This is a Z4 Research Pre Call Note

COG Reports Solid 3Q19 Results Despite Depressed Natural Gas Prices; Increases Dividend; Lays Out Potential Maintenance Mode Avenue

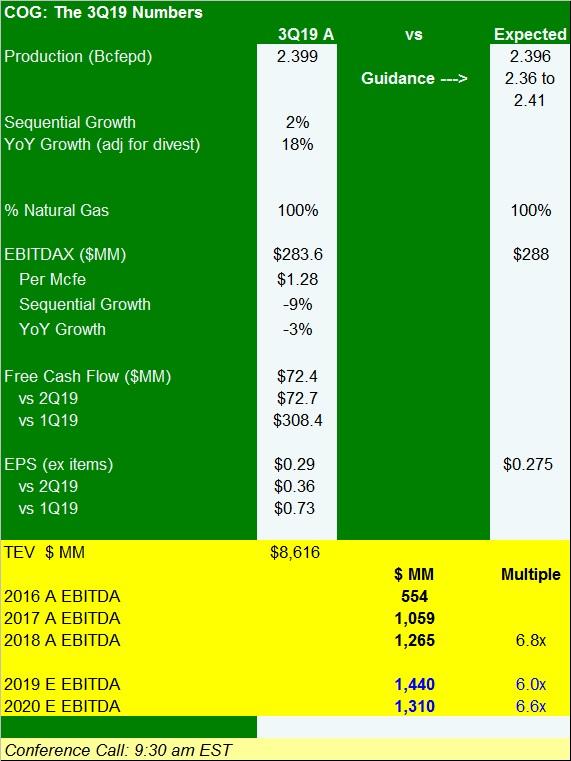

The 3Q19 Numbers:

- Volumes were in the upper half the guidance range,

- Differentials: $0.34 below Nymex (a not unexpected widening and there was no change to the 2019 differential guidance range).

- Cash OPEX (defined by us as direction operations plus transportation and gathering plus production taxes plus cash G&A) were $0.84 / Mcf, flat with 2Q levels and down 4 cents / Mcf vs 3Q18.

- Free cash flow story continues as noted in the table above.

2019 Guidance:

- Volumes: 17% vs prior guidance of up 16 to 18%. The Street was already essentially splitting the guidance.

- 4Q at 2.375 to 2.425 Bcfgpd.

- 4Q costs assumptions were fine with no surprises.

- Spending: Reaffirmed vs prior plan of $800 to $820 mm,

2020 Guidance:

- Volumes: Previously they have provided preliminary guidance for growth of 5%,

- With spending of $700 to $725 mm,

- ... But ...

- This preliminary outlook was predicated on better prices of $2.50 which have since deteriorated.

- They are also now evaluating a maintenance budget of $575 mm that would hold at the noted 4Q19 level above. We note that the $575 mm is in line with management's comments on the last call and includes about $50 mm of non D&C spending. This is above stale maintenance level figures from years ago due to current service pricing though there is the potential for improvement on that front given the current environment.

- On our math this would work out to growth of about 2% on a raw basis but they show 0% due to planned shoulder season curtailments. This would be below the Street but spending would be as well

- No decision yet