Introduction

It seems that the past week was calm for the sector and the instruments traded quite stable. Many of the Z-scores that we discussed in our last article are much higher today and even positive. The average Z-score is higher today, the average discount as well. The leading benchmarks traded quite stable during the short week. There are a couple of overvalued closed-end funds which deserve our attention as well.

The News

Source: Yahoo.finance.com

The Benchmark

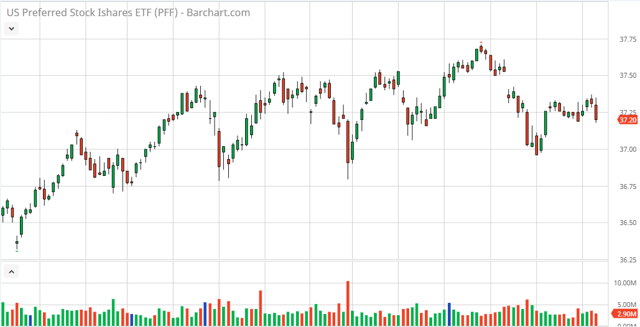

During the past week, the leading benchmark of the preferred stock sector (PFF) finished negative, closing the last trading session with a loss of only $0.03 per share. The trading volume of the ETF was below the average one. PFF started the week modest but quite promising with higher opening at $37.23 per share, but came the 'Black Friday' and erased all of its gains during the short week.

Source: Barchart.com - PFF Daily Chart (6 months)

As you know, we follow the performance of the U.S. Treasury bonds - considering them a risk-free product - with maturities greater than 20 years: the iShares 20+ Year Treasury Bond ETF (TLT). The past week was calm with very low trading volume. However, the bond ETF finished positive in the end of the week. On a weekly basis, TLT rose with $0.12 per share closing the week at a price of $140.42 per share.

Source: Barchart.com - TLT Daily Chart (6 months)

Below we can see where is the 10-Year Treasury rates:

Source: cnbc.com - 10 Year Treasuries

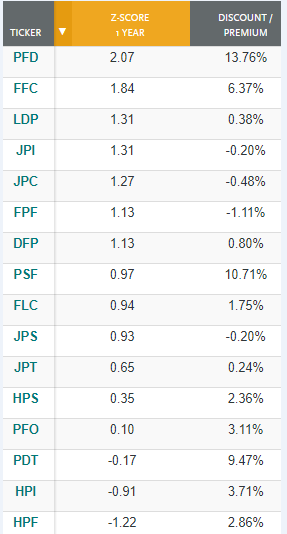

1. Sorted By Z-Score

Source: cefconnect.com

From the table above we can see the statistical evaluation of the different closed-end funds in the sector. As we can easily see, we do not have any negative results in the chart today. The lowest result that we can find is -1.22 points.

Trade With Beta

At Trade With Beta, we also pay close attention to closed-end funds and are always keeping an eye on them for directional and arbitrage opportunities created by market price deviations. As you can guess, timing is crucial in these kinds of trades; therefore, you are welcome to join us for early access and the discussions accompanying these kinds of trades.