As was largely being expected, Pakistan’s central bank announced to raise its target policy rate by 100bps to 13.25% on July 16, 2019. Following the monetary policy announcement, the question arises if further rate hikes are on the cards. Further monetary tightening in Pakistan will put pressure on Pakistan’s equities and consequently on the Global X MSCI Pakistan ETF (PAK). We believe that the central bank may need to slightly increase rates again because its current inflation expectation appears optimistic. Signals from Pakistan’s money market suggest that participants are foreseeing a peaking of interest rates in the near future.

Effect of PKR Devaluation On Inflation May Be Greater Than The Central Bank Expects

Pakistan’s inflation is currently still in the single digits, with consumer prices having recorded a growth of 8.89% year over year in June 2019. The central bank has increased rates in anticipation of inflation averaging 11%-12% in FY20. If inflation rises significantly above the central bank’s expectation then it will raise rates again, as mentioned in its latest monetary policy statement.

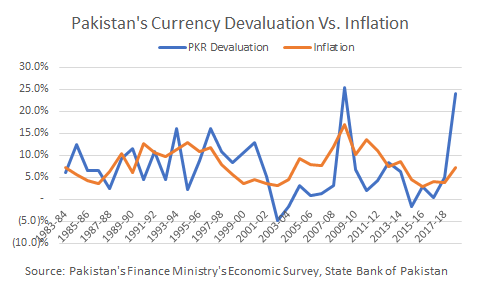

We believe that it’s likely that inflation will exceed the central bank’s expectation, leading to a rate hike. Our thesis is based mostly on the sharp Pakistan Rupee, PKR, devaluation towards the end of FY19. Pakistan’s inflation is highly dependent on the country’s exchange rate chiefly because the country relies on imported oil and LNG for its energy needs. The chart below shows how closely inflation and PKR devaluation are related. From the chart, we can see that the last time PKR experienced as severe a devaluation as it has done in FY19, Pakistan’s inflation was recorded north of 15.0%. This is why we fear that actual inflation in FY20 will exceed the central bank’s expectations.

Our theory is validated by IMF’s projections. IMF expects Pakistan’s