Immunomedics (IMMU) stock has risen approximately 8% in the last week since we picked it up in my premium research service. The stock is a good contrarian pick and shares have more upside ahead.

Immunomedics' sacituzumab has the potential to change the treatment paradigm of refractory, heavily-pretreated, metastatic triple-negative breast cancer, a disease with great unmet need

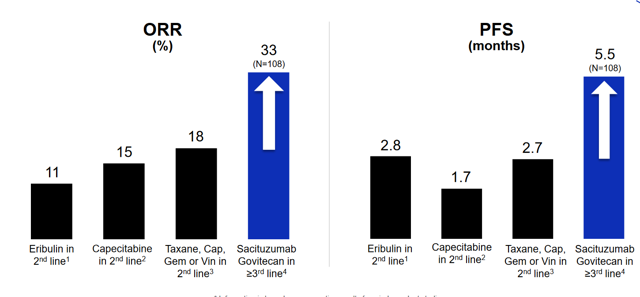

Immunomedics' proprietary antibody-drug conjugate, sacituzumab govitecan (IMMU-132, which combines a humanized monoclonal antibody, which targets the human trophoblast cell-surface antigen 2 (Trop-2), with SN-38, conjugated to the antibody by a cleavable linker; patent protection till 2033) has shown excellent response rate of 33% with median duration of response = 7.7 months, increase in progression-free survival, PFS of 5.5 months (higher than standard of care, SOC), and increase in overall survival of 11 months in advanced/metastatic, heavily-pretreated triple-negative breast cancer (mTNBC), a disease with poor prognosis and high unmet need, resulting on FDA Breakthrough therapy designation (its efficacy is significantly higher compared to SOC therapies, with acceptable safety profile) (target market=about 8,000 patients in the U.S. and 14,000 patients in the EU and Japan).

Sacituzumab's mTNBC data (Source)

Sacituzumab's CRL was related to manufacturing issues which have been addressed

FDA issued a complete response letter, CRL, to sacituzumab's BLA (under accelerated pathway) as a third line or higher mTNBC indication in January this year, citing manufacturing related issues (primarily at the New Jersey-based facility where the antibody is manufactured). According to the news release, "The issues related to approvability in the CRL were exclusively focused on Chemistry, Manufacturing and Control matters and no new clinical or preclinical data need to be generated." Combined with the CEO's departure in February, the stock has been down from its peak as a result.

The management has addressed the manufacturing issues raised by the FDA (including a recent deal

Premium service 50% discount offer

I invite you to take a no-obligation two-week free trial of the premium service, Vasuda Healthcare Analytics, where my reports are published first before public release. A 50% discount offer is open this week for the 4th of July occasion (for new subscribers, on annual subscription only), thus reducing the price to just $17/month. Please send me a direct message on Seeking Alpha's platform to get your discount code.