Editor's note: Seeking Alpha is proud to welcome Lemming Insight as a new contributor. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA PREMIUM. Click here to find out more »

Overview

Though a number of concerns have developed in recent years, McKesson (NYSE:MCK) still possesses strong competitive positioning and enviable future prospects. The headwinds facing the company have been exaggerated by the markets such that McKesson has been undervalued for years and will soon revert back toward its intrinsic value.

A brief background on the pharmaceutical distribution industry will explain the position distributors hold in the pharmaceutical supply chain and why MCK leads its peers. Further analysis of the major headwinds facing MCK and its industry will show that those headwinds have been exaggerated. Due to these exaggerations a simple valuation will indicate that McKesson is undervalued and provides meaningful upside potential based on only reasonable assumptions, while displaying little downside under pessimistic assumptions.

Industry Background

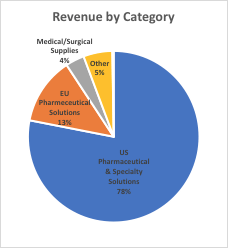

McKesson provides pharmaceutical and medical supply distribution, as well as some other specialty solutions, to companies across the healthcare supply chain in the U.S., Canada, and Europe. Their pharmaceutical distribution segment represents most of their business and operates as part of an oligopoly with peers Cardinal Health (CAH) and AmerisourceBergen (ABC) that controls over 90% of pharmaceutical distribution in the U.S. McKesson itself delivers over 1/3 of all prescription medications in the North America and does so with a 99.9% accuracy level.

McKesson Revenue by Category -- Source: Created by author using 10k data

In order to compete, distributors have continuously consolidated through acquisitions in order to minimize their initial drug sourcing costs. This process has improved their buying power and economies of scale, resulting in a highly concentrated market of