For this week's "best dividend stocks to buy now" article, I wanted to highlight a great way to screen dividend stocks for all the fundamental things that result in exponentially growing income and great returns over time.

7 Proven Ways To Beat The Market

I'm in the process of updating the Dividend King Master List which is a comprehensive database covering 370 companies (soon to be 400) that includes everything an income investor needs to make reasonable and prudent decisions with their hard-earned savings.

- Yield

- Sector

- Quality score (11 point scale)

- Dividend safety score (5 point scale)

- Fair value (for any given year's expected fundamentals)

- Discount to fair value

- Good buy price (based on quality and risk)

- Potential trim/sell price

- 5-year CAGR total return potential range

- Dividend growth streak

- 5-year CAGR dividend growth rate

- Long-term analyst consensus growth rate

- Forward PE (or P/FFO or P/EBITDA depending on industry)

- PEG ratio

- The historical fair value PE ratio (or industry equivalent)

- Realistic growth potential range

- Most appropriate F.A.S.T Graphs time period (similar fundamentals and growth rate)

- Joel Greenblatt Return On Capital (for all appropriate companies)

- ROC industry percentile

Needless to say, maintaining such a database for 400 companies (I'll swap out lower quality names for higher quality blue chips as I find them) is a lot of work. However, I consider it time well spent and preparation for the market's unavoidable and usually irrational overreactions.

In other words, if a quality watchlist is worth its weight in gold, then the Master List is worth its weight in diamond.

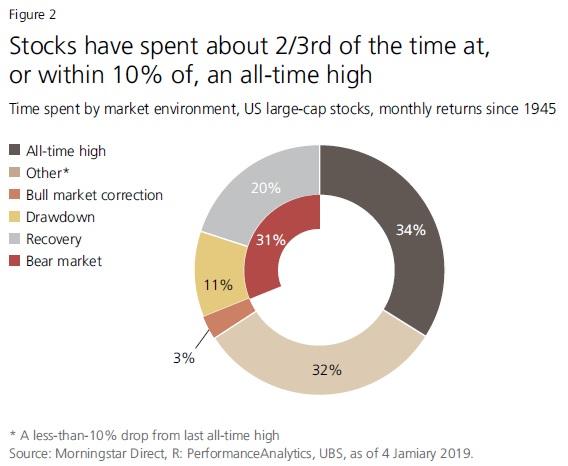

The market is near record highs today, as it is most of the time.

(Source: UBS)

(Source: UBS)

Since 1945 stocks have been at record highs 34% of the time and 66% of the time they are within 10% of record

---------------------------------------------------------------------------------------- Dividend Kings helps you determine the best safe dividend stocks to buy via our valuation/total return potential lists. Membership also includes

Dividend Kings helps you determine the best safe dividend stocks to buy via our valuation/total return potential lists. Membership also includes

- Access to our four model portfolios

- 30 exclusive articles per month

- Our upcoming weekly Podcast

- 20% discount to F.A.S.T Graphs

- real-time chatroom support

- exclusive weekly updates to all my retirement portfolio trades

- Our "Learn How To Invest Better" Library

- Price Goes Up By $50 Per Year February 1st, Lock In The Current Price Forever By Joining Today

Click here for a two-week free trial so we can help you achieve better long-term total returns and your financial dreams.