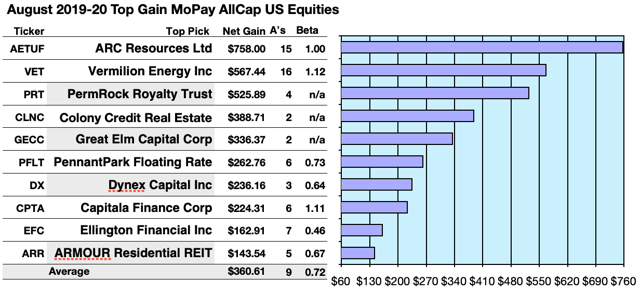

Actionable Conclusions (1-10): Brokers Estimated Top Ten MoPay Equities To Net 14.35% to 75.8% Gains By August 2020

Four of the ten top-yield MoPay stocks (shaded in the chart below) were verified as being among the top-ten gainers for the coming year based on analyst one-year target prices. Thus, the yield-based strategy for this MoPay group, as graded by broker estimates for this month, proved 40% accurate.

Projections based on estimated dividend amounts from $1000 invested in each of the ten highest yielding stocks and the one year analyst median target prices for those stocks, as reported by YCharts, made the data points. Note: one-year target prices from one analyst were not applied (n/a). Ten probable profit-generating trades to 2020 were:

source: YCharts

ARC Resources Ltd. (OTCPK:AETUF) netted $758.00 based on the median target estimates from fifteen analysts, plus estimated annual dividends less broker fees. The Beta number showed this estimate subject to risk equal to the market as a whole.

Vermilion Energy Inc. (VET) netted $567.44 based on dividends plus the median of annual price estimates from sixteen analysts less broker fees. The Beta number showed this estimate subject to risk 12% more than the market as a whole.

PermRock Royalty Trust (PRT) netted $525.89, based on dividend plus the median of target price estimates from four analysts less broker fees. A Beta number was not available for PRT.

Colony Credit Real Estate (CLNC) netted $388.71 based on a median of target price estimates from two analysts, plus dividends less broker fees. A Beta number was not available for CLNC.

Great Elm Capital Corp. (GECC) netted $336.37 based on dividend, plus the median of target prices estimated by two analysts, less broker fees. A Beta number was not available for GECC.

PennantPark Floating Rate (PFLT) netted $262.76 based on

Get The MoPay 'Safer' Dividend Dog Story

Click here to subscribe to The Dividend Dogcatcher & get more information.

Catch A Dog On Facebook At 8:45 AM every NYSE trade day on Facebook/Dividend Dog Catcher, A Fredrik Arnold live video highlights a portfolio candidate in the Underdog Daily Dividend Show!

Root for the Underdog. Comment below on any stock ticker to make it eligible for my next FA follower report.