A plethora of regulatory risks and tracking prevention in both Apple Safari and Mozilla Firefox have reduced Criteo's (NASDAQ:CRTO) revenue growth from 20% CAGR to an estimated 3-6% in 2019. Despite negative developments, over two-thirds of internet users use Google Chrome, where Google ([[GOOG]], GOOGL) has taken a much more balanced approach than Apple (AAPL) and Mozilla by allowing the use of third party cookies for retargeting, provided users give consent. This is similar to E.U.'s GDPR and will have minimal impact on Criteo's core revenues as over 90% of internet users do not care about the implications of consenting to cookies. Meanwhile, Criteo's core value propositions has consistently delivered high CTR and ROAS for advertisers as to warrant it a necessity on Facebook/Instagram, where 25% of all ad campaigns consist of retargeting. While installing ad-blocking extensions have become a trend dominating over 40% of global internet users, the company's revenues have not witnessed a likewise pro rate decline. Overall, Criteo has seen remarkable resiliency in holding onto its core revenues. Looking back at last year's thesis, the author did state the stock was justified in its valuation of $26 with just 5% or more in sales growth, and hence Criteo's buy rating will be reiterated today.

Recent Catalysts/Inhibitors:

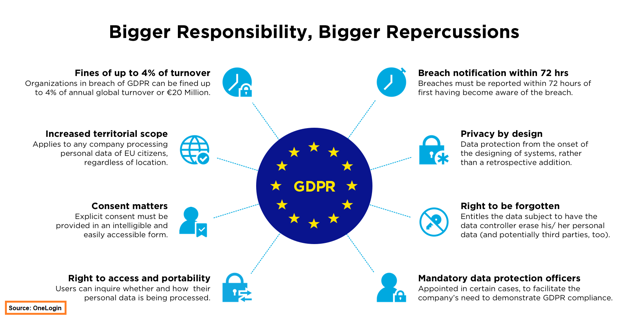

E.U. Regulation

Source: OneLogin

Source: OneLogin

The General Data Protection Regulation legislation for E.U. citizens became enforceable in May 2018 and requires the user's explicit consent for advertisers to use their browsing cookies for data analytics. Users who wishes for more information can be then taken to a compliance section of the publisher's website, where their rights with regards to privacy are explicitly stated along with the option to refuse consent to allow cookies. While seemingly burdensome on advertisers, the legislation specifically allows the practice of ad-retargeting for both advertisers and middlemen ad-tech companies like Criteo. Moreover, operational data have