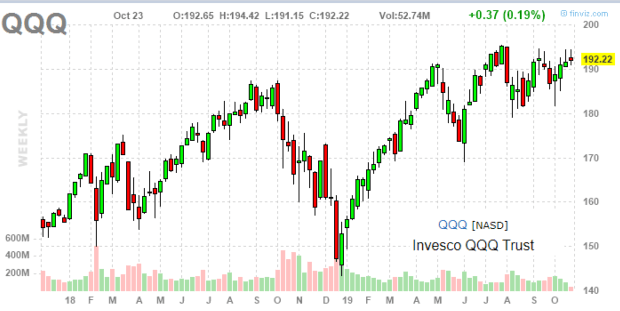

The Invesco QQQ ETF (NASDAQ:QQQ) once again is trading within a few points of its all-time high with a really impressive performance in recent months, essentially tearing down the proverbial "wall of worry". The fund is up 25% year to date on a total return basis, driven by a combination of better-than-expected earnings from the leading stocks, along with more bullish overall sentiment supported by the recent Fed rate cuts. In September, a breakthrough in the U.S.-China trade dispute reaching what was called a "phase one agreement" potentially opened the door for more upside through the end of the year. On the other hand, lingering concerns over decelerating global growth and a more uncertain outlook for the U.S. economy may limit a clear breakout to the upside. This article looks at the recent performance and valuation metrics of QQQ, along with our view on where the fund is headed next.

(Source: Finviz)

QQQ Background

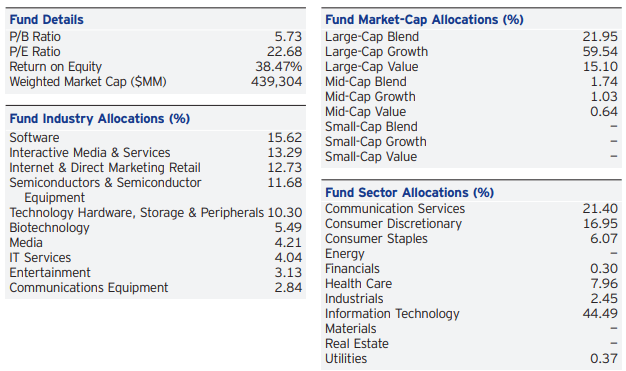

What else is there to say about QQQ - the quintessential large-cap growth fund with technology sector stocks representing 44.5% of allocations? While traditionally recognized as a tech-based index, the actual sector breakdown from the NASDAQ 100 are largely arbitrary, as many stocks blur the lines between technology and other sectors like consumer discretionary and healthcare. From an industry perspective, software application represents 15.6% of the fund, and this is an area of the market that has been very strong considering the move by companies towards the "software-as-a-service" model and of utilization of cloud-based infrastructure that offers centralized and more resource efficient solutions. The theme is generally high segment leadership and product innovation.

(Source: Invesco)

QQQ is up 392% over the past decade, significantly outperforming a broad market index like the S&P 500 (SPY), highlighting the attraction of the fund as a long-term winner. It's hard