When it's raining gold, reach for a bucket, not a thimble. - Warren Buffett

If you've been following my work, you'd notice that Clovis Oncology (CLVS) is one of the most groundbreaking stories in late 2019. As we're heading into the New Year, the market is less concerned about the China Trade War and drug pricing concerns. As such, Phillip Fisher's growth equities like Clovis are embarking on mega rallies.

Despite the fact that investors took profits, Clovis still logged in 237.6% returns. In my view, the robust fundamental developments, coupled with a drastic change in market sentiment, powered the said phenomenon. Now my gut feeling (i.e. instinct) is telling me that there are more rallies ahead. In this article, I'll feature a deep-dive analysis into Clovis and share with you my forward expectations.

Figure 1: Clovis chart (Source: StockCharts)

Figure 1: Clovis chart (Source: StockCharts)

About The Company

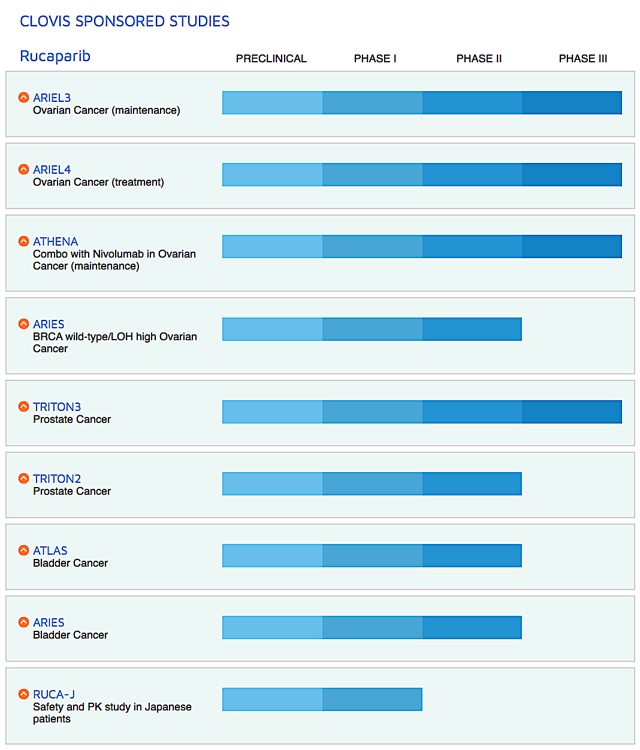

As usual, I'll present a brief corporate overview for new investors. If you are familiar with the firm, you should skip to the next section. Headquartered in Boulder, Colorado, Clovis is engaged in the innovation and commercialization of medicines to serve the unmet needs in cancer treatment. The company is currently focusing on ovarian, prostate, breast, and bladder cancers.

The flagship molecule, rucaparib (Rubraca) is FDA approved back in April 2018. As an oral, small-molecule inhibitor of poly (ADP-ribose) polymerase (“PARP”), Rubraca is marketed as second-line maintenance for recurrent ovarian cancer. Because it is a second-line drug, sales have been gradual. In my view, the most aggressive revenue growth occurs when Rubraca goes into first-line. That is to say, it'll become a blockbuster.

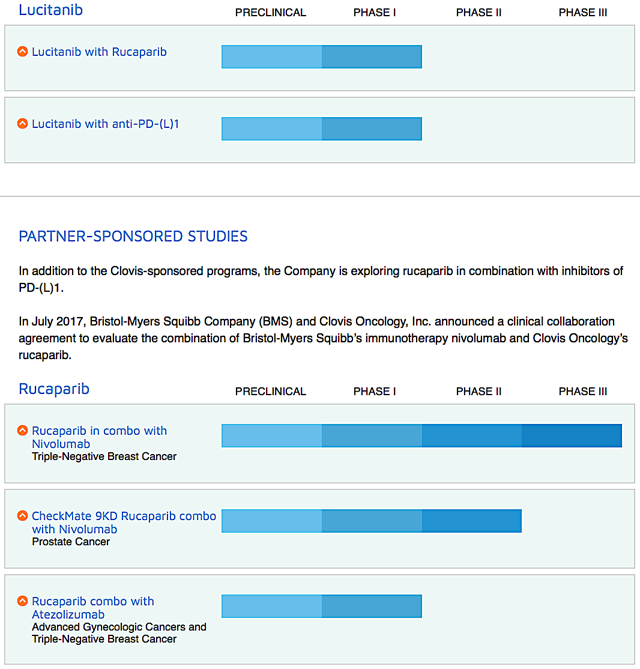

Figure 2: Therapeutic pipeline (Source: Clovis)

That aside, Clovis is assessing different combinations treatment of Rubraca either with immune checkpoint inhibitors and other drugs (lucitanib and rociletinib) for various cancers. Just recently, the firm in-licensed the rights to a

Thanks for reading! Please hit the orange "Follow" button on top for more. Don't miss out on the most profitable content (i.e. higher level intelligence) inside IBI. Here's what members said:

Dr. Tran's analyses are the best in the biotech sphere, well worth the price of subscription.

Very professional, extremely knowledgeable, and very honest … I would highly recommend this service, and his stock picks have been very profitable.

Not satisfied? See countless testimonies here.

I'm so confident in the value of my service that I'm giving you a 2-week FREE trial, money-back guarantee.