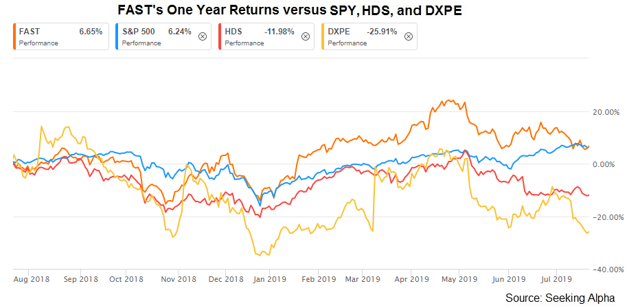

FAST Looks Good In The Medium To Long Term

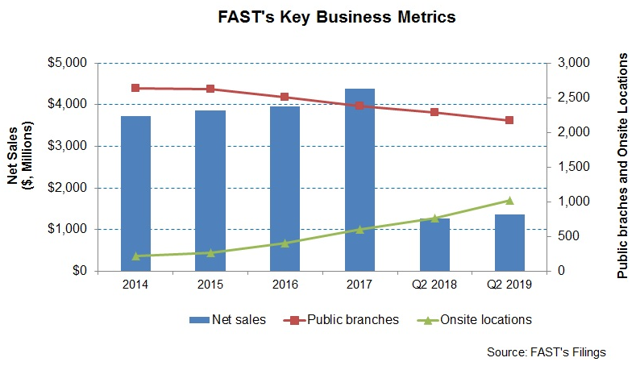

Fastenal Company (NASDAQ:FAST) is a wholesale distributor of industrial and construction supplies in North America. Fastenal’s competitive advantage lies in its robust business model. The company’s legacy business model was branch-based, but it has gradually adopted more technology-based solutions and onsite locations. The long-term value drivers point towards a steady activity flow. As the company starts improving its margin, returns from the stock can increase in the medium-to-long-term. In the short-term, I expect FAST to maintain a stable top-line, while pressure on the margin is likely to keep returns limited.

Its current strategy involves adding to the onsite locations significantly while reducing the reliance on the public branches. It has also shifted away from fastener sales to other industrial product sales. The change in product mix along with a deceleration in the higher-margin non-National Account customer growth impacted gross margin adversely. Therefore, the primary focus of the company has been on improving the gross margin. It now has set a path to increase pricing and pass along the impact of the tariff hike on to the customers, which is likely to improve margin gradually up to Q4 2019.

Analyzing The Current Drivers

For FAST, typically, the larger customers produce a below-company average gross profit. This large-versus-small customer mix and fasteners versus non-fasteners product mix change have put pressure on the company’s gross profit. In the past year until Q2 2019, it fell further to ~47% from 48.7% a year earlier. The company’s gross profit margin was 50.8% in FY2014. Because large customers can leverage the company’s existing network, the company seeks to target this group. The other root cause for the margin fall was the deceleration in the higher-margin non-National Account customers, which grew less than 1% in Q2 2019.

In

The Daily Drilling Report

We hope you have enjoyed this Free article from the Daily Drilling Report Marketplace service. If you have been thinking about subscribing after reading past articles, it may be time for you to act.

Good news for new subscribers! In May we are offering a 10% discount off the annual subscription rate of $595.00

Give it some thought, and act soon if you are interested. A 2-week free trial is applicable, so you risk nothing. Hope to see you in the DDR as we look for bargains in the oil patch!