This will be a short one. Well, hang on a minute. Let me clarify: It will be a short one as far as Heisenberg posts go.

What I want readers to consider is the following simple question: Is the bond rally overdone?

To be sure, that's a question many market participants didn’t think anyone would be asking at the end of January. Headed into the new year, a consensus had formed around the idea that between 2019’s rate cut bonanza and the abatement of tensions between the world’s two largest economies, economic green shoots would rise from the ashes of the global factory slump and with them, long-end bond yields.

To be sure, the drop in 10-year US yields to the lowest since October isn’t down to poor incoming data. On balance, the data from around the world has been reasonably encouraging (albeit by no means “robust”). That's in line with expectations for a tentative inflection in global growth.

The problem is that two black swans (the assassination of Qassem Soleimani and a burgeoning pandemic) have catalyzed a safe haven bid which, along with a bullish seasonal for UST futures and a tendency for some folks to revert to the “duration infatuation” default “setting” at the first sign of trouble, has the long-end in rally mode and the curve erasing half of the Q4 steepening.

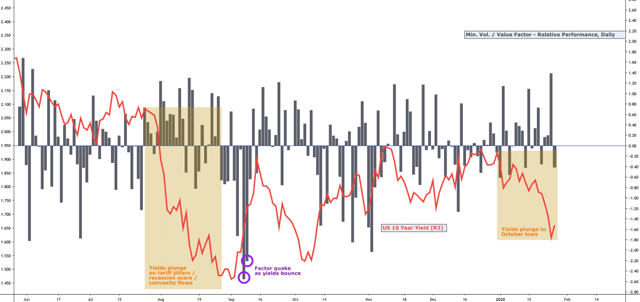

And yet, one wonders if everyone has completely forgotten September, when, after the August recession scare catalyzed an epic bond rally that inverted the 2s10s and pushed 10-year German yields to -0.71%, Treasurys sold off sharply, triggering multi-standard-deviation unwinds in a hodgepodge of popular equity expressions tethered to the duration trade as yields jumped some 45bps.

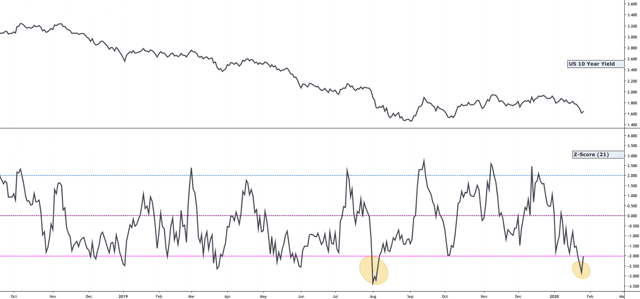

In case you have a short memory (or in case, like me, years of drowning the synapses in Balvenie makes it hard to remember what happened two weeks ago, let alone what happened four months ago), it’s worth noting that, as Bloomberg’s Luke Kawa pointed out Monday, “the speed of the decline in Treasury yields is approaching the August extremes.”

In fact, the 21-day Z-score is nearly -3.

TD’s Priya Misra, for one, has seen enough. “We take profit on our long 10y trade as we don’t think that the risk-reward to being long Treasurys is as attractive any longer.” she said Monday.

“Part of the reason we took off the trade is that we don’t expect the Fed to go more dovish simply because the market has become more nervous,” Misra’s colleague Gennadiy Goldberg told Bloomberg over the phone, adding that “the whole virus story is still relatively new and in its infancy and I doubt the Fed will react to it."

It’s far too early for the Fed to consider any kind of “response” to the virus outbreak, and Tuesday’s comeback rally on Wall Street (despite the "Bern" rising in the polls) will allay fears of tightening financial conditions.

The point is that if you were looking for the Fed to be yet another catalyst for the bond rally, you’ll probably be disappointed.

And yet, it’s hard to rule out the possibility of another overshoot to the downside (on yields), even if it doesn’t reach the extremes seen in August when convexity flows magnified the drop and thereby the bull flattening.

“Market participants expecting an early 2020 reflation trade have been left wanting,” Deutsche Bank’s Stuart Sparks said Monday, on the way to putting things in the perspective of the bank’s 2020 outlook:

Our Treasury forecasts reflect expectations of falling yields through Q3, driven by equity-fueled pension demand, persistent dollar strength, and a transition from trade policy uncertainty to election uncertainty. However, our forecasts depict 10y Treasury yields at 1.75% at the end of Q1, 1.70% at the end of Q2, and 1.55% at the end of Q3. In this sense the rally is ahead of schedule. We expect risk-off to subside, pension demand to be persistent through H1, and for dollar appreciation – and inflation weakness – to intensify.

In other words, the bond rally makes sense, but it’s overshot in the near-term thanks to the haven appeal of the US long-end at a time when the only word that matters is “virus.”

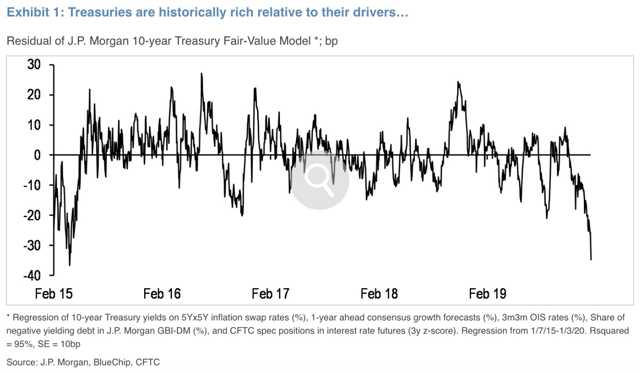

For whatever it’s worth, JPMorgan now says 10-year yields are some 30bps too rich.

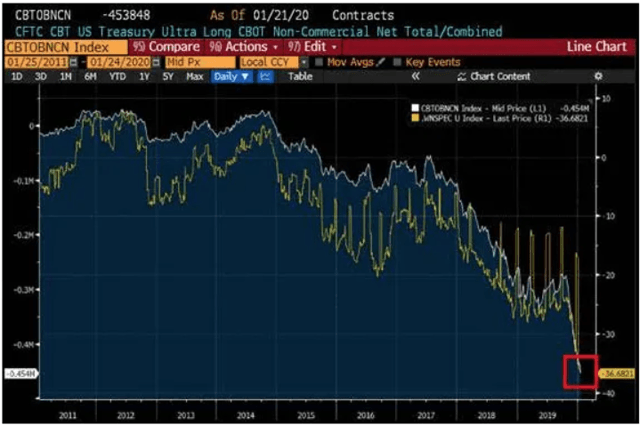

And some folks (read: shorts) are hurting...