Cleveland-Cliffs (NYSE:CLF) has not been written on in a while. The last article was in January 2019, with the price at $7.63. The shares closed September 9, 2019, at $7.58.

“Had it not been for the share repurchase announcement, the shares might have been considered for a high-risk investment or trade.

Risk-tolerant investors seeking exposure to Cleveland-Cliffs might want to explore selling put options to either earn the option premium or to purchase shares at a discount to the current price.”

Change Year to Date

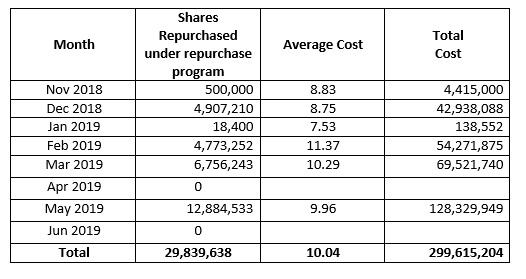

The CEO of Cleveland-Cliffs has been frustrated over the share price, feeling that that it is undervalued. This is understandable. In November 2018, the Board of Directors approved a $200 million share repurchase program, and then on April 24, 2019, an additional $100 million share repurchase program was approved. Let us review the prices paid for shares.

Nearly $300 million has been spent on acquiring shares. Cleveland-Cliffs reported in a 10-Q filing that there were 298,018,441 shares outstanding on October 17, 2018. Therefore, roughly $1.00 per share was spent on buying back shares. While the share price did move higher, it has since retraced the entire gain and then some.

It is unclear why so few shares were repurchased during January 2019 when the share price was lower and no shares were repurchased during April and June 2019. The share price closed on September 8, 2019, at $7.26. Therefore, the nearly $1.00 per share paid per outstanding shares as of October 17, 2018, resulted in a price decline of $2.78. The shares are lower than where they closed on January 3, 2019.

More recently, Cleveland-Cliffs announced a special dividend of $0.04 on top of the quarterly dividend of $0.06. It is unclear if the company's board has decided the best way to reward shareholders is with a cash dividend, or if

Stout Opportunities provides brief trading ideas making use of option to enter and exit position, and or generate additional income.