ANTA Sports (OTCPK:ANPDY) recently held its annual Investor Day event, where management provided an update on its immediate and mid to long-term financial outlook, strategies for positioning its brands globally as well as the progress the company has made with regards to the acquisition of Amer Sports.

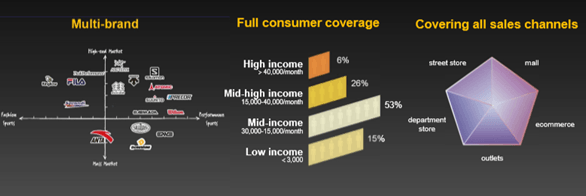

The event reinforced my bullish view on the stock - I believe ANTA Sports is well-positioned to provide superior value to its shareholders in the mid- to longer-term time frame as it transitions from a Chinese sportswear company to a global conglomerate. The company is set to benefit from a number of key tailwinds, from structural growth in the domestic sportswear market, a multi-brand omnichannel strategy, and increasing premiumization of its products, to the successful integration of the Amer Sports brand portfolio.

Source: Company Presentation

With the company set to build on its recent outperformance relative to its Chinese counterparts, I believe ANTA's growth trajectory is set to extend further, and thus, I remain bullish on the stock, especially given the current discounted multiple relative to global peers.

Investor Day - Key Highlights

Accounting for Amer Sports acquisition still a work in progress: Coming off the first three-quarters of FY19, ANTA expects revenue to grow in the range of 30%-35% and net profit to grow by over 30%, despite the adverse impact from its Mascot Joint Venture (JV) Company, the consortium that ANTA set up with other investors to acquire Amer Sports. Loss estimates from the JV now stand at Rmb 650 million for FY19 (including a one-time expense of Rmb 200 million and up to Rmb 500 million from the purchase price allocation (PPA)). The PPA exercise, which remains pending, will take some time to sort out given it covers the finer details of Amer's asset base (e.g., inventory, PPE, and contracts with customers). Though the PPA has proven to be a key overhang on the stock, FY19 looks to be the peak year as a large portion of the PPA has already been allocated to FY19.

FY20 set to be an investment year, with revenue acceleration from FY21: FY20 will see a number of key investments planned, from the company's in-store expansion and broader product offerings for lifestyle to its soft goods products. Any major revenue acceleration in China, as well as other regions across the globe, is expected to begin from 2021. Notably, ANTA expects positive earnings contribution from Amer Sports (Purchase price allocation - PPA impact included) in 2020, despite the planned investments.

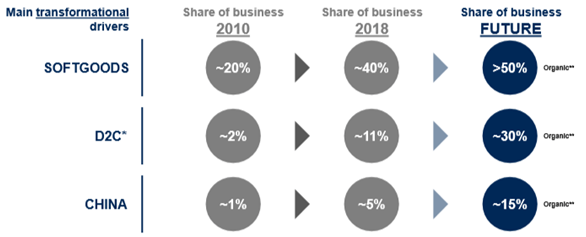

Transformation towards faster growth, higher profitability, and better asset efficiency: Soft-goods, direct-to-consumer (DTC), and China are expected to be the main transformational drivers for Amer Sports over the next five years.

Source: Company Presentation

While Amer is a global leader in niche markets, ANTA's management believes it can substantially expand the potential addressable market by expanding into the soft-goods market. Management noted that the market size for treadmills stands at Rmb 2 billion, snowboard sales are less than RMB 200 million (excluding rentals), and premium tennis rackets are only about Rmb 200 million in China. Hence it aims to focus more on soft goods to drive a >50% revenue mix in the future.

Additionally, ANTA is also reviewing Amer's sports watch business, Suunto, to assess potential synergies with the core business.

Source: Company Presentation

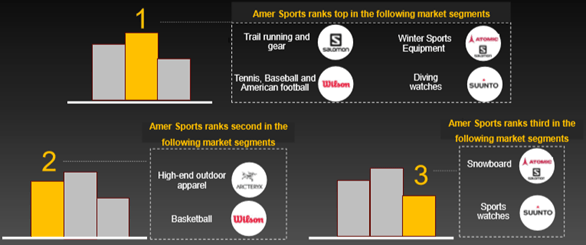

The "Three Big" strategies: The five-year growth strategy for Amer Sports is set to unlock a sales CAGR of 10-15% over the next 4-5 years, drive margin expansion and improve return on capital employed (ROCE). These "Three Big" strategies are:

Big brands: The target here is to achieve strong sales growth across Amer's three big brands - Arc'teryx, Salomon & Wilson - to make them "Billion Euro Brands." To achieve this goal, Amer will expand into the lifestyle category by leveraging each brands' authentic performance positioning.

Source: Company Presentation

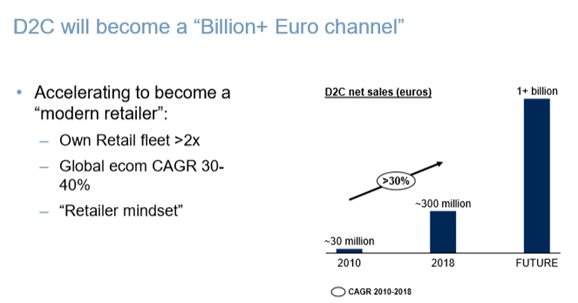

Big channels: Targeting to more-than-double the company-owned retail fleet and e-commerce sales CAGR of 30%-40% globally in 2018-2023, the strategy is to accelerate the transformation from wholesale to retail model to achieve a DTC revenue mix to reach 30% in future, with a dedicated go-to-market (GTM) structure in every brand.

Source: Company Presentation

Big Countries: Targeting to grow China sales by over 4x and the USA by ~50% in 2023 vs. 2018, the strategy is to accelerate sales expansion in China underpinned by the "Big Brands" and "Big Channels" strategies, to achieve ~15% sales from China market by 2023.

Source: Company Presentation

Specific brand strategies to grow into "Billion Euro Brands":

Arc'teryx: Expansion to everyday lifestyle products with more product offerings, usage occasions, wider price range, and a more balanced gender product offering is the strategy to make Arc'teryx a "Billion Euro Brand." On the channel side, the plan is to focus on ten global epicenters, with 35% of total retail stores by 2023. Management plans to double the annual store opening rate to expand its retail presence by helping customers achieve outstanding experiences in the best retail locations and larger stores. In China, the plan is to accelerate new store openings by 3x per year to enhance the premium retail experience. In the USA, 25% CAGR growth for online sales is targeted over the next five years, along with retail expansion and high-street distribution of everyday product lines.

Salomon: Sales for Salomon soft goods are expected to grow at a double-digit CAGR (vs. the mid-single-digit CAGR guided previously). The customer base is set to expand from sports enthusiasts and athletes to broader active consumers by offering more lifestyle products rather than just outdoor products. On the channel side, the focus is on doubling the annual store opening rate and accelerating e-commerce growth to achieve 30% CAGR in the next five years vs. 15% CAGR over the last ten years. In terms of geography, securing sustainable growth in the USA and EMEA and accelerating growth in China via the opening of new self-owned stores and expanding online capabilities remain the key focus.

Justifying the Bull Case

ANTA Sports has outgrown the sportswear industry in China continuously in the past three years, leveraging strength across brands like ANTA and FILA. Going forward, the company appears to have solid plans in place to gain more traction for Descente and the newly acquired Arc'teryx and Salomon brands. With all of its key brands strongly positioned in their respective categories, I strongly believe ANTA Sports can become the No. 2 player (ANTA holds the third-largest share as of 2018) in China. Additionally, its product portfolio which caters to demand from core sports (running, basketball, training), athleisure and outdoor and winter sport, enables it to tap into markets where global giants like Nike (NKE), Adidas (OTCQX:ADDYY), Puma, VF Corp (VFC) and Canada Goose (GOOS) operate and puts the company on a firm footing globally.

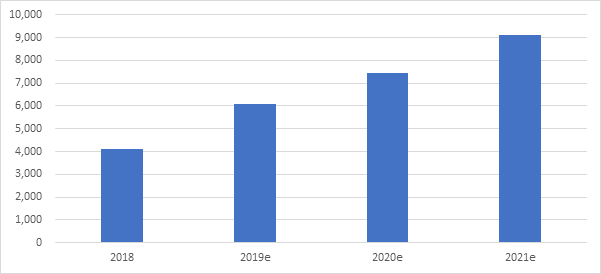

ANTA remains one of the few Chinese consumer discretionary companies with sufficient tailwinds to sustain >20% EPS growth rates. Net income (ex-Amer) is set to rise 48% YoY in FY19, and penciling in a more sustainable >20% growth driven by both margin expansion and a 10-15% top-line CAGR, I believe ANTA could see ~Rmb 9 billion in net profit by 2021 (~Rmb 9.5 billion including Amer).

Source: Author, Company Filings

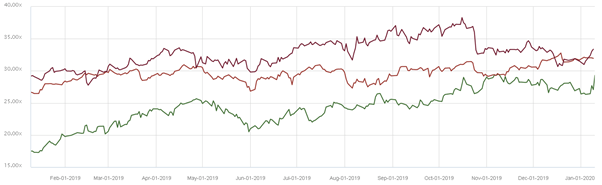

Yet, ANTA's valuation pales in comparison to its global peers (e.g., Nike and Puma), with the stock trading at <30x earnings - 3-4 turns below peers.

Source: Bloomberg; ANTA's fwd P/E ratio denoted in green, Nike and Puma in red and purple

Given the company's strong underlying economics and the vast opportunities ahead, there is a clear argument in favor of ANTA commanding similar multiples to its global peers. Thus, I believe the market will eventually price in ANTA's multiple legs of growth and re-rate in recognition of its ability to compound at an impressive rate over the long term. As a result, I see ANTA's target P/E multiple at ~30x forward earnings, implying a price target of HK$119 (~53% upside).