Oil and Gas equities have been in a severe slump over the last three years. Oil & gas, MLPs, and coal all show steep declines. Yet, perhaps unexpectedly, solar equities have done exceedingly well. The Invesco Solar ETF (TAN) is up over 80%, most of it in 2019. Top fossil fuel ETFs, however, are off 19% to 32%.

This article will look at reasons for this rather surprising divergence and likely future trends.

Reasons for the wide divergence

First, let's look at why traditional energy stocks are performing so poorly?

Low oil prices immediately come to mind. WTI peaked at $140/barrel in 2007, but it's been mostly downhill ever since. Currently, WTI is a little above $60. The September attacks on Saudi oil facilities cut production by about 1/2 (some, but not all of which, has been restored), yet Brent prices only temporarily spiked.

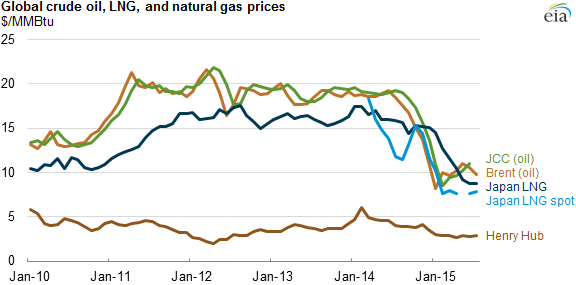

Things are even more dismal for natural gas. Despite huge increases in demand in recent years, Henry Hub prices, $12/MMBtu in 2014, now struggle to stay above $2.20/MMBtu. LNG exports were expected to help prop up U.S. gas markets, but even though LNG exports have started, U.S. gas prices still brush all-time lows. Even overseas, gas prices now run some 50% lower than just a few years back.

U.S. oil and gas production has soared in recent years thanks to fracking in the Permian and elsewhere. The U.S., much to OPEC's dismay, is now the world's top oil and gas producer. Unfortunately, the resulting abundance of oil and gas comes at a time when global demand is stagnating - hence the low prices.

In the past, during periods of high prices, oil and gas exploration and production were highly profitable. You dropped a pipe into large oil or gas pockets and pumped the stuff out. At times the reservoir was