Today was an incredible day for the oil bull in the United States 3x Oil Fund (USOU) with shares delivering a double-digit 11% return. Today's action brings the year-to-date return of the ETF to a strong 30%. In this piece, I will argue that the party is just getting started for the oil bulls, and for the aggressive investor, a trade in USOU could strongly deliver through 2020.

The Instrument

Prior to jumping into a talk about the oil markets, let's run through the instrument's methodology. It's really important to look under the hood of a fund before buying it to get an idea of what exactly you're going to be exposed to.

USOU is simple: it's just the USO ETF but leveraged up to 3 times capital. That's it. If you understand USO, then you understand USOU. But if you're unfamiliar with the benefits and detriments of USO's simplistic methodology, then this section is for you.

The basic methodology which USOU follows is this: it holds exposure in the front month WTI contract, and then roughly 2 weeks before expiry, it will roll exposure into the second month WTI contract. This means that, for a period of around 2 weeks, USOU is holding exposure in a contract which is not the prompt contract (until the prompt contract expires and then the second month becomes the prompt).

When it comes to holding exposure across a futures curve, you have to think about roll yield and its implications. Basically, roll yield is what you get from holding exposure in futures contracts as they move towards the front month contract. Tangibly, this means that, for the two-week period, when USO is holding second-month WTI exposure, the actual return of the second-month contract isn't going to perfectly track the front month return. The reason why is that the return of the second month is both a component of what happens in general to crude pricing as well as the second month contract gradually moving towards the front of the curve.

This means that the specific market structure (difference between contract prices) in these two contracts is highly important. When a market is in contango (front contract under back contracts), roll yield will be negative due to the higher-priced contracts tending to fall in relation to the front. Conversely, a market in backwardation will see positive roll yield because lower-priced futures will be increasing in value through time in an approach towards the front month.

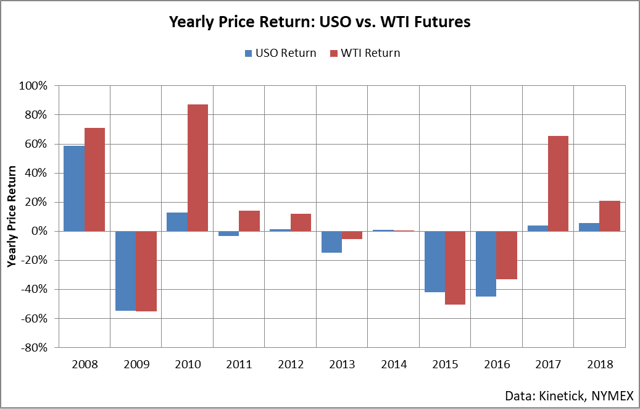

This may seem dull, boring, and highly nuanced, but it's a really big deal. Roll yield can actually be one of the largest explainers of return in some periods. For example, USO (again, the same methodology that USOU leverages) has at times dramatically underperformed the actual price of crude oil as can be seen in the following chart.

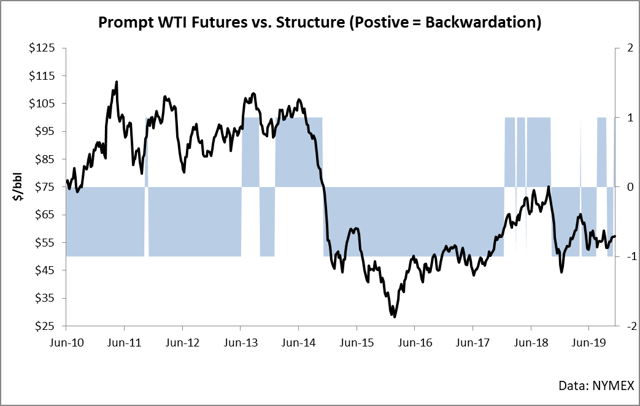

The reason for this is quite simple: the front two WTI contracts are almost always in contango. In the following chart, I've created a simple +/- chart which shows when the market has been in contango versus backwardation: as you can see, contango is the norm in these two specific contract months.

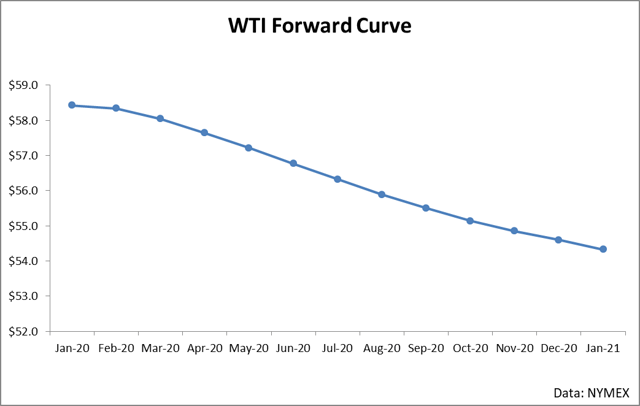

This is the peril when you trade an ETF like USOU: it is entirely agnostic to the shape of the futures curve, and it places exposure in a very simplistic manner. Other ETFs (like my beloved DBO) are adaptive and move exposure across the futures curve (by rolling into later month contracts) to maximize the benefits of positive roll or minimize the detriments of negative roll. But with USOU, you're stuck playing this part of the futures curve - a trade which on average doesn't pay out very well.

But, at present, we are currently in backwardation in the front two contracts…

…Which means that roll yield is slightly positive in USOU and therefore will be buoying returns as long as this condition remains.

Beyond roll yield, another key thing to note is the leveraged nature of the ETF. This is a very risky ETF. In the next section, I will point out that I believe that there's a possibility that crude oil will rally by 50% over the next year. Assuming we see this happen, there will be lots of volatility over the next year (in other words, the market isn't going to go straight up). This means that, with USOU, it is entirely possible that monthly fluctuations of 10-20% could be norm over the next few turbulent quarters. Carefully think through the possibility of these swings in the value of your holdings in USOU and size your position appropriately.

Crude Markets

And now, for the main enchilada. In my opinion, crude markets are currently entering one of the most bullish environments in the last several years. I base my bullishness on a few key factors which are mainly on the supply side of the balance.

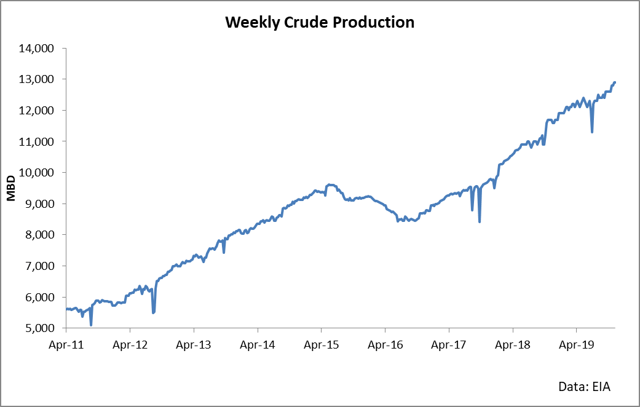

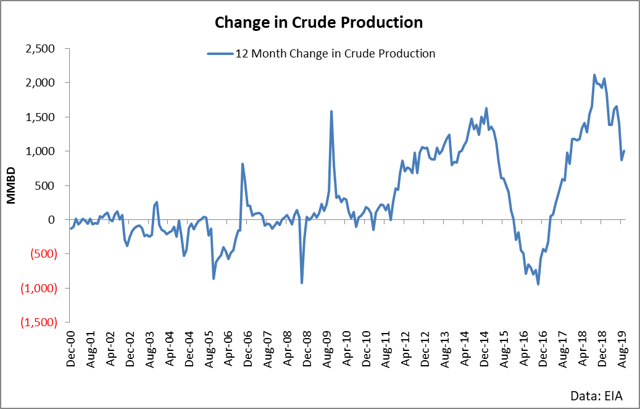

Crude production has long been touted as the glowing force of the American petroleum industry.

But there is a key problem which most market participants aren't actually noticing: crude production growth has been slowing for basically a year straight.

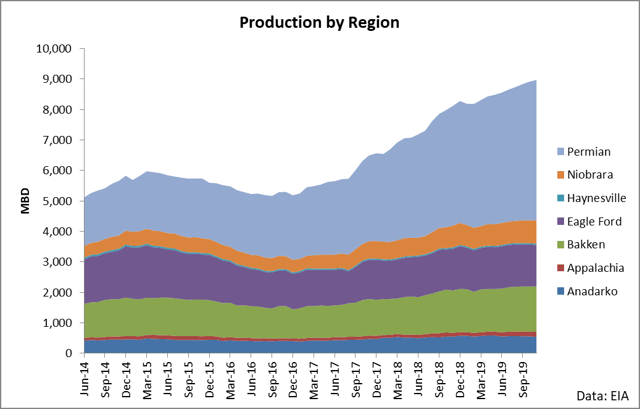

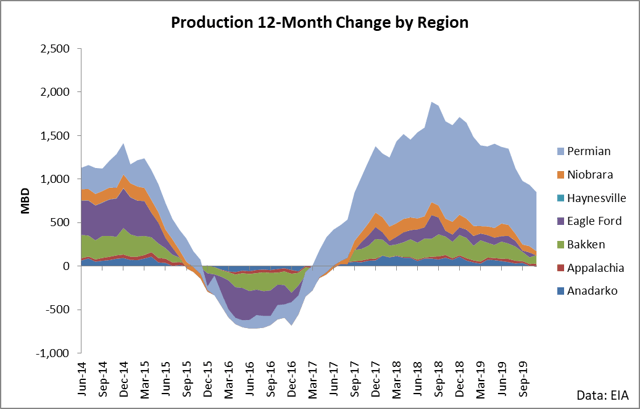

This is being driven by a wave of bankruptcies in the Permian Basin due to low prices and capital constraints. The impact of these bankruptcies in the Permian Basin is directly felt in the overall production figure because the Permian is the largest producing region by a fair margin.

Not only does the Permian produce most of the crude oil, but the Permian also accounts for most of the growth (and current decline) in production.

In other words, the Permian is largely most of the story when it comes to overall crude production in the United States. And its producers are failing due to low prices.

It's really quite simple. For crude production to pick back up, we are going to have to have higher prices. Until then, production is going to drop for prices to increase enough to incentivize more production. In other words, look for production to keep dropping until prices are significantly price higher.

The other part of the equation is OPEC. OPEC cuts have been in place throughout all of 2019, and by the end of this week, OPEC is expected to extend (or even lower) its production targets through half of 2020.

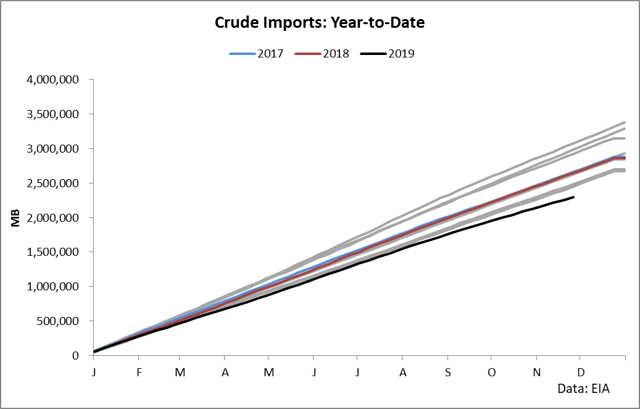

This is a bullish problem for the United States, because OPEC's weak exports have resulted in the lowest level of imports in decades.

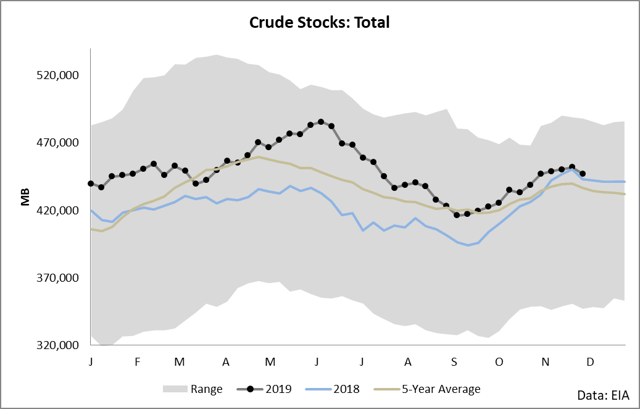

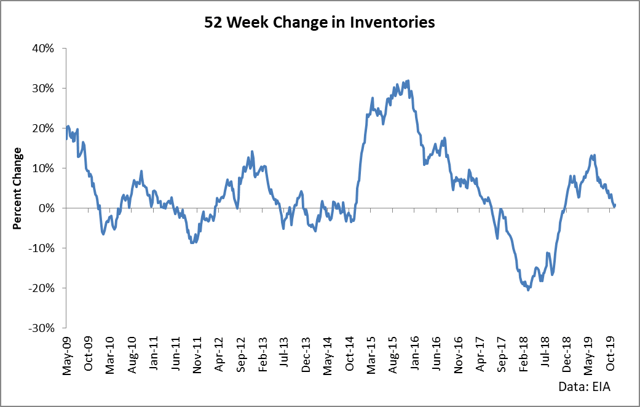

These twin ongoing supply risks have resulted in the crude balance progressively tightening throughout 2019 with the year-to-date change in crude inventories shrinking substantially.

At present, we are within a rounding error of entering the first year-over-year drop in inventories since the drop of 2017.

I would encourage you to go back and study what happened starting around April of 2017 - the last time crude inventories fell. To spoil it for you, the price of WTI rallied by over 50% throughout the next 18 months (until supply once again re-exerted itself).

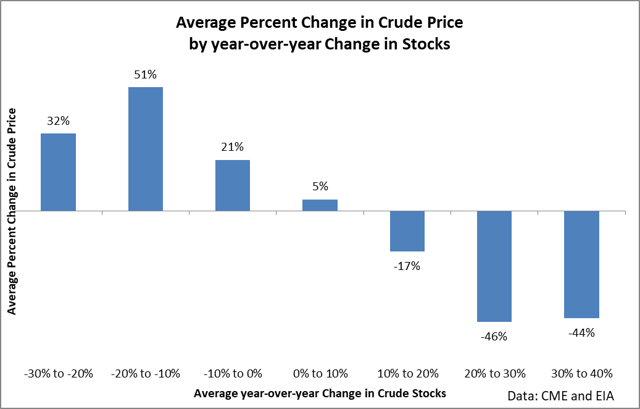

Numerically speaking, the simple trend in place will see crude inventories experience a 20% drop by the end of 2020. Historically, drops of this magnitude are associated with an increase of the price of crude oil by around 50%.

This data encompasses the last 25 years and makes perfect economic sense: prices rise when inventories fall.

Given that crude oil is poised to substantially rally over the next year, I believe that USOU makes for a strong trade for the aggressive trader. As always, risk is a very real possibility when handling leveraged ETPs, so manage your risk appropriately.

Conclusion

USOU is just USO with three times the leverage - pay attention to roll yield prior to investing in the ETF. The crude markets are vulnerable to upside risk due to ongoing supply constraints - constraints which demand higher prices to resolve. The current trajectory of declining stocks will see 2020 witness a 20% decline in inventories, leading to higher prices.