Introduction

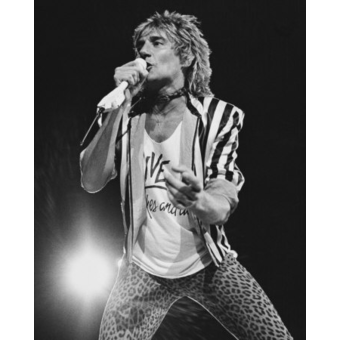

It was Fall of 1971 when a raspy-voiced English crooner ruled the airwaves with a song of pain and betrayal called Reason to Believe. Stewart wasn't the first to record it, but he put it in our ears and the on the map.

“If I listened long enough to you,

I’d find a way to believe that it’s all true,

Knowing that you lied straight-faced while I cried,

Still I look to find a reason to believe.”

- Tim Hardin

(Source)

As I sat down to write this article a few days ago for members of the Daily Drilling Report, the words copied above came into my head and seemed appropriate. How many times have we been down this road with tiny Tetra Technologies (NYSE:TTI)? Pain and betrayal seem to sum up investors' experience over the past year.

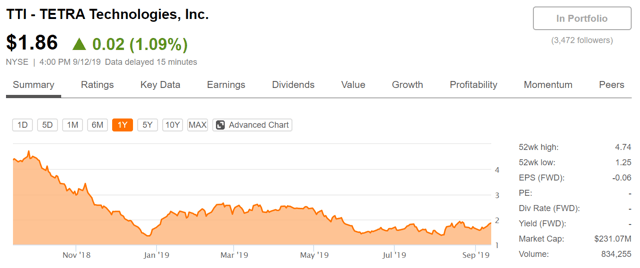

(Source)

Tetra has rallied since the first of the year from a low of $1.25 to as much as $2.60 per share. It dove down to $1.35 before Q2 earnings on the general market disdain for anything oilfield these days, but has rallied back nicely since, touching a recent high of $1.93 and has stayed in that range. An increase of 30% in a little over a month, putting it in a class nearly by itself in the OFS space.

The question before us is, what does all of this mean? Can we find a reason to believe?

In this missive, we will hit the high points of the earnings release and see if we can forecast the company's near-term future prospects.

It's all about Neptune

I've written up this technology fairly extensively in past articles, so I am not going to rewrite that verbiage. Here are some links if you need schooling.