Despite fears that it is becoming obsolete, this company continues to generate lots of cash. It has successfully adapted to numerous technological changes over its 150-plus years of existence, and investors are underrating its resilience.

We first made Western Union a Long Idea on Sept. 12, 2018, and the stock is up 19% since then while the S&P 500 is flat. Even after this outperformance, the stock remains undervalued. Western Union (NYSE:WU) is this week’s Long Idea.

GAAP Earnings Mislead Investors

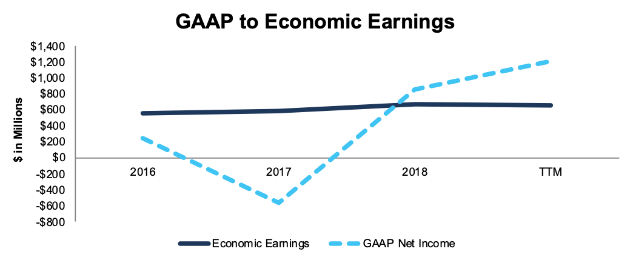

WU’s GAAP net income has been volatile over the past few years, which might lead investors to underrate the stability of this business. As Figure 1 shows, the company’s economic earnings – the real cash flows of the business – have been remarkably consistent since 2016.

Figure 1: WU’s GAAP Net Income and Economic Earnings: 2016-TTM

The disconnect between GAAP and economic earnings has a few different drivers, some easy to spot and some more hidden. In 2016, GAAP earnings were reduced by the one-time expense of $601 million (11% of revenue) for the “Joint Settlement Agreement” that Western Union paid the FTC to settle allegations that its money transfer system was used by fraudsters.

In 2017, GAAP earnings were hit by a non-recurring $464 million write-down to its Business Solutions segment (not a part of its core money transfer business) and an $828 million one-time charge due to tax reform. Combined, these two non-operating charges accounted for 23% of revenue.

Finally, TTM GAAP earnings are overstated due to a $525 million (10% of revenue) gain on the sale of its bill-pay subsidiary, Speedpay, in Q2 2019.

These non-operating items have some analysts calling WU a “turnaround” story, but economic earnings show that the business has actually been producing consistent profits the entire time.

Balance Sheet Efficiency Drives Shareholder

Get our long and short/warning ideas. Access to top accounting and finance experts.

Deliverables:

1. Daily - long & short idea updates, forensic accounting insights, chat

2. Weekly - exclusive access to in-depth long & short ideas

3. Monthly - 40 large, 40 small cap ideas from the Most Attractive & Most Dangerous Stocks Model Portfolios

This paper compares our analytics on a mega cap company to other major providers. The Appendix details exactly how we stack up.

Harvard Business School featured our unique technological capabilities in “New Constructs: Disrupting Fundamental Analysis with Robo-Analysts”.