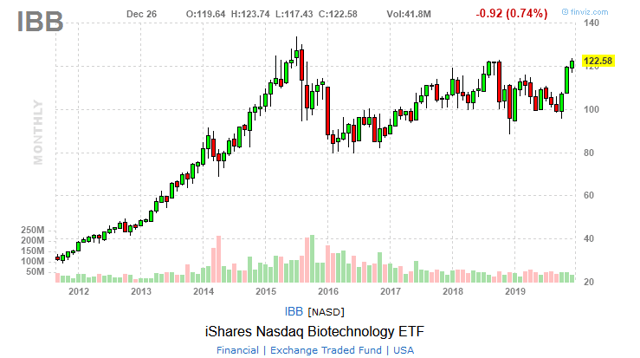

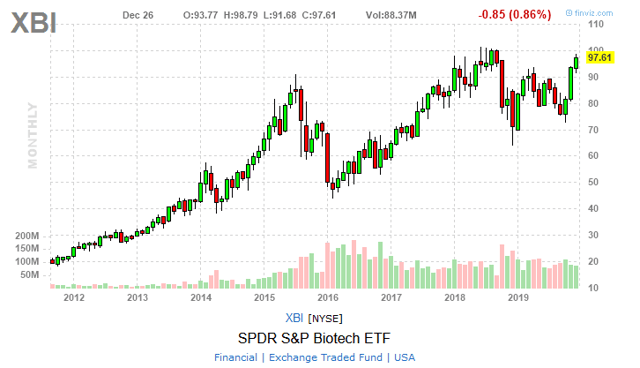

Q4 2019 has been the best quarter (IBB up 22.5% XBI up 26.7%) for biotech investors since Q1 2015, which was the top of 2014-2015 rally. This 20+% rally is largely attributed to Fed's overall easing stance, increased mergers & acquisitions, positive regulatory backdrop, solid trial results and better-than-expected corporate earnings. 2019 deal activity has increased significantly, and large Biopharma companies are actively conducting mergers and acquisitions in order to deliver higher long-term return for their investors.

Based on data from Chimera Research Group (Biotech M&A - 2019 Deals), there were 28 biotech M/A deals in 2019, comparing to only 16 last year. The accumulative deal value is $203.7B, which includes two mega deals: BMY buying Celgene for $74B and ABBV buying Allergan for $63B. In 2018, total deal value was only $48.2B. Going into 2020, I am optimistic about the high volume of biotech deal activity will continue.

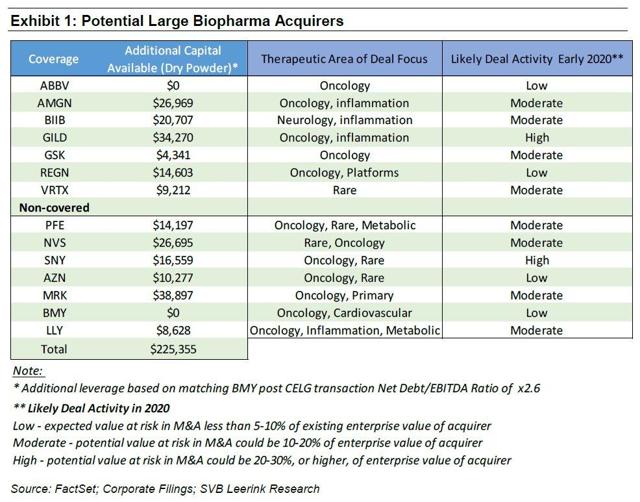

According to SVB Leerink Research, large Biopharma acquirers currently have $225B dry powder available for M&A deals. While I don't expect we have another year with over $200B total deal value, a year with $100-150B is very likely.

Based the EY M&A Firepower report, a couple of large Biopharma companies such as GILD, PFE, SNY, PFE, NVS, still haven't made any significant M&A deals in 2019. Based on the chart above, these five companies have about $15B to $25B of dry powder. Companies like GILD, MRK, AMGN, or NVS, might do a mega deal, acquiring a large-cap biotech company in a transaction valued more than $15B. While mega deals are hard to predict, I will focus on deals valued at less than $10B so that this would not use up all the dry powder of those large Biopharma companies mentioned at the start of the section.

Therefore, I am picking 5 best