If investing is entertaining, if you’re having fun, you’re probably not making any money. Good investing is boring. – George Soros

United Technologies Corp. (UTX) had a fantastic 2019 and is set up to continue through in 2020. Set to report earnings on January 28, if profits go anything like the prior reported quarter, the stock should move firmly higher. In 3Q19, the company posted a triple threat beat by beating estimates on revenues, earnings, and guiding higher for 2020. The most important of those numbers was the guidance higher and is something I am watching closely this quarter. UTX expects 2019 full year to now be $8.05-$8.15 per share, up from $7.90-$8.05 prior.

That guidance raise was after already raising guidance in the preceding quarter. Management is clearly underestimating the aerospace giant’s abilities quarter to quarter. This doesn’t take into consideration the potential synergies from the announced combination of the aerospace business with Raytheon (RTN), which is hoping to close in 2020. More on that below. Either way, it is hard to bet against a company with so much momentum right now.

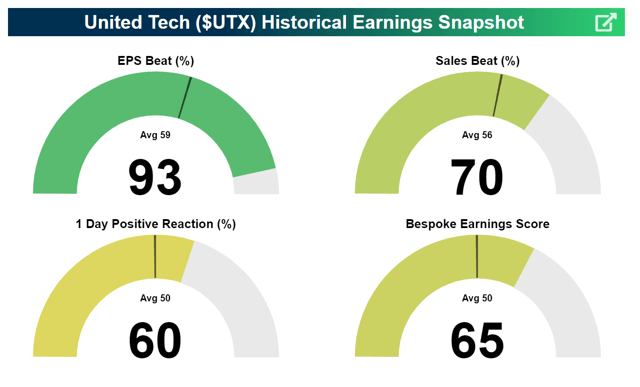

As mentioned in the Lead-Lag Report, the prior quarters were also in the face of heightened global trade tension, and with that dimming, the company has a long runway to fly through. Not to mention, the company has some great history when it comes to beating consensus earnings estimates, according to Bespoke Investment Group. Historically they have beat EPS 93% of the time and sales 70% of the time. Those are incredible numbers. We expect more of the same at the end of January, along with a higher stock price for it.

Source: Bespoke Investment Group

Last year in June, United Technologies and Raytheon aerospace businesses announced their intent to combine to address rapidly growing segments of

How To Avoid the Most Common Trading Mistakes

How To Avoid the Most Common Trading Mistakes

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you'll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.