Today, we will study why VBI Vaccines (VBIV) is an attractive pick in 2020.

Company overview

VBI Vaccines (VBI) is a commercial-stage biopharmaceutical company focused on the development and commercialization of vaccines and therapeutics targeting immuno-oncology and infectious disease conditions. The company has already secured commercial approvals for its trivalent hepatitis B vaccine, Sci-B-Vac, in Israel and 10 other countries. VBI Vaccines has also completed the pivotal Phase 3 program for Sci-B-Vac in the U.S., Europe, and Canada.

VBI Vaccines is also studying investigational immune-therapeutic, VBI-2601, in collaboration with Brii Biosciences as a treatment option for chronic hepatitis B infection. The company has already completed a Phase 1 study for VBI-1501 as a CMV (cytomegalovirus) prophylactic vaccine. The company is also studying VBI-2501 as the Zika virus prophylactic vaccine in the pre-clinical stage.

VBI Vaccines is also working on cancer vaccines. The company is studying the VBI-1901 vaccine trial for GBM (glioblastoma multiforme) in the Phase 1/2a trial and another VBI-2701 vaccine for medulloblastoma in preclinical trials.

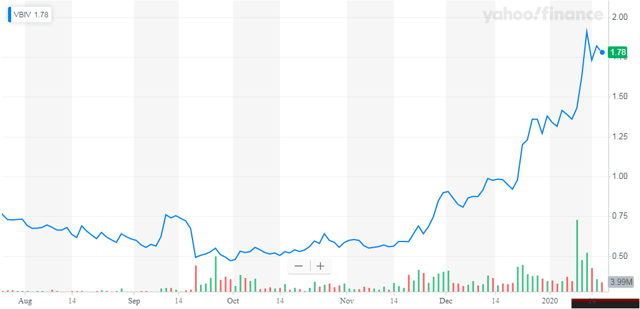

On January 14, VBI Vaccines announced that it has regained compliance with the minimum bid price requirement under Nasdaq Listing Rule 5550(a)(2). In July 2019, the company was added to Russell 2000® and the Russell 3000® Indexes.

Why does the developed world need a trivalent hepatitis B vaccine?

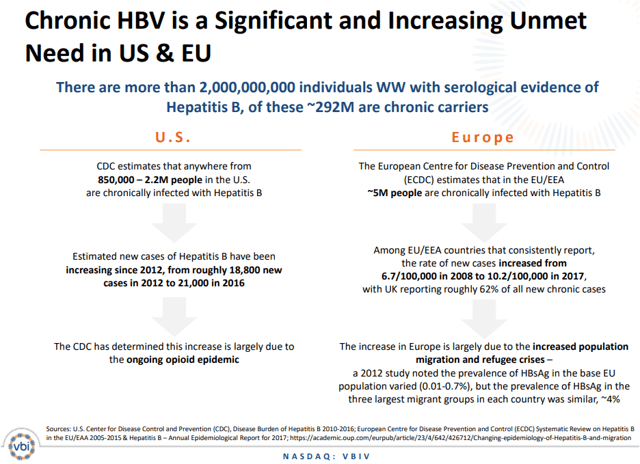

According to WiseGuyReports.com, "Global Hepatitis B Vaccines Market Insights, Forecast to 2025" report, the global hep B vaccine market was worth $1.39 billion in 2016. The market is expected to grow at a CAGR of 3.5% and reach $1.89 billion in 2025.

The opioid epidemic in the U.S. and migration and refugee crisis in Europe have led to a rapidly increasing spread of the hepatitis B infection across the developed markets.

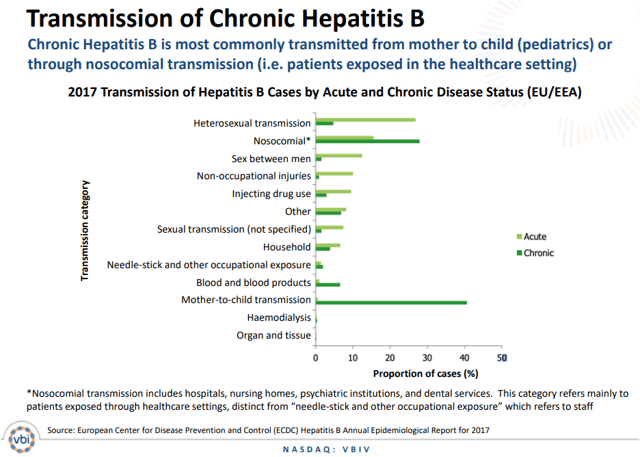

Chronic hepatitis B can be transmitted in many ways. According to the Mayo Clinic