American International Group's (NYSE:AIG) stock has performed well so far in 2019, as AIG shares have outperformed the broader market by almost 20 percentage points over the last 11 plus months.

Looking back, however, the stock performance has not been anything to write home about. To this point, AIG shares have underperformed the S&P 500 over the last 3, 5 and 10-year periods.

But, as I previously described here, AIG's path forward is slowly becoming clearer under the newish leadership team and, in my opinion, the insurer's most recent operating results supports the thought that AIG is still worthy of investment dollars.

The Latest Results Were "Good Enough"

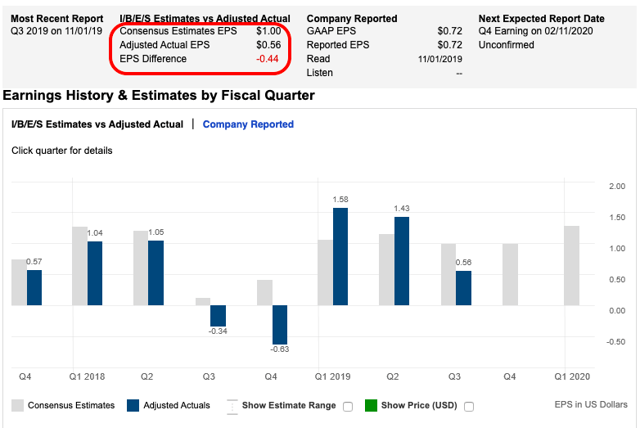

On November 1, 2019, AIG reported Q3 2019 results that missed the bottom-line estimate of $1.00 per share by a wide margin.

Source: Fidelity

The company reported Q3 2019 EPS of $0.56, which is a significant increase from the year-ago quarter.

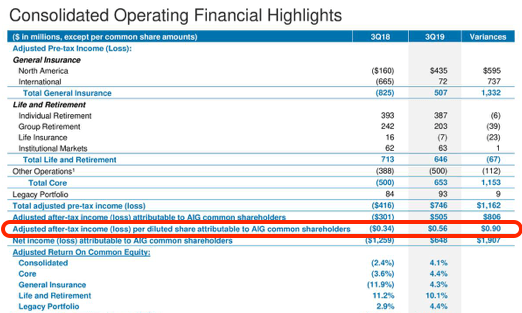

Source: Q3 2019 Earnings Presentation

Highlights from the quarter:

- Total net investment income of $3.4B, which is consistent to the year-ago quarter

- Net income increased by $1.9B to $648M, which was largely a result of an unfavorable charge taken in Q3 2018

- Book value per share ($74.85) and adjusted book value per share ($57.60) increased by 15% and 5%, respectively, when compared to 12/31/2018

AIG shares were initially down a few percentage points after the company reported its Q3 2019 results but the stock has performed well over the last week.

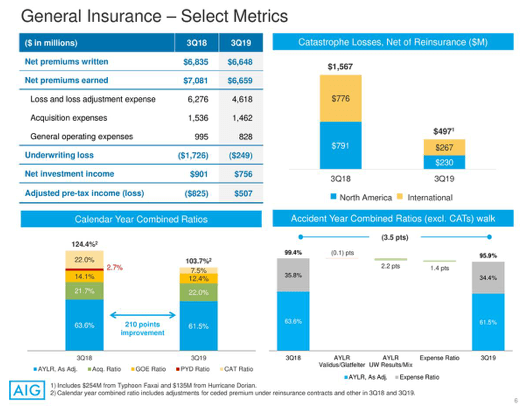

The real standout for the quarter was the General Insurance division, as shown above by the $1.3B swing in adjusted pre-tax income. The division saw premiums decline YoY but catastrophe losses, net of reinsurance improved by slightly over $1B from Q3 2018.

Source: Q3 2019 Earnings Presentation

Management has consistently talked about improving the company's underwriting profitability by focusing

If you enjoyed our stock coverage, please consider joining the Going Long With W.G. marketplace service. We cover at least one new small-cap company each month and we regularly update our thoughts on past recommendations. Additionally, subscribers have access to a Live Chat feature that allows for one-on-one and/or group conversations. *Start your free trial today*