Thesis

Lear Corporation (NYSE:LEA) is positioned well to profit from the future trends of the auto industry. The company can leverage its existing working relationships with all the major automakers around the world to bring their innovative products to the market. As car seats are becoming more customisable and integrated with new features and technology, Lear's Seating segment can earn more per each unit it sells. Car systems are also changing to be more connected with other devices, with a focus on sustainability, electrification, and autonomous driving as well as configurability/personalisation for each customer. This is what Lear's faster growing E-Systems unit can profit from.

The Company

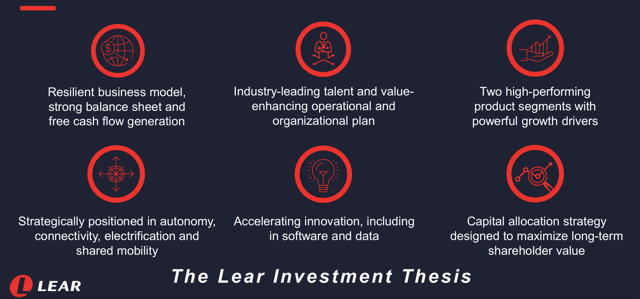

Lear is an automotive technology company focused on two business segments: Seating that makes up around 75% of sales and E-Systems that brings in 25% of revenues. Lear can count all the major automakers around the world as its clients that it serves through its 161,000 employees in 39 countries. As a global automotive tech leader, the company is positioned well for the future automotive trends of connectivity, electrification, autonomous driving, and shared mobility. The acquisition of Xevo, a leader in connected car software, should further improve Lear's connectivity offerings. Over the last 5 years, an average of 70% of FCF was returned to shareholders through growing dividends and buybacks, which makes it an interesting pick for investors looking for growing income. Although Lear operates in a very cyclical industry, the dividend is very well covered, and the balance sheet is strong which should help Lear to weather future downturns. With 2019 being a tough year for Lear due to the trade war, slowdown in auto sales, and the strike at GM, shares are trading at favourable valuations even after the recent run-up.

Source: Lear Investor Relations

Source: Lear Investor Relations

Dividend

Lear's current dividend yields 2.2% and