GameStop (NYSE:GME) is in troubled waters and things are getting worse. AMD recently announced that AMD did well in CPUs but they also announced very bad numbers for console sales with forward console projections estimated to be very poor. Per the AMDQ2 2019 conference call: "Turning to our Enterprise Embedded and Semi-Custom segment, revenue decreased 12% from a year ago due to lower Semi Custom revenue."

and

"As we look into the second half of the year, we are seeing additional softness in game console demand, which is now reflected in our full-year guidance."

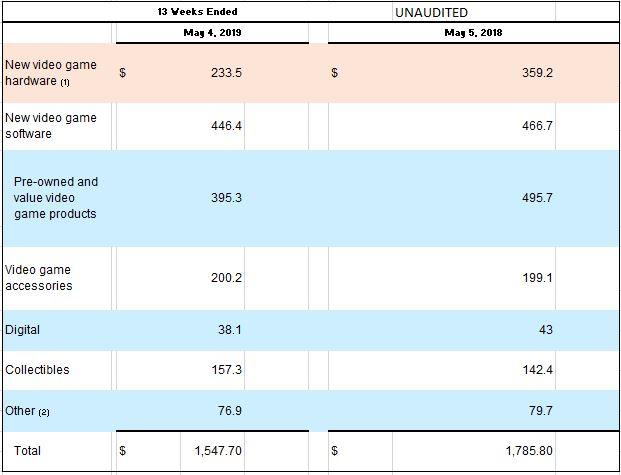

Obviously, soft console sales will impact GameStop in a very negative manner. If we look at a recent unaudited 10-Q, we will see console sales already in decline: The situation is about to get a lot worse.

Crunching the numbers, the only real section growing well (or not in decline) is collectibles and it shows in the floor space at any GameStop.

Crunching the numbers, the only real section growing well (or not in decline) is collectibles and it shows in the floor space at any GameStop.

Layoffs

In a bid to control out-of-control spending, GME is cutting regional managers and elements of its sales force. Obviously, this will impact future sales... but the Marine motto of "do more with less" comes to mind. Maybe it works out or maybe it does not, but cutting the force that actually brings in the revenue is not my idea of a wise move. On top of that 67 stores were closed while the remaining stores experienced a 10.3% decrease in sales. Per GameStop:

"Net sales decreased $238.1 million, or 13.3%, for the 13 weeks ended May 4, 2019, compared to the 13 weeks ended May 5, 2018. The decrease in net sales was primarily attributable to a decline in comparable store sales of 10.3%, the negative impact of foreign exchange rate fluctuations of $33.1 million and the impact of 67 store closures (net of openings). The decrease in comparable store sales was primarily driven