The Company

Though the title of this article is "The Gap, Inc. As A Dividend Growth Investment," it might as well be titled "Old Navy As A Dividend Growth Investment."

By the end of 2019, The Gap, Inc. (NYSE:GPS) plans to spin off Old Navy as its own stand-alone company and thus its own stock. Old Navy will go it alone while the old Gap, Inc. will retain its eponymous retail brand plus its smaller house brands such as Banana Republic (professional wear), Athleta (women's "athleisure"), Janie and Jack (kids' clothes), Intermix (designer clothes), and Hill City (men's "athleisure").

As its own company, Old Navy plans to expand its brick-and-mortar footprint aggressively, doubling in total store count from the 1,166 it has currently to over 2,000 in North America. Just how long this growth project will take has not been specified. The expansion includes a focus on smaller markets (about 75 non-mall sites added per year), where the company aims to carve out a niche as the affordable family clothier for in-trend fashion.

The company may even expand into China, according to Old Navy CEO Sonia Syngal, where the company has little to no presence at the moment.

The store may also extend its product selection by adding lingerie, plus sizes, and beauty products, as well as to expand its omnichannel service by pushing for greater online ordering / in-store pickups. E-commerce already makes up about 20% of sales, and Syngal expects it to continue growing.

While I like the idea of moving toward greater omnichannel operations as well as adding more plus sizes, I worry that Old Navy tying to compete in lingerie and beauty could put the company at risk of becoming a "jack of all trades but master of none."

Management expects sales of $10 billion annually once this expansion is complete. Compare this to the $16.4 billion TTM total sales from GPS currently (about half of which already comes from Old Navy).

Personally, I have no interest whatsoever in any of Gap's brands besides Old Navy. While I'm certainly no fashionista, nor am I a frequent shopper of clothing in general, the clothes I occasionally do buy overwhelmingly come from Old Navy. I think the store has done a good job of keeping its styles fresh and trendy and at reasonable prices.

I am apparently not the only other person with this opinion of Old Navy vis-a-vis GPS's other brands, as the vast majority of the combined company's sales growth over the last three years (~95%) has come from Old Navy. This is over and against a $300 million revenue decline from Gap Global over the same time period, according to the Trefis Team writing in Forbes. Trefis expects GPS minus Old Navy to grow revenue at an average annual rate of 1.6% over the next few years. Gap Global's revenue is expected to continue its decline, and thus all growth will likely come from its smaller brands like Athleta and Janie and Jack. But even these face strong competition from the likes of Lululemon (LULU) and myriad kids' fashion brands.

Soon, Old Navy's revenue will be higher than the rest of the company's brands' combined, and with a higher operating margin than any of them.

In short, I feel about GPS-minus-Old Navy about like Ryan Gosling's character felt about The Gap in the movie, Crazy, Stupid, Love:

"Be better than The Gap."

Post-spinoff, GPS shareholders should own the Gap/Other Brands company and the new Old Navy company equally. In other words, Old Navy is about half the total market value of GPS.

I have no desire to either own or shop at any of these other stores / brands. To me, the bull case for GPS rides entirely on two things: (1) Old Navy, and (2) the dividend.

Let's take a step back to look at the bigger picture in order to understand why.

Performance

Look at the tags of almost any of Gap's brands' clothing. Where were they made? China, Indonesia, Mexico, Malaysia, Guatemala, etc. During the heyday of international trade expansion, GPS exploded as new designs could be brought to market quicker and cheaper.

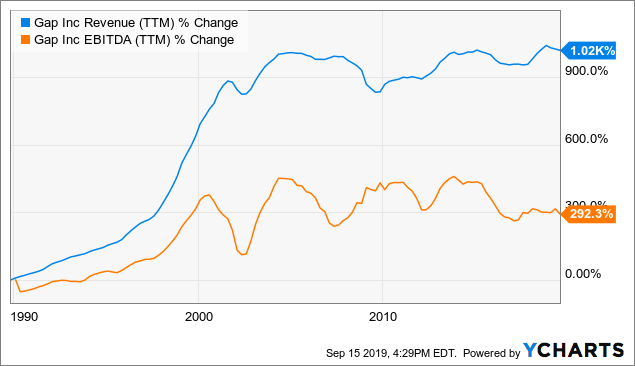

Data by YCharts

Data by YCharts

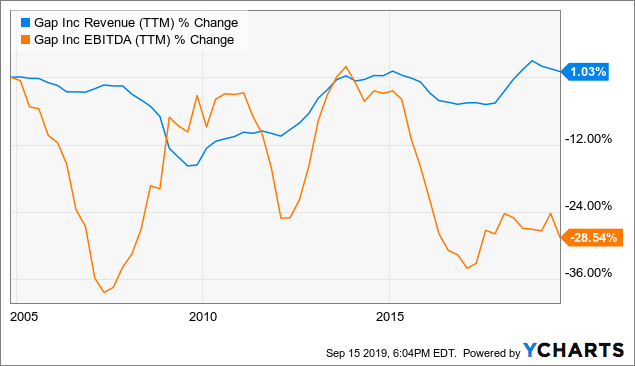

As you can see, almost all of GPS's historical growth in both sales and profits happened in the 1980s and 1990s, when international trade was growing. Since the peak in 2004, GPS has achieved practically no sales growth at all while suffering negative profit growth:

Data by YCharts

Data by YCharts

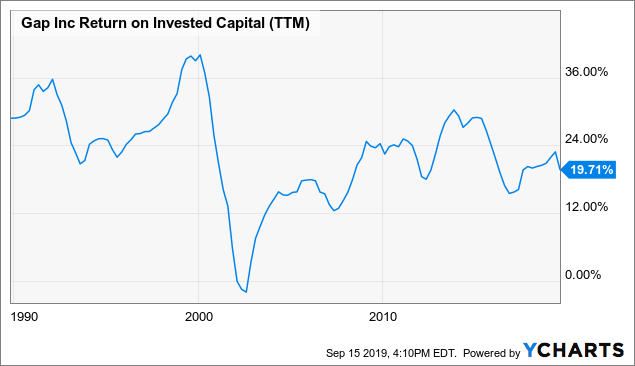

Moreover, in return on invested capital, one can visibly see the difference between the period of growing international trade in the 1990s and plateaued trade thereafter.

Data by YCharts

Data by YCharts

ROIC has still been decent and even growing from the early 2000s through 2015, but has slipped recently.

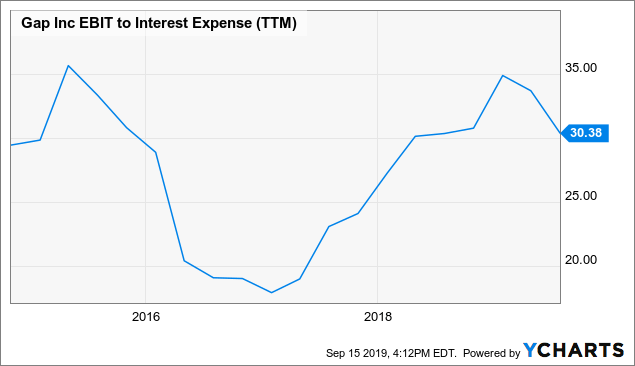

Total long-term debt to EBITDA is quite low at 0.63x, and interest coverage remains healthy:

Data by YCharts

Data by YCharts

Compare, for instance, to Target's (TGT) EBIT to interest expense of 9.4x or Nordstrom's (JWN) 7.9x.

Valuation

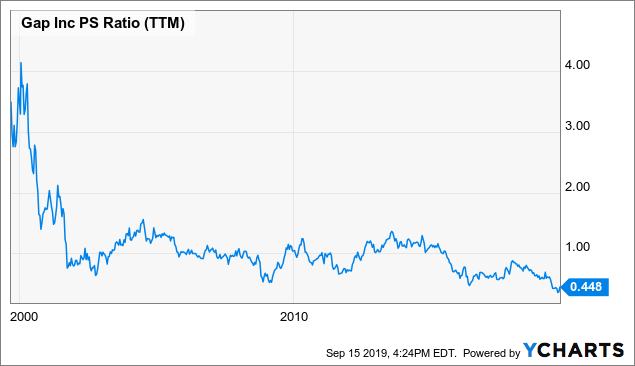

On a price-to-sales ratio, GPS hasn't been this cheap at any point in the last two decades.

Data by YCharts

Data by YCharts

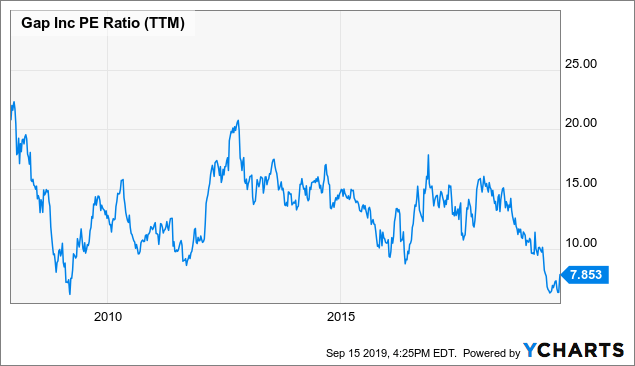

But sales alone matters less than how sales translate into profits. However, in terms of price-to-earnings, GPS is also quite cheap, trading near its Great Recession lows.

Data by YCharts

Data by YCharts

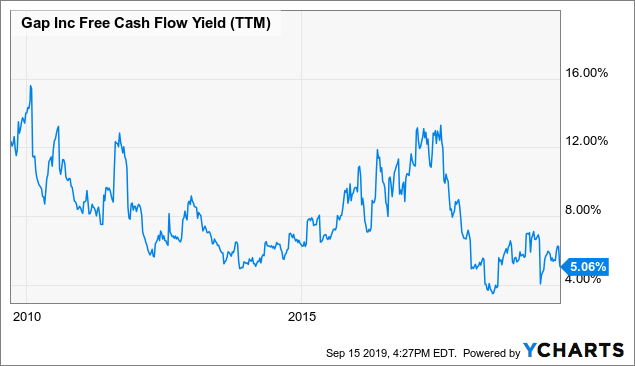

Once profits filter down to free cash flow, however, we can see the fundamental weakness of the company. A higher free cash flow yield signifies higher margins and greater dividend coverage.

Data by YCharts

Data by YCharts

As we'll see below, with a current free cash flow yield of only a little above 5% and an almost identical dividend yield, GPS is paying out close to 100%.

The Dividend

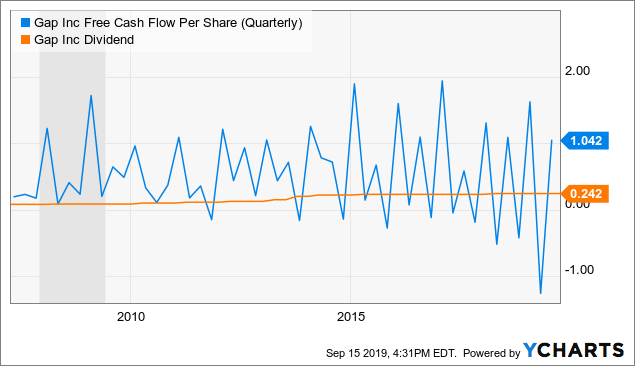

Through the Great Recession, quarterly FCF per share continuously covered the dividend payout. But beginning around 2014, FCF began slipping in some quarters as the FCF payout ratio crept up.

Data by YCharts

Data by YCharts

Most of GPS's brands, and especially Gap Global, are dragging down Old Navy, which on its own would probably have a more comfortable FCF payout ratio.

At the present juncture, it's difficult to project future dividend growth since the company will soon be splitting in two.

It is especially tricky to attempt a projection of stand-alone Old Navy's dividend, but assuming it achieves earnings per share of $1.39 (per Vince Martin's recent SA article) and pays out just under half of that as a dividend, investors could expect a payout of $0.66 per year. For a $9 stock price, that would equate to a 7.3% yield.

Assuming a more modest 33% payout ratio, the annual payout would amount to $0.46 per share, which would equate to a 5.1% yield.

Assuming, however, that Old Navy wishes to preserve even more profits for reinvestment and pays out only 25% of earnings, the yearly payout would amount to $0.35 and the yield would come to 3.9%.

DDM & Target Yield-On-Cost Calculations

Since GPS's various brands operate in the fickle retail apparel industry, I would assign a higher risk to the company and thus the future dividend growth. As such, I'll use 9% and 10% discount rates for my calculations, as well as a relatively low 2.5% annual dividend growth estimate.

9% DR: 0.97 / (0.09 - 0.025) = $14.92 per share

10% DR: 0.97 / (0.1 - 0.025) = $12.93 per share

At the current share price of $19.24, GPS is too expensive to consider if my assumptions are well-founded. Admittedly, I am being pretty conservative with those assumptions. What if the combined parts of GPS achieved 3% dividend growth in aggregate? Well, that would make the DDM calculations look like this:

9% DR: 0.97 / (0.09 - 0.03) = $16.17 per share

10% DR: 0.97 / 0.1 - 0.03) = $13.86 per share

GPS traded in this range in early September but has risen out of it since then. Now, what about a 10-year yield-on-cost (YoC)? What if I wanted to calculate the YoC for Old Navy only?

Let's assume GPS spins off Old Navy at $9 per share and the spinoff pays out 33% of earnings to shareholders as a dividend, giving it a 5.1% starting yield. Let's also assume that sales growth continues at 3% per year and margins improve so as to allow for comparable dividend growth. This would result in a 10-year yield-on-cost of 6.85% for Old Navy alone.

However, if I assume Old Navy expands its payout ratio over time to boost the speed of dividend growth, achieving 3.5% annual dividend raises, the 10-year YoC would come to 7.19%. Not bad, but not great either considering the execution risk. If I could pick up Old Navy stock at a 6% yield, with 3.5% annual dividend growth, I would be looking at an 8.46% 10-year YoC. Much more enticing.

How to translate that into the current GPS's share price? Picking up shares at $16.15 or lower would result in a 6% yield, which would in turn increase one's starting yield of Old Navy correspondingly. I think that's a good target to wait for.

Of course, this is assuming Old Navy pays any dividend, which is not yet confirmed. They may wish to maximize retained earnings for growth purposes.

Insider Trading Activity

Unfortunately, neither management nor the board of directors have demonstrated conviction in their turnaround plans via personal share purchases. Instead, over the last few years, we find insiders overwhelmingly dumping the stock:

Source: NASDAQ

Source: NASDAQ

Perhaps some solace for shareholders or potential investors is that insider selling has stopped since the stock price dipped below the mid-$20s. However, that does not mean that as the stock dipped further into the mid-teens insiders became buyers.

No company insiders have purchased shares on the open market since March, 2018. And that was a negligible amount from someone on the board of directors who previously had no position in GPS at all.

To be fair, there is substantial insider ownership of GPS's shares outstanding — around 10%, according to Guru Focus. But that has fallen from 25% a decade ago, even as total shares outstanding have also been reduced through buybacks.

Source: Guru Focus

Source: Guru Focus

Conclusion

Old Navy reported poor sales in the most recent quarter, including -5% same-store sales, which was the primary cause of the GPS stock plummet. But the American consumer remains strong and continues to spend, which gives me hope that this recent quarter could have been a mere hiccup.

From 2013 to 2018, same-store sales grew at a compound annual growth rate of 3% with plenty of volatility and some quarters of negative growth, according to SA author Vince Martin. It isn't gangbuster-growth, but it's a steady clip that makes me hard-pressed to understand how the trend would just suddenly cease. That is especially true as Old Navy expands its footprint post-spinoff.

I think $16.15 per share of the current GPS (Old Navy included) is a good target to wait for. That price offers investors a relatively safe 6% yield as well as the certainty of more Old Navy shares for one's money than current share prices.