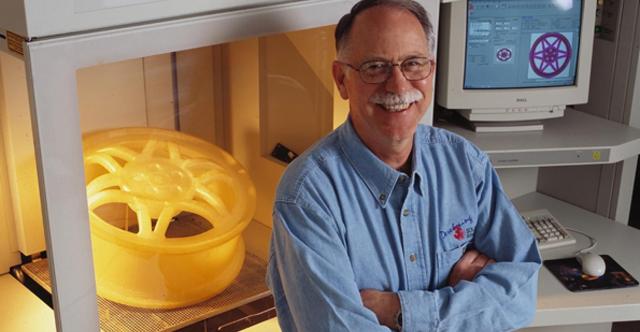

The incredible story of 3D Systems (NYSE:DDD) is really the story of the beginning of an entire industry. You see it was Chuck Hull, the co-founder and CTO of DDD, who invented Stereolithography and printed the world's first-ever 3D printed part in 1983, changing the world forever.

From Industry Week

Today, 3D printing is commonplace, used in everything from automobile manufacturing to space exploration. The technology even save lives by allowing for miracle inventions like 3D printed heart valves. Mr. Hull's invention changed the world and his company 3D Systems lives on today, although the landscape they operate in is much different than it once was.

These days 3D Systems uses not just stereolithography technology, but also more recently developed selective laser sintering, direct metal printing, multijet printing, and colorjet printing. DDD sells this tech in a host of printing systems as well as through a 'turnkey' solution that includes software and proprietary materials, allowing for more recurring revenue.

3D Systems stock appreciated enormously between 2010-14 as the company had spent years developing intellectual property through a combination of research and development and acquisitions which left them an industry leader during a boom era for 3D printers. However after 2014, expiring patents, increasing competition and a falling out of love with the 3D printing industry by investors put pressure on 3D Systems' growth and the company turned to more, perhaps unwise, acquisitions.

Since then share prices have cratered from highs of almost $100/share to around $8.50/share as DDD has struggled to reach profitability and maintain revenues. Although DDD is no longer the growing 3D player it once was (as seen below), the company is attempting to right the ship with new products, a renewed focus on operational efficiency, as well as cost and debt reduction.

Unfortunately, Q2's results were not the