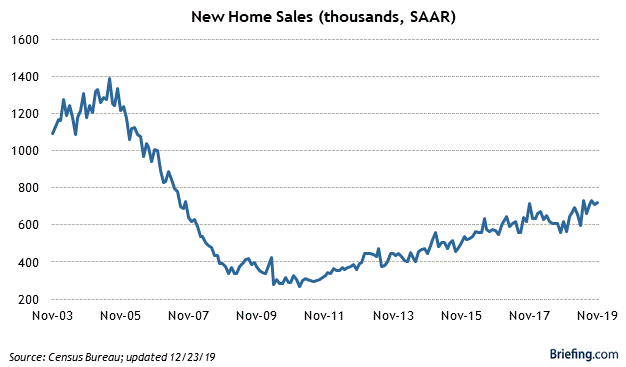

New Homes Sales

Slow and steady improvement for new homes continues, as sales in November came in at an annualized rate of 719,000, which was up 1.3% from a downwardly revised 710,000 in October. This places new home sales up 16.9% over the past year. Sales prices have risen to the point that they are probably starting to crimp sales. The median price of a new home is up 7.2% over the past year to $330,800.

The continued improvement in new homes sales suggests that the economy is not at risk of recession at any point in the immediate future. The decline in mortgage rates by 110 basis points since peaking in November 2018 has been another important factor propelling sales. Sales in all of 2019 are on pace to exceed sales in 2018 by 10%.

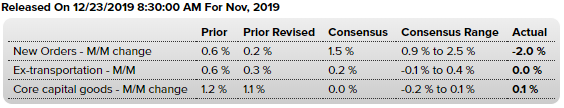

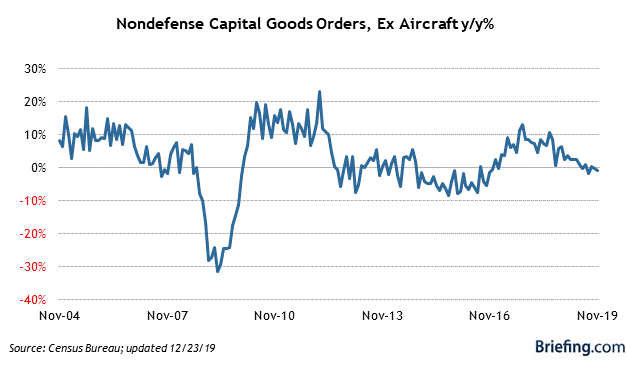

Durable Goods Orders

Ugly! It was thought that the October report had reversed prior weakness, but the 0.6% increase was revised down to just 0.2%, and the number ex-transportation was revised down from 0.6% to 0.3%.

Worse yet, November’s expected 1.5% increase was a decline of 2%! When we exclude orders for transportation equipment, orders were flat. Most importantly, orders for non-defense capital goods excluding aircraft, otherwise known as capital spending, rose just 0.1%. The shipment of these goods used to compute GDP was down 0.3% from October and is now down four of the past five months. If there is no change in December, shipments will be down 0.2% in Q4 versus the average for Q3.

Conclusion

The economic data in aggregate suggests that we continue to see the economy grow, but at a gradually slowing rate. What is slowing growth and continues to be its greatest headwind is the surging amount of debt at the government, corporate and consumer levels. Debt is boosting growth today, but at

The Portfolio Architect is a Marketplace service designed to optimize portfolio returns through a disciplined portfolio construction and management process that focuses on risk management. If you would like to see how I have put my investment strategy to work in model portfolios for stocks, bonds and commodities, then please consider a 2-week free trial of The Portfolio Architect.