Tencent: short introduction

Tencent is one of the largest tech companies in the world. It is primarily known for its all-encompassing app called WeChat. Citizens in China use WeChat for basically everything: communicating with friends and family, ordering a cab, doing payments.

Tencent can't be compared to a social network, because it's more than that. It can't be compared to a fintech, because it's more than that. Not to a game publisher either, because...

The company does a lot of things at the same time. It's operating revenue comes primarily from gaming and the social networks it has. More and more, however, the company has been investing into other tech companies. If you're buying Tencent, you're not only buying a diversified tech business: you're buying a diversified tech fund.

Tencent is the portal into the Chinese internet, which is growing every day.

How has Tencent fared in 2019?

Tencent had a miserable 2018. Regulatory issues has pushed back a lot of new game development and game publishing. The company was unable to monetize some of its most played games. The Chinese government is cracking down on game addiction, and naturally Tencent has taken a hit.

Late January, there was finally some good news: the Chinese government started working through a backlog of unapproved games. Tencent makes 40% of its revenue from games, so this is absolutely essential for the company.

The company is up 16.77% YTD, even with the China-U.S. trade war in full effect.

On May 15th the company released its Q1 earnings.

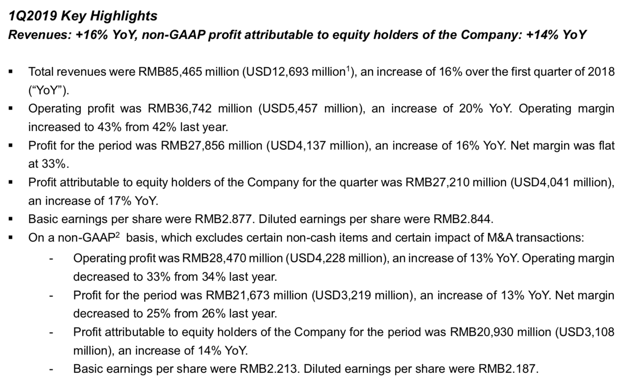

Figure 1: taken from Tencent's Q1 earnings release

Figure 1: taken from Tencent's Q1 earnings release

The company grew revenues by 16% year over year, while operating profit was up 20%. This wouldn't sound too bad, except that the company is considered a high growth tech stock, so it got badly hurt. Revenue growth is at the lowest pace since