Investor Takeaway

Transportadora de Gas del Sur S.A. (NYSE:TGS) trades at 4.2x earnings and is a large natural gas name in Argentina. Profit margins and earnings growth have been positive in recent years, along with a reliable dividend. With the recession in Argentina, the equity has sold off considerably and brought equity to attractive levels for a long entry.

Company Profile

Transportadora de Gas del Sur S.A. provides natural gas extraction, transportation, and distribution services within Argentina. The company was established following the privatization of state-owned company Gas del Estado. TGS is the largest natural gas extractor in the country of Argentina, while three pipelines operated by the company account for 60% of the company revenue.

Consolidated Financials

Earnings growth was the story for TGS this past year, as the company grew earnings 57.9% in the last reported twelve months. The equity trades at 4.2x earnings, which is undervalued compared to the gas and oil industry average of 10.2x. We also saw improvement in the net profit margins, the metric increased to 44.4% in the last twelve months, compared to 19.2% for the twelve months prior. Looking back further in earnings, we can see that the company grew earnings at 70.8% per year over the past five years. The oil and gas industry contracted by 13.3% over the last year, while earnings grew at 57.9%, as stated earlier. Although the company still holds a considerable amount of debt, the debt to equity ratio declined over the last five years. The ratio was 118.6% five years ago and now it is 73.8%. Operating cash flow can easily cover the existing debt on the books. The dividend of the company is remarkably high at 12.52%, while dividends have increased consecutively over the past 10 years. There has been no meaningful dilution of shares over the past year. Consolidated financials over the last reported quarter can be found below here.

Catalysts

Several institutional investors have shown interest in the natural gas distributor. A large name among them is State Street Corporation (STT). The financial institution increased its state in TGS by 2.5% in the third quarter of 2019. Pensions have also shown interest in the common equity; Teacher Retirement System of Texas also increased its stake in the company by 88.4% in the 3rd quarter of 2019. The company has stated that it will invest in the Argentina-wide 1,200 km gas pipeline project. The company will be investing an initial $250 million on transportation infrastructure. The new pipeline will boost both energy exports for Argentina, along with increasing the top line of the company. The new pipeline will also help diversify the product line by increasing the number of pipelines the company is involved in.

Technicals

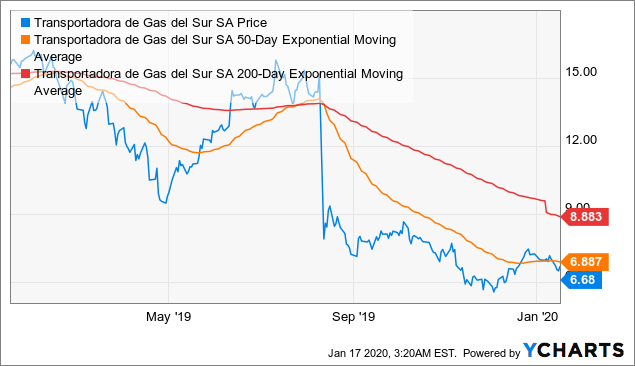

Data by YCharts

Data by YCharts

A bearish golden cross between the 50- and 200-day exponential moving averages occurred a while back as the equity experienced a sharp decline and has continued to trend lower. Trading at $6.68 as I am writing, the equity briefly crossed over its 50-day EMA and crossed below shortly afterward. The decline in price has made the equity fairly cheap compared to levels back in late August at around $14.9. The undervalued reading we got from the consolidated financials section above is in line with the discount we observed from the price-performance graph above. The recession in Argentina seems to have reflected on equity prices in the country. I would ideally wait for the equity to cross and stay above the 50-day EMA, before opening a buy position. Meaning, I prefer short-term momentum build-up present in the equity before initiating a purchase.

Conclusion

The new pipeline project will add diversity to the product line at TGS, considering only three pipelines are responsible for 60% of revenue generation for the company. The company is too reliant on too few pipelines as of right now. Profit margin improvement is a plus, in a recession environment. The dividend is also attractive as the equity has sold off substantially over the past months. Hence, those seeking yield have the opportunity to get in on the action at a reasonably cheap price. Financials showed an undervalued reading based on P/E, along with a decline in the debt-to-equity ratio for the firm. Looking ahead, investors ought to keep an eye on this metric. The decline in debt should continue for a meaningful long opportunity ahead. If that reverts and the company starts piling up debt, that would reflect as a considerable risk factor. Overall, the gas extractor is in a prime spot for those seeking some dividend yield outside the United States.