Investment thesis

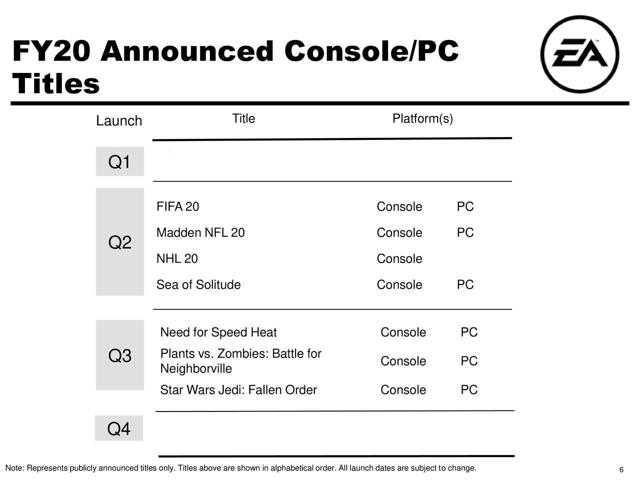

Previously I wrote about the cyclicality of the video game industry and how game releases concentrate around the last quarter of the year. This year's pipeline wasn't much-saturated before. A few days ago, after Ubisoft (OTCPK:UBSFY; OTCPK:UBSFF) announced a delay in some of its core titles, the situation is even more advantageous. Electronic Arts (NASDAQ:EA), with its robust pipeline for FQ3, is in an excellent position to reap the benefits of this cyclicality.

The company raised guidance for the fiscal year in a conservative way

[Soruce: Q2 earnings slides]

[Soruce: Q2 earnings slides]

A conservative approach is right when you expect conservative returns. For example, in the case of Need For Speed Heat. The company expects 3-4 million in unit sales, similarly to previous titles in the franchise.

Based on available pieces of information, NFSH tries to leverage what has historically worked in earlier games of the franchise. The latest titles weren't outright failures. However, given the growth in the market since previous great titles in the franchise, these releases in recent years were lackluster.

Does this mean EA is not confident about his new title? If this were the case, they would also acknowledge they don't trust their expertise in leveraging what has historically worked in a single title.

However, that is not the case. NFSH is going to be available both on EA Access and Origin Premium. These subscription services do not contribute to unit sales.

There are going to be some convenience microtransactions in Need for Speed Heat. This kind of monetization might not be a long-term revenue source, but it's a great tool to leverage more income from the subscription services as well.

Given the company doesn't expect its subscription service to cannibalize its unit sales, one could easily argue whether they expect more from the game than the