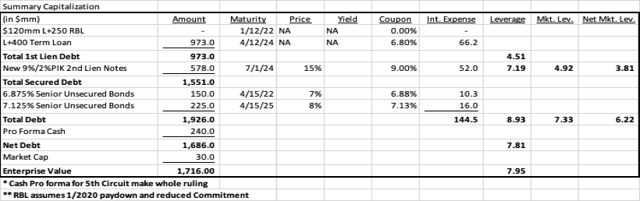

I recommend buying Ultra Resources 9% 2nd Lien bonds (9% cash/2% PIK) (CUSIP:90400GAE1) at 15% of Par with a current cash yield of over 50%. Investors are buying into Ultra at less than 3.5x pro forma EBITDA, assuming that Ultra is able to fully recover the $240 million that it is owed as result of the favorable 5th Circuit judgment relating to the make-whole litigation, at multi-year lows on natural gas prices while earning a current yield of more than 50%. Even assuming that Ultra is unable to fully recover the $240 million from the make-whole litigation and is unable to refinance its 2022 maturities, 2nd Lien bonds should still be able to receive at least 5 coupon payments providing an approximate 33% cash return.

Ultra Petroleum’s recent credit facility amendment and announcement to suspend drilling in its Pinedale field should enable Ultra, through this reduction in capital expenditures and its substantial production profile coupled with low cost structure, to generate significant free cash flow to continue to reduce debt and meet its financial obligations before it needs to address any debt maturities in 2022. Additionally, the credit facility amendment removes any maintenance covenants under the credit facility and allows for Ultra to repurchase its discounted debt in the secondary market further reducing its outstanding debt. Moreover, Ultra is expected to have fully repaid its Revolving Credit Facility as of February 2020, leaving availability of $120 million under the Credit Facility and expected proceeds of up to $240 million from make-whole litigation relating to its 2016 bankruptcy proceedings that could provide up to $360 million in additional liquidity to address any 2022 maturities. Even if Ultra is unsuccessful at recovering the remaining balance of make-whole payments, Ultra’s decision to suspend drilling, should allow the Company to generate significant free cash flow to repurchase discounted debt and continue to make coupon payments before needing