The recent successful launch of Call of Duty Mobile has Activision Blizzard (ATVI) rallying to multi-month highs. The company had long missed out on the growth potential of mobile games. Investors should hold onto shares bought below $50 on previous bullish calls.

Image Source: Call of Duty website

Initial Success

In just a few days, Call of Duty Mobile was already the top downloaded game on iOS and Google Play platforms. Activision confirmed the game had 35 million downloads in the first 3 days.

The free to play game is another big step in Activision moving away from premium console games that earn $60 per game in initial purchases, but the games make little in ongoing revenues after the initial wave causing lumpy sales. The app reached the largest download levels on iOS in over 100 countries after a global release that included all but Greater China, Vietnam and Belgium.

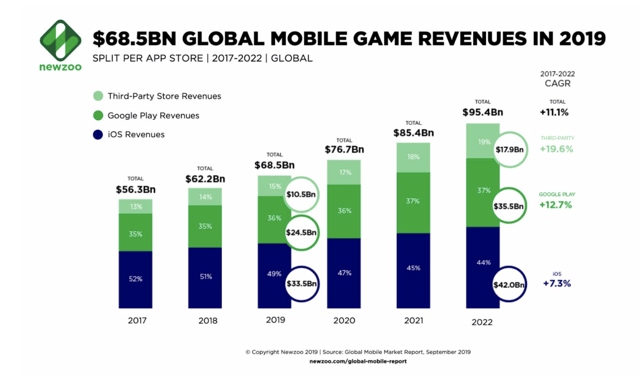

The company tapping into the mobile market is crucial as mobile games now dominate the market. NewZoo had the mobile market hitting 2018 revenues of $62.2 billion and growing over 10% to reach $68.5 billion this year.

In total, the mobile gaming market will make up 45% of the gaming market in 2019 after slowness in China approving licenses for new mobile games held the mobile market back from topping 50% of the gaming market in 2018. The research firm has the mobile gaming market reaching $95.4 billion in sales in only a few short years.

Source: NewZoo

No reason exists for Activision to not benefit from small screen games while still capturing a large share of revenues from premium games. Hardcore gamers will still focus playing time on the large screens offered by console/PC games and increasingly via cloud game platforms. The total gaming market is set to reach