Brief Background

Before delving into Hunt Companies Financial Trust (HCFT) of the current, I feel we must reflect on where this little MREIT is coming from. HCFT is the current name and iteration of the formerly failed Five Oaks Investment Corp (OAKS).

on January 18th, 2019 Hunt companies assumed control of the company - essentially taking it over moving forward. Previous management and the previous external manager were replaced entirely, along with the liquidation of the previous portfolio. In essence, Hunt companies cleaned the slate after picking up an already publicly listed company - saving them the cost of an IPO while also picking up many abused shareholders.

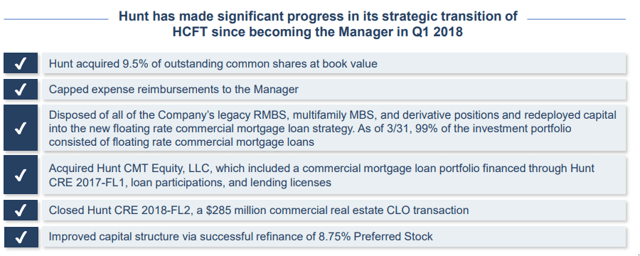

Hunt Companies quickly adapted HCFT to be aligned with the formerly abused shareholders:

Source: HCFT Earning Slides

Hunt Companies and HCFT Overview

Before understanding the future of this little part of the Hunt family of companies, we must observe the parent company.

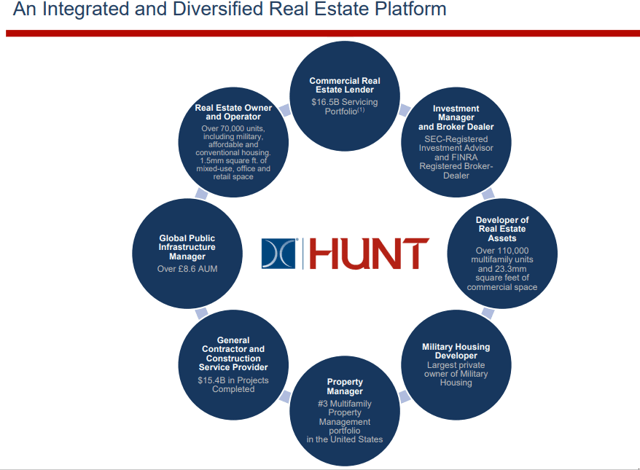

Hunt is one of the largest developer, builder, and investor in multi-family commercial real estate.

Source: HCFT earning slides

Hunt also manages a large array of multi-tenet real estate and holds a vast amount of Commercial Real Estate servicing rights.

Source: HCFT earning slides

When Hunt bought out Five Oaks, it had a specific purpose in mind. HCFT would integrate its loan origination portfolio and manage newly minted Collateralized Loan Obligations comprised of commercial real estate.

Quietly, HCFT bought out another Hunt company - Hunt Mortgage group - mainly to control its one CLO. This deal was designed to bring the CLO under HCFT's management.

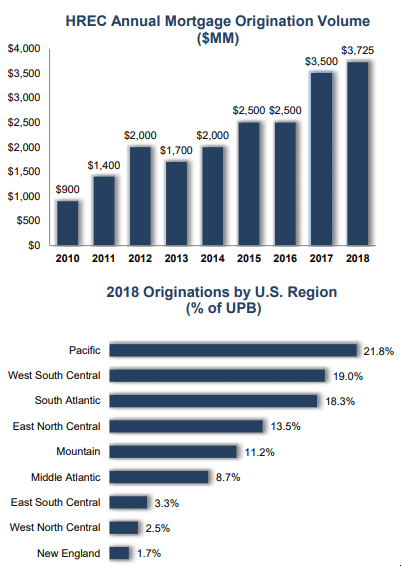

HCFT will allow Hunt to move loans from their Hunt Real Estate Capital group - who is Hunt's main loan originator - to CLOs under their management. HREC originates an extremely large number of loans:

Source: HCFT earning slides

When HCFT originates a new CLO, it

High Dividend Opportunities Autumn Sale! The Deal of the Year!

We are the most subscribed-to service in the high-yield space, consistently the highest-ranked service on Seeking Alpha since 2016. As a member, you will receive unbeatable analysis to achieve high immediate income, in addition to retirement strategies. We are offering a limited time discount for the first 100 members who join! Pay $389 and save 25%!

Invest with the Best! Join us to get instant access to our model portfolio targeting 9-10% yield, our preferred stock and bond portfolio, and our report "Our Favorite High-Yield Picks Today" . Start your free two-week trial today!