Over the last few weeks, a parade of analysts have come out bullish on Apple (NASDAQ:AAPL) giving the market an impression of an analyst base overly bullish when the stock is at all-time highs. The reality is the analyst community isn't actually overly bullish on the stock. My investment thesis remains bullish on the stock heading into year-end realizing the stock and the market are likely due for a sell-off in January.

Image Source: Apple website

Not So Bullish

Only last Friday, both Piper Jaffray and Bernstein analysts both came out resoundingly bullish on Apple. The reality is that neither analyst made an overly bullish call to generate some sort of peak bullishness in the stock.

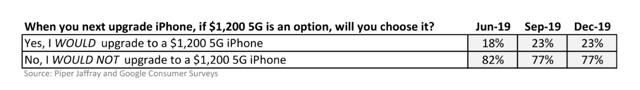

Piper Jaffray was the most bullish analyst, raising the price target of analyst Michael Olson to $305 from $290. The analyst basis the rating on an internal survey that suggests 23% of respondents are now willing to pay an ASP of $1,200 for a 5G iPhone. The number isn't actually shocking as only a quarter of consumers willing to pay premium prices for a 5G iPhone was already a general view of prospects for next year.

Source: Apple 3.0

Bernstein analyst Toni Sacconaghi sounded bullish with a positive view of AirPods, but the analyst kept a Market Perform rating on Apple with a $250 price target. With the stock at $284, his view should count as a Sell rating considering the expected 10% decline.

Where the Bernstein call is even more bearish than on the surface is the bullish statement surrounding AirPods really isn't bullish. Mr. Sacconaghi predicts Apple selling 85 million units for 2020 revenues of $15 billion. My previous estimate had Apple reaching 100 million units and sales of $20 billion.

Of 45 analysts, only 25 are Bullish on Apple. Another 20 have a