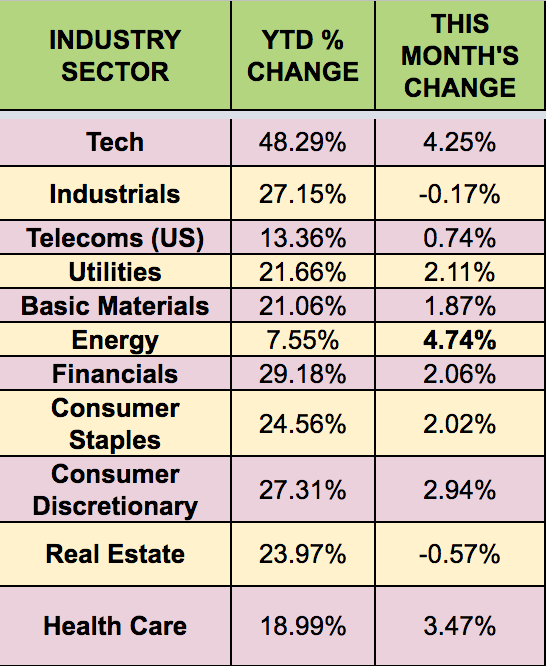

Trying to figure out the latest market sentiment? As it happens, energy has been the leading sector, with a 4.74% gain, boosted by OPEC production cut agreements and lower US supplies:

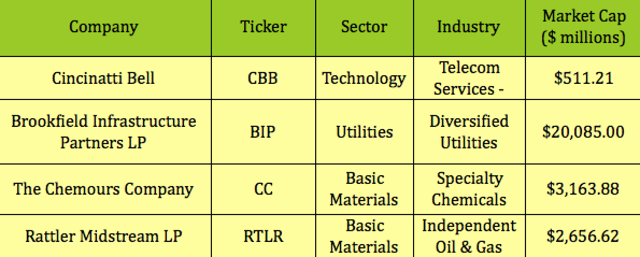

Drilling down to individual high-yield winners over the past month brought us to these four companies. Three of them were big gainers:

Drilling down to individual high-yield winners over the past month brought us to these four companies. Three of them were big gainers:

A Telecom/ Tech firm - Cincinnati Bell (CBB)

A Basic Materials/ Chemicals company - Chemours Co. (CC)

A new midstream company - Rattler Midstream LP (RTLR)

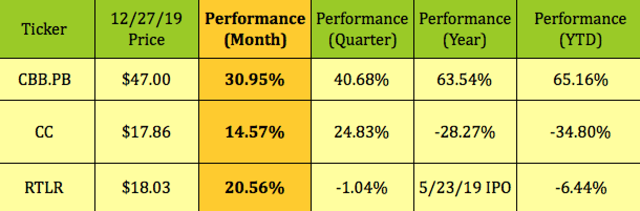

The fourth company, Brookfield Infrastructure Partners LP (BIP), actually fell over the past month, but its 12/23/19 announcement that it was acquiring Cincinnati Bell was the catalyst for a holding of ours, Cincinnati Bell Inc., 6 3/4% Dep Shares Cumulative Convertible Preferred Stock (CBB.PB) to rise ~31%.

The fourth company, Brookfield Infrastructure Partners LP (BIP), actually fell over the past month, but its 12/23/19 announcement that it was acquiring Cincinnati Bell was the catalyst for a holding of ours, Cincinnati Bell Inc., 6 3/4% Dep Shares Cumulative Convertible Preferred Stock (CBB.PB) to rise ~31%.

CC also has had a good rise, of 14.57%, while, RTLR, an LP which only IPOd in May 2019, has gained more than 20% over the past trading month.

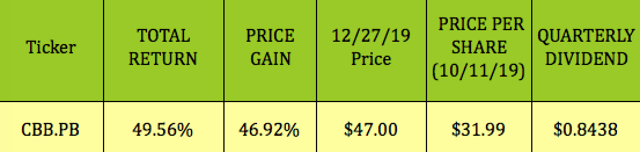

We first wrote about CBB.PB in one of our previous articles, in early October, when it was at $31.99. Since then, it has had a price gain of ~47%, and has gone ex-dividend for its usual $.8438 quarterly dividend, for a total return of 49.56%.

We first wrote about CBB.PB in one of our previous articles, in early October, when it was at $31.99. Since then, it has had a price gain of ~47%, and has gone ex-dividend for its usual $.8438 quarterly dividend, for a total return of 49.56%.

We'd like to claim that we're clairvoyant, but that's not the case - we were merely positioned correctly to benefit from the ongoing consolidation in the telecom/tech industry. This is the second regional telecom buyout we've benefited from in the past month.

Another interesting thing about CBB.PB is that its dividends will now be covered by BIP, an infrastructure juggernaut, which has been moving dramatically into the data infrastructure field.

Another interesting thing about CBB.PB is that its dividends will now be covered by BIP, an infrastructure juggernaut, which has been moving dramatically into the data infrastructure field.

Prior to its Cincinnati Bell acquisition, BIP spent $600M to acquire telecom towers in India and a data distribution company in New Zealand.

Then on 12/23/19, BIP announced an agreement through

Hidden Dividend Stocks Plus, covers undercovered, undervalued income vehicles, with dividend yields from 5% to 10%+.

Our latest success story a 51% total return from inception for one of our core holdings, a little-known 124-year old US microcap dividend stock, which is getting bought out at a 34% premium. In addition to the buyout premium, HDS+ subscribers received 2 years of fat dividends, yielding over 8%.

We publish exclusive research articles weekly for the HDS+ site that you won't see anywhere else. Find out now how we can help your portfolio. There's a 20% discount for new members.