and other online quoting services for preferred stock symbols is not standardized. For example, the Series A preferred stock from Public Storage is “PSA-A” at TDAmeritrade, Google Finance and several others, but this same security is “PSA.PR.A” at E*Trade and “PSA.PA” at Seeking Alpha. For a cross-reference table of how preferred stock symbols are denoted by sixteen popular brokers and other online quoting services, see “Preferred Stock Trading Symbol Cross-Reference Table.”

There are currently 125 high-quality preferred stocks selling for an average price of $25.81 (June 28), offering an average current yield of 5.4 percent. And 29 of these high-quality issues are selling below their $25 par value, offering an average current yield of 5.0 percent. By high-quality I mean preferreds offering the characteristics that most risk-averse preferred stock investors favor, such as investment grade ratings and cumulative dividends.