Baker Hughes Keeps It Steady, But Difficulties Remain

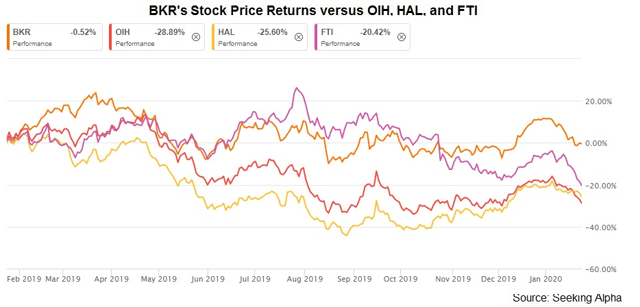

Baker Hughes (NASDAQ:BKR) provides technology solutions and equipment & services to energy and industrial customers worldwide. The company has been servicing several large LNG (liquefied natural gas) projects internationally, which is a part of its strategic plan in the medium term. However, the steep decline in natural gas and LNG prices over the past year has put a question mark on the profitability of that move. The company is about to separate from GE and operate independently. On top of that, with the crude oil price remaining volatile, a quick turnaround in the upstream business is unlikely. In the short term, the stock is likely to stay subdued.

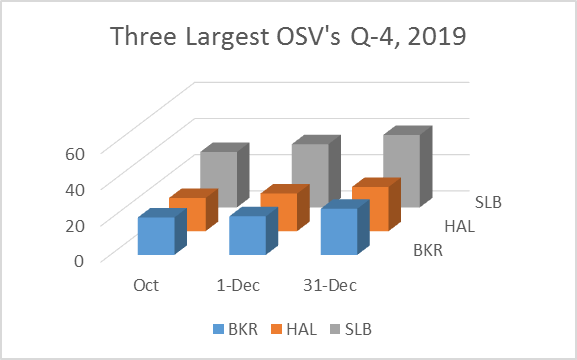

Despite all these obstacles, the international business, particularly the offshore part, is looking to provide improved returns in 2020. I think various cost reduction and productivity enhancement actions can pull margin up in the oilfield services part. The company's alliance with technology leaders like Microsoft (MSFT) can help maintain an edge over its competitors. I think BKR's stock price will see improved returns in the medium-to-long-term.

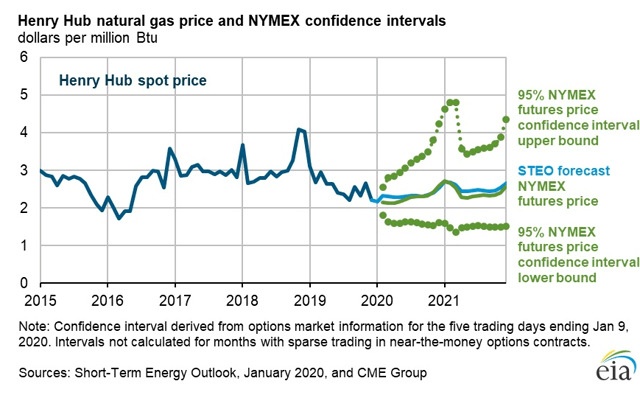

Natural Gas: Demand, Supply, And Price

The natural gas price has decreased by 40% in the past year until now. Despite low prices, the U.S. natural gas marketed production increased by 10% in 2019 compared to a year ago. However, if the price stays low for long, it will eventually catch up with production, in which case, it will start affecting the energy servicing companies' top and bottom line. While production and consumption of natural gas are expected to remain in balance in 2020, the EIA expects output to decline in 2021 in response to the low price base. The EIA expects natural gas spot prices to average $2.33/MMBtu in 2020, and increase to $2.54/MMBtu in 2021.

From

The Daily Drilling Report

We hope you have enjoyed this Free article from the Daily Drilling Report Marketplace service. If you have been thinking about subscribing after reading past articles, it may be time for you to act. The oilfield has been at a low ebb but has recently gained steam.

We have been recommending these companies since late summer. Locking in a gain of about 20% in a single month, and we think there's more to come in 2020. Give it some thought, and act soon if you are interested. A 2-week free trial is applicable, so you risk nothing.