Quick Take

Molecular Data (MKD) has filed to raise $69 million in an IPO of ADSs representing underlying Class A shares, per an amended F-1/A registration statement.

The company operates an online marketplace for the chemicals industry in China.

MKD has done well to grow its gross merchandise value [GMV] marketplace, but the chemical industry’s slowing forecast growth combined with the firm’s slowing growth and negative operating & net results lead me pass on the IPO.

Company & Technology

Shanghai, China-based MKD was founded to develop an online marketplace to enable chemical industry market participants to list, buy, sell, and arrange for transportation and warehousing of industrial chemicals.

Management is headed by Founder and Chairman Dr. Dongliang Chang, who has extensive industry experience and previously published over 30 articles, has received 11 patents and obtained his biology doctorate from the Swiss Federal Institute of Technology in 2004.

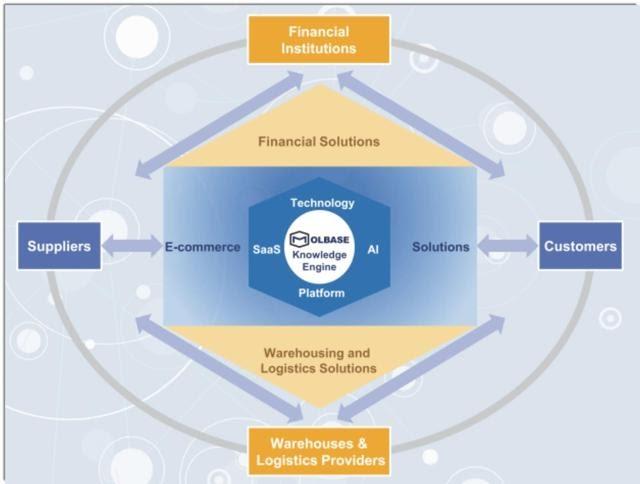

The firm provides a range of e-commerce capabilities from within its website and service, as shown in the graphic below:

MKD has received at least approximately $75 million from investors including Cool Emotion International, Trustbridge, Max Smart, Greatest Investments, Vangoo, Sinovation Ventures and TR Grand Fund.

Customer/User Acquisition

The company provides its services through its marketplace as well as through a direct sales model where it acquires chemicals and resells them on its marketplace.

For its financial solutions, the firm partners with banks and non-bank providers to provide financing options for users.

The group has also developed warehousing and logistics solutions and service provider relationships in order to facilitate buyer and seller transactions on its platform.

Sales and marketing expenses as a percentage of revenue have been dropping as revenues have increased, as the figures below indicate:

Sales & Marketing | Expenses vs. Revenue |

Period | Percentage |

Nine Mos. Ended Sept. 30, 2019 |

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis. Get started with a free trial!