Air Products: A Long-Lasting Growth Story

Last Friday, Air Products & Chemicals (NYSE:APD) reported earnings which might have seemed to be a mixed bag at first sight. However, when listening to the conference call and digesting the financial statements and forward-looking remarks it was nothing but a solid quarter. After having raised the dividend for 38 years in a row now, which obviously makes it a robust Dividend Aristocrat while clearing the path toward obtaining the Dividend King status, the future looks bright for APD with a significant boost in CapEx spending for 2020.

Despite some calling the stock overvalued, I believe APD shares provide meaningfully attractive value right here with a share price trying to break out and recent optimistic remarks from its CEO Ghasemi for 2020 and 2021. The past 18 months filled with chatter about the US-China trade war didn't hurt the company's execution at all and with the recent "Phase One" deal, industrials may see their share prices revive which almost certainly would be beneficial for APD.

From now on, APD should be able to produce recurring free cash flows in excess of 2.7B USD before dividends and growth capex (including M&A). This represents a FCF/EBITDA conversion rate of 71.9%, a percentage which most other chemical companies barely achieve. After deducting the dividend payments of 1.01B USD, there's still a sizable 1.7B USD left to re-invest directly into the core business.

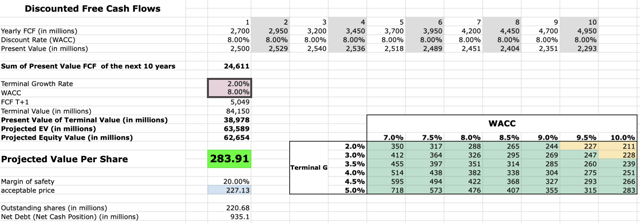

In my base case scenario, APD's fair value is near $283.91. My conservative assumptions are based on a starting annual growth rate of 9.3% (less than management's guidance of 13% for FY 2020 and FY 2021) which slows down to 5.3% in year 10. This translates into 17.6% upside potential from today's price.

Focusing On Core Assets Has Paid Off

APD serves customers in a wide variety of technology, energy, healthcare, food and industrial markets worldwide with atmospheric industrial gases (mainly oxygen, nitrogen, argon, hydrogen and carbon dioxide), process and specialty gases, performance materials and chemical intermediates. The company distributes gases to customers through a variety of supply modes, including liquid or gaseous bulk supply delivered by tanker or tube trailer and, for smaller customers, packaged gases delivered in cylinders and dewars or small on-sites (cryogenic or non-cryogenic generators). For large-volume customers, it constructs an on-site plant adjacent to or near the customer’s facility or deliver product from one of its pipelines.

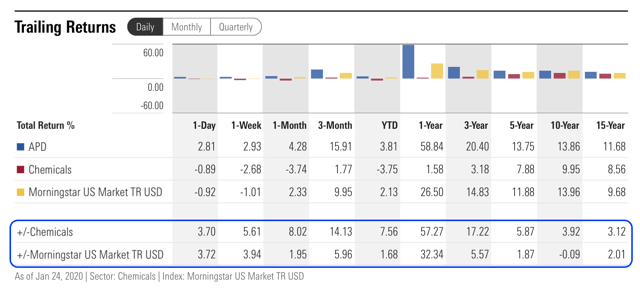

Past divestures and the completion of the spin-off of Versum Materials back in 2016 led to a clearer focus on becoming an industry-leader in the industrial gases space and have since unlocked significant shareholder value. On a 15-year time frame, shares have handsomely outperformed the S&P-500 and the entire chemical industry by an annualized compound 2% and 3.1% respectively.

(Source: Morningstar)

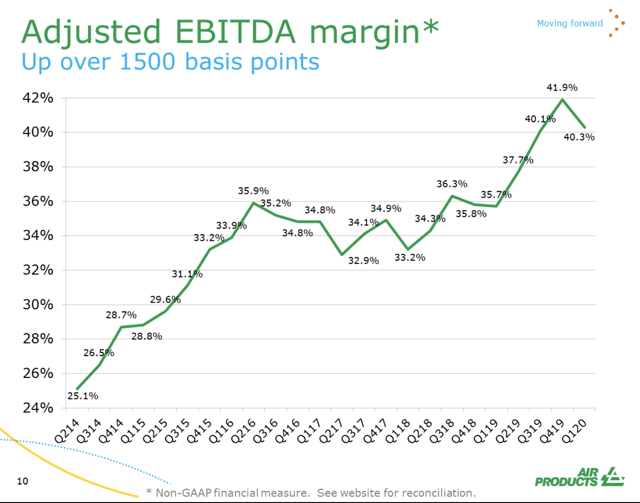

With a remarkable streak of continuously improving EBITDA margins, there's unquestionably a lot to like about this company. Since Ghasemi has taken over the role of CEO, APD's EBITDA margin has improved by as much as 1,500 basis points.

(Source: Investor Presentation)

(Source: Investor Presentation)

Scaling Up Capex To Fuel Future Volume Growth

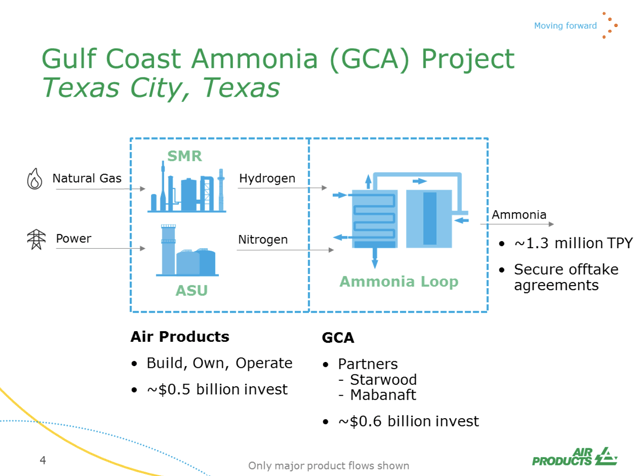

Ammonia Project In Gulf Coast

As APD's profit margins have already risen sharply over the past quarters, its management team is now beefing up future capex spending to boost volume growth and take advantage of growing demand for its Industrial Gases solutions.

APD recently announced its largest-ever investment in the U.S. (worth 500M USD) with a long-term onsite business model supply deal producing hydrogen for a project with Gulf Coast Ammonia ("GCA") in Texas City. Additionally, the company will build, own and operate an air separation unit ("ASU") for supplying nitrogen. Air Products will also own and operate a steam turbine generator for supplying power and other utilities to GCA's new ammonia production facility.

(Source: Conference call)

Balance Sheet Strength Secures Long-Term Potential

Thanks to APD's relatively low leverage of 0.7x EBITDA this year and a large debt capacity of 10.7B USD because of a strong investment grade balance sheet, the company is able to fund its Capex program easily. Summing up these items, APD enjoys an estimated FY18-FY22 capacity of 17.7B USD in aggregate. This is in contrast to what other chemical companies have to do, namely scaling back investments courtesy of overcapacity, shrinking margins and higher leverage. I'd like to stress that these investments in new capacity are going to be a drag on APD's non-adjusted free cash flow in 2020. Later in this thesis, I'm going to break up the cash in and outflows to gauge APD's recurring FCF utilizing maintenance CapEx.

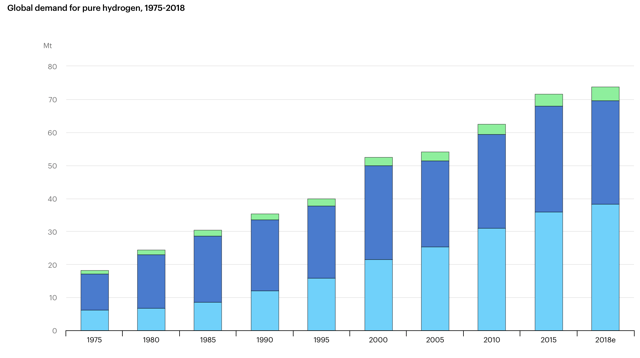

The Hydrogen Market Enjoys Unprecedented Momentum

APD is making the right moves when it comes to tapping into the potential of hydrogen and nitrogen as the number of countries with polices that directly support investment in hydrogen technologies is increasing. According to IEA, the hydrogen market is now expected to grow by around 6%-8% per annum, backed by oil refining and production of fertilizers. But hydrogen can be utilized in more sectors such as power generation (to enable more contribution for renewables), transport and building. There are, however, several challenges to relying on hydrogen as it relates to carbon emissions (extraction from natural gas and coal) and the cost of using low-carbon energy.

(Source: "IEA")

Merchant-based hydrogen generation is the fastest growing segment in the hydrogen generation market. The merchant-based hydrogen can be produced by water electrolysis and natural gas processes. This method of distributed hydrogen generation reduces the need for transportation of fuel and construction of new hydrogen generation infrastructure. Hence, merchant-based hydrogen generation is expected to grow at a high CAGR during the forecast period. APD has made significant progress in acquiring market share in this business area. It sees significant opportunities to solve sustainability challenges through gasification, carbon capture technology solutions, and hydrogen for mobility. Gasification enables an environmentally friendly way to use plentiful, lower value feedstocks, and technology strength is key in this area. After having completed the acquisition of GE’s gasification technology in 2019, APD can provide a complete solution to its customers, including development, technology, engineering, construction, and operation of large syngas projects.

Financial Analysis

Revenue Breakdown By Segment

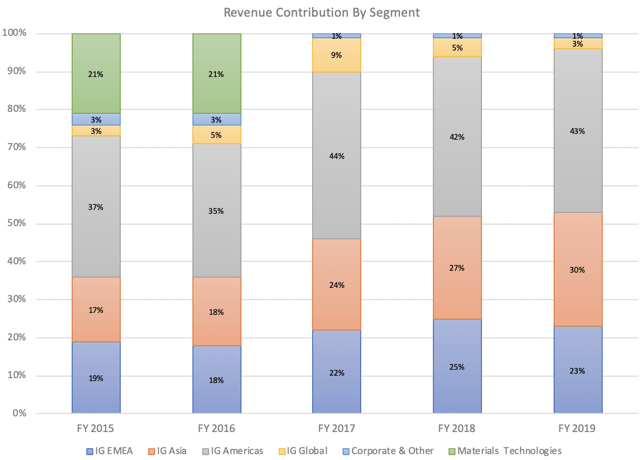

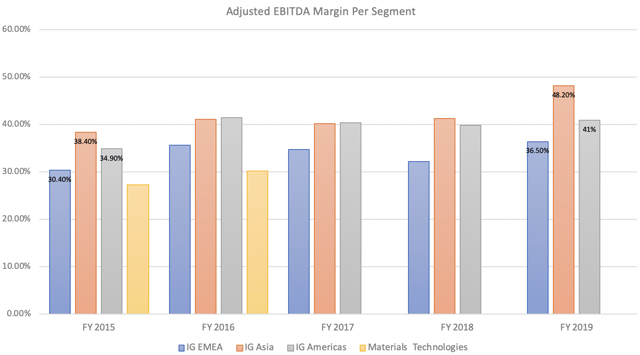

As I've already mentioned at the beginning of this article, APD completed the spin off of its Materials Technologies business in FY 2017 as it started to re-focus on its core segment, namely "Industrial Gases" ("IG"). This well-thought-out step made a lot of financial sense as this business served the semiconductor, polyurethanes, cleaning and coatings, and adhesives industry. These end-markets are more subject to changing economic conditions and provide lower cash conversion rates with fierce competition. Materials Technologies clearly didn't fit into APD's framework aiming at becoming the world's most profitable industrial gas company.

(Source: Author's work)

As can be seen from the stacked diagram above, the fast-growing Asian market now represents roughly 30% of APD's total revenues with EMEA being the smallest contributor of the three major segments ("IG Asia", "IG Americas" and "IG EMEA"). I'm going to dig deeper into the Asian opportunity later on.

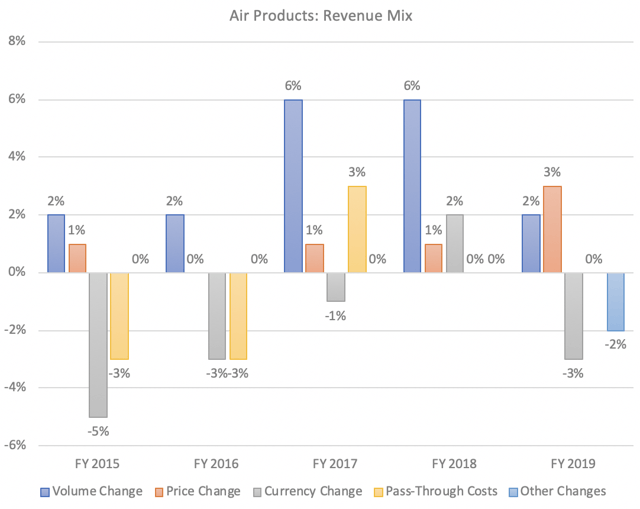

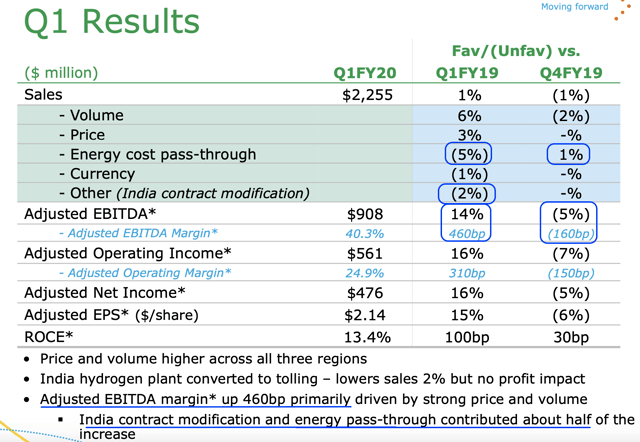

Healthy Volume and Price Growth Last Year

In FY 2019, APD continued to benefit from healthy volume growth and in addition to that, the current supply and demand situation allows for price hikes, as can be seen from the summarizing graph below.

Heading into 2020, management is confident about maintaining this positive momentum with 6% YoY volume growth in Q1. Thanks to a combination of acquisitions, underlying sales growth and new plants, APD was able to more than offset the adverse impact of weaker foreign currencies and lower energy-pass through costs.

APD's Adjusted Free Cash Flows Keep Growing Despite Soft Economic Outlook

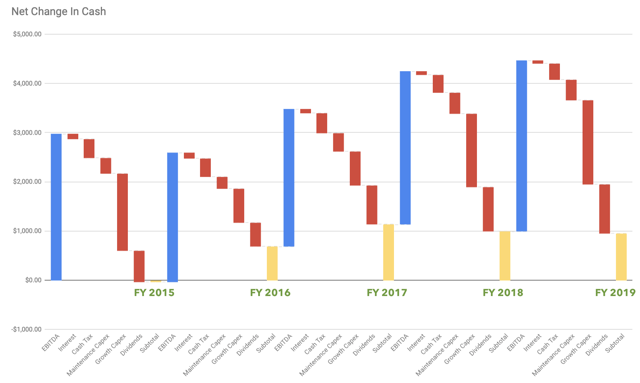

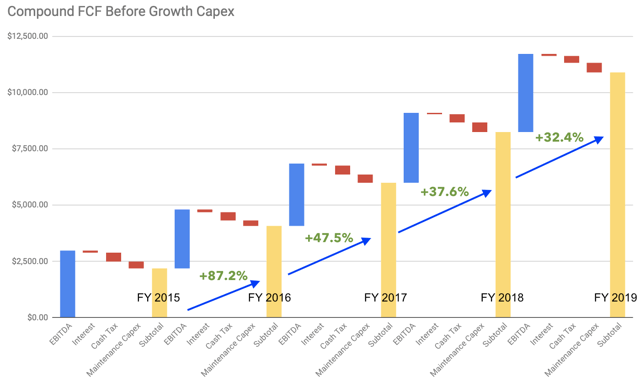

Analyzing adjusted cash flows is by far the best approach to gather information about a company's capability of announcing new investments (building a new plant), paying down debt and finally distributing dividends. If you take a look at APD's simplified cash flow statement and take those numbers at face value, you'll notice that the company has used its entire operational cash flow to fund both maintenance and growth Capex (including M&A) without being forced to take on new tranches of debt.

(Source: Author's work based on the company's information)

When dissecting the cash flows and looking only at the maintenance Capex, the situation changes dramatically with a cash flow accumulation in excess of 11B USD over the past 5 years. The following picture underpins management's pledge to create superior shareholder value as it continues to grow distributable cash flow.

(Source: Author's work based on the company's information)

APD's business profile and strategy of focusing on the core business has resulted in strong cash conversion rates for quite some time now. The recently announced large investments do not change my view on that matter as they are set to improve efficiency and profit margins while allowing for significant underlying (volume) growth.

For FY 2020, management is guiding for total capex spending of 4B to 4.5B USD, including the expected investments for the Jazan gas and power project. From now on, APD should be able to produce recurring free cash flows in excess of 2.7B USD before dividends and growth capex (including M&A). This represents a FCF/EBITDA conversion rate of 71.9%, a percentage which most other chemical companies barely achieve. After deducting the dividend payments of 1.01B USD, there's still a sizable 1.7B USD left to re-invest directly into the core business.

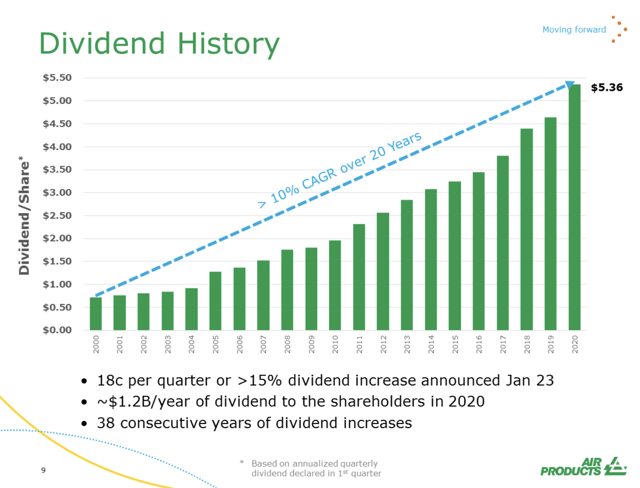

Dividend Growth Accelerates

A day before releasing the Q1 2020 earnings report, APD surprisingly hiked the dividend 15.5% thereby marking the largest increase in absolute dollar terms. This decision fits into the longer-term picture of showing clear alignment with shareholders to consistently grow the dividend at a double-digit rate. I see no structural change in APD's dividend policy as the payout ratio remains healthy at 40% of distributable cash flow.

(Source: Company presentation)

During the conference call for Q1 2020, CEO Ghasemi made the following comment regarding APD's dividend policy:

I think you should expect that we would continue to give approximately half of our free cash flow as dividends. That has been kind of one guidance, and obviously, a percentage of the share price is another part. I personally think that we should continue to pay a very healthy dividend, something which is in the order of 2.5% of our share price and also about half of our free cash.

(Source: Conference call transcript)

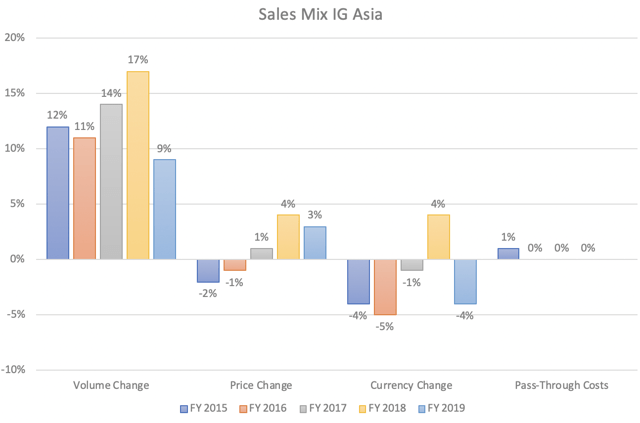

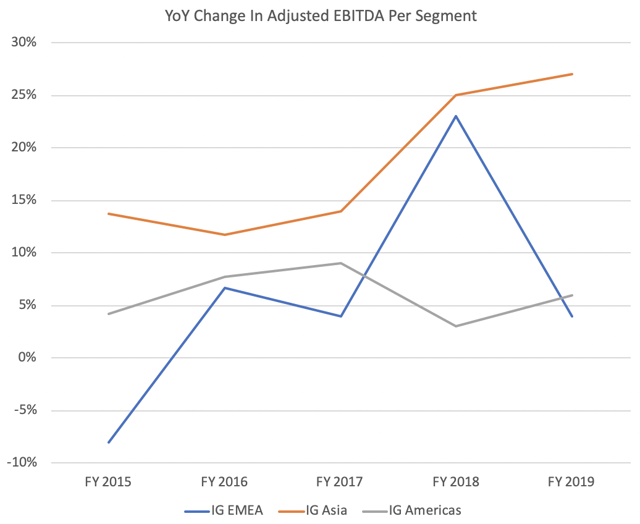

Strong Momentum In Asia Despite Trade War Tensions

While many chemical and thus cyclical companies have been struggling with the Asian market due to decelerating economic growth and weaker pricing, APD has been enjoying the 11th consecutive quarter of year-on-year price improvement. In conjunction with strong volume growth of 9% in the first quarter of 2020, this led to a considerable year-on-year increase in the Asia's EBITDA margin from 47.5% to 50.1% or the highest among all geographical areas. During the conference call of FY 2019, APD's CEO was really pleased with these results and said:

This strong performance reinforces that our business has not been materially affected by trade tensions. Furthermore, our customers and Chinese Government continue to be excited about how Air Products is helping China may meet its goals. They are very supportive. We are successfully executing projects and remain very optimistic about our long-term prospect in this region.

(Source: Conference call transcript)

In Q1 2020, the EBITDA margin for the Asian business rose to 50.1%, marking a YoY improvement of 260 basis points. Backed by rock-solid sales growth of 11%, this caused the EBITDA number to increase 16%.

As shown below, APD has achieved mid-teen volume growth in Asia over the past 5 years. Since 2017, price changes have again turned positive despite worries about a worldwide economic slowdown and a slump in manufacturing activity.

(Source: Author's work based on the company's information)

Not only has Asia grown much faster than the developed markets, it also posts the best profit margins while the annual EBITDA growth rates have proven much more resilient than for example in EMEA. Although Asia's EBITDA margins have seen a serious uptick over the last 5 years, EMEA's profit margins have been oscillating around 36%. As mentioned earlier, the Materials Technologies business was spun off in 2017 as this segment wasn't complementary to APD's simplified structure.

(Source: Author's work based on the company's information)

(Source: Author's work based on the company's information)

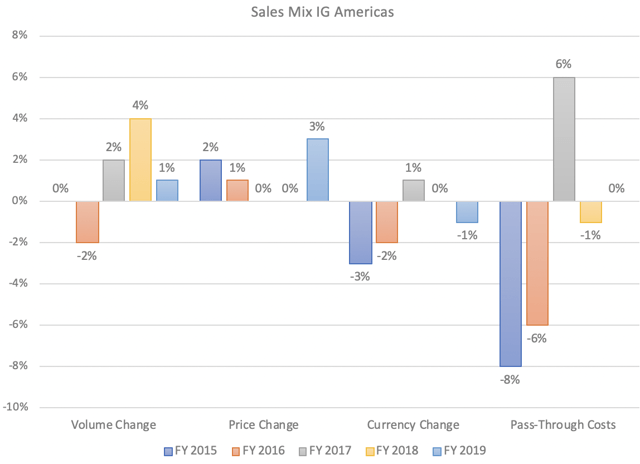

Margin Improvement in Americas

During the first quarter of 2020, underlying sales growth was 4% courtesy of strong price momentum and the Gulf Coast hydrogen activities. Excluding the favorable impact of lower energy pass-through costs, APD's EBITDA margin saw a YoY improvement of 370 basis points.

It's important to understand that lower energy pass-through costs have a negative impact on APD's top line, but don't further affect its EBITDA and entire bottom line. For example, a service provider may subcontract a portion of the service it provides to customers and agree with the customer to be reimbursed for the subcontracted services (referred to as a "pass-through" cost). Based on revenue recognition, APD's energy pas-through costs are part of its top line, but the EBITDA margin (and thus the relationship between EBITDA and revenues) is oppositely affected. The same goes for exceptional items such as the India modification which impacted APD's revenues unfavorably, but contributed significantly to its improving EBITDA margin.

Long story short, the bottom line and real cash flows are what APD shareholders should pay attention to. The following slide from APD's latest earnings call should make it clearer.

(Source: Company's earnings call)

For Q2 2020, CFO Scott said the "Americas" division is expected to see exceptionally higher maintenance spending due to planned life-extension work on several facilities.

The region's top line performance has been characterized by volatile energy prices, currency headwinds but strong price momentum. While volume growth for FY 2019 came in at just 1% compared to 4% in FY 2018, new projects are expected to bolster underlying sales growth going forward.

(Source: Author's work based on the company's information)

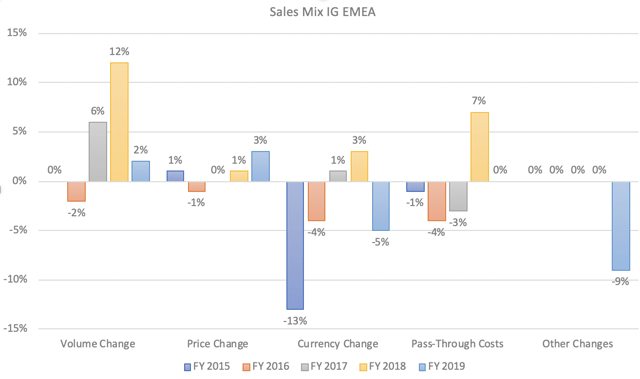

Solid Performance in EMEA

In Europe, the Middle-East and Africa, underlying sales growth accelerated in all subregions in the first quarter of 2020 despite muted economic growth. While the India contract modification and adverse energy pass-through costs nibbled at the top line growth, they contributed over 400 basis points to the 610 basis points improvement in EBITDA margin. I hope we'll see more consistency in underlying sales growth for the EMEA region.

(Source: Author's work based on the company's information)

As you can see from the graph above, FY 2015 was a horrible year for EMEA with a FX headwind of 13%. But generally speaking, underlying sales growth has been pretty robust over the past 5 years despite challenging market conditions. Recent manufacturing data from Europe are pointing to stabilization, but it remains to be seen when we get a substantial economic recovery.

Peer Comparison

In the world of industrial gases, there are basically four major oligopolists accounting for more than 80% of total production: Linde Plc (LIN), Air Liquide (OTCPK:AIQUF), Air Products and Taiyo Nippon Sanso. Ranked by their size, Linde - which merged with Praxair in 2018 - stands out from the group with pro forma sales of 28B USD. Air Liquide has total revenues of 22.2B EUR, while APD's sales are close to 9.5B USD and Taiyo's approaching 8B USD. As it relates to their financial performance and future prospects, let's have a closer look at their profitability, debt profile and growth profile. Please note that I've used FY 2019 for APD's actual results and the forecasted FY 2019 results for Linde and Air Liquide. Also, as a new entity, one should be assessing Linde's future prospects instead of analyzing outdated numbers.

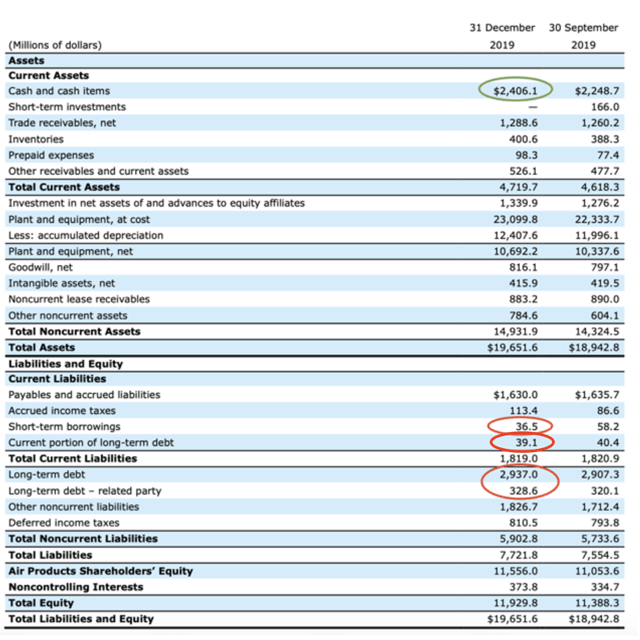

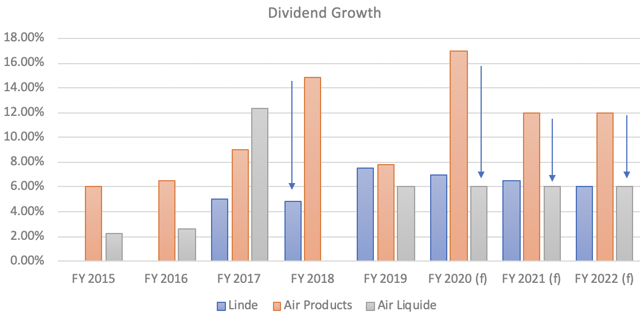

Dividend Growth

Thanks to its robust balance sheet, there's no need for APD to pay down its marginal net debt portion of 935.1M USD.

(Source: Company's financial statements)

Instead, as I mentioned earlier, its investment-grade balance sheet and large debt capacity allows for substantial Capex spending which will drive top line growth. As Air Liquide and Linde are both primarily focusing on squeezing synergies out of their large acquisitions, APD should be able to continue to outpace its rival by achieving a double-digit dividend growth rate over the next 3 years.

As apposed to APD's capital return strategy which relies solely on dividend payments, Linde's management believes share repurchases are the major catalyst for future earnings growth. Linde completed a $1 billion share repurchase program in December of 2018, followed by a $3 billion buy out of Linde shares that weren’t tendered in the merger with Praxair. Finally, the company has another $6 billion program that runs through February 2021. In addition, the dividend was recently raised once again and now runs at about $2 billion annually. Linde is very serious about its capital returns as the business generates more cash than it can profitably invest.

(Source: Author's work based on the company's information)

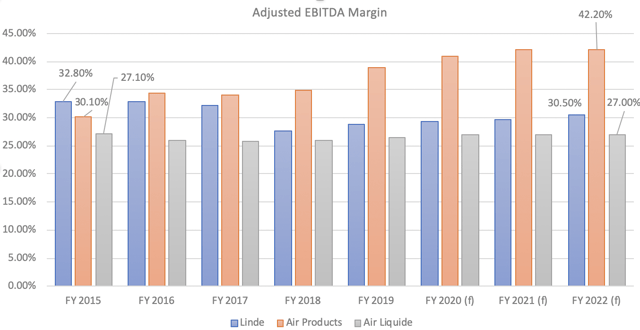

Profitability

As for profitability, APD should be capable of further improving its EBITDA margin with an expected change of 1,210 basis points over an 8 year time span (from FY 2015 to FY 2022). Air Liquide's profit margins, on the other hand, have been hovering around 27% for quite some time now, despite its savings plan related to the Airgas acquisition being ahead of schedule.

(Source: Author's work based on the company's information)

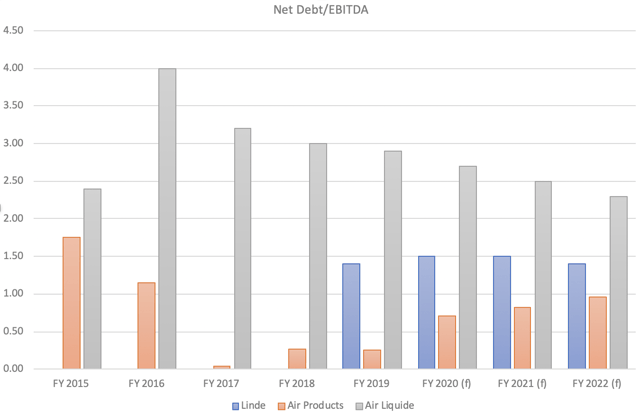

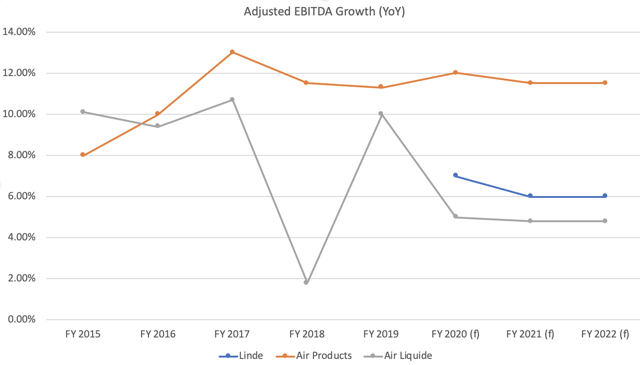

Leverage and Growth Prospects Go Hand in Hand

The fortress balance sheet of APD is precisely what sets it apart from the rest. While Air Liquide is steadily paying down debt by keeping investments under control, APD is moving forward with its substantial capex plan of 4.5B USD this year and an expected 3B USD for both 2021 and 2022. To put some context around those numbers, APD will be spending 109% of its EBITDA on net capex this year, whereas Linde and Air Liquide re-invest around 36% - 40% of their gross cash flow.

(Source: Author's work based on the company's information)

(Source: Author's work based on the company's information)

The fact that leverage, capex and EBITDA growth are closely connected to each other results in industry-leading growth prospects for APD, as shown below. Its cash flow growth rate is about double that of Linde and 2.5 times that of Air Liquide.

(Source: Author's work based on the company's information)

Valuation

Given the attractiveness of the gases industry, superior management execution and double-digit EPS growth over the next 3 years, I believe APD is a buy at today's levels. I expect the annual shareholder return to be a combination of both adjusted earnings yield and EPS growth. With 2.7B USD in recurring FCF based on maintenance capex, APD shares offer a 5.1% shareholder yield which is quite decent when putting its growth profile and track record in perspective.

In my base case scenario, I bank on 2020E adjusted FCFs (based on maintenance capex) of $2.7B evolving to $4.95B in 2029E. With a reasonable discount rate of 8%, a perpetual growth rate of 2% and 935.1M USD in net debt last year, APD's fair value is near $283.91. This translates into 17.6% upside potential from today's price. My conservative assumptions are based on a starting annual growth rate of 9.3% (less than management's guidance of 13%-15%) which slows down to 5.3% by year 10.

(Source: Author's work based on his own assumptions)

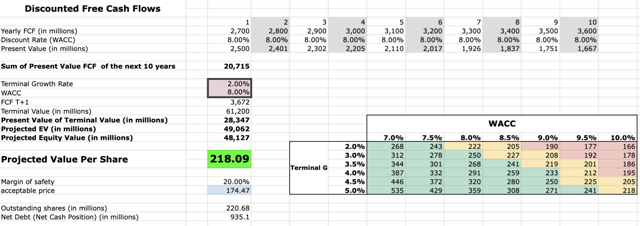

In my bear case scenario, annual cash flow growth comes in at 2.5% - 3%, which is highly unlikely given management's recent projections and track record of consistently delivering on its guidance. Even if this scenario comes true, shares are still worth $218.09. This represents 9.7% downside risk potential from today's level.

(Source: Author's work based on his own assumptions)

Along with an EBITDA margin in excess of 42% by 2022, shares could easily provide annualized returns of around 15% in the long run, in line with the returns we've seen over the last 5 and 10 years.

Based on recent history, there's a reason why APD should be trading at multiples exceeding its peers', which isn't the case right now from an Earnings/EV point of view. For 2021, Air Liquide trades at an adjusted earnings yield of 3.8% based on its enterprise value of 73.3B EUR, while Linde shares produce a yield of 3.2% when taking the share buyback program into account. With an adjusted earnings yield of 4.8% for 2021, APD unquestionably comes out on top.

Risks

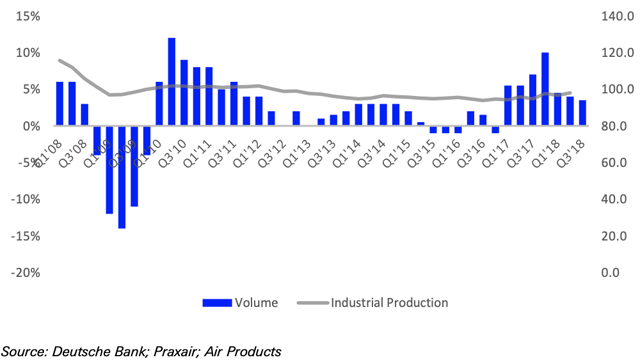

As always, there are risks to consider before pulling on the trigger buying shares of APD. I believe that the biggest threats are external, as APD's balance sheet and profitability are by far the best of the whole industry. While a slowdown in economic growth is expected to weigh on the demand for industrial gases, APD has proven itself capable of overcoming hurdles related to the US-China trade war (over 2018-2019, APD has posted a total volume growth of 8%) and the economic challenges of 2016 when its underlying volume growth amounted to 2%.

Looking at APD's nearest competitor (Praxair which is now part of Linde Plc), the weakness in 2015-2016, during which Praxair posted 8 consecutive quarters of flat-to-down volumes, reflected weakness in US steel, oil & gas and manufacturing, recessionary conditions in Brazil and modest growth in Europe. So, APD was still able to grow underlying volumes by acquiring market share.

Another risk is a slower-than-expected adoption to the hydrogen technology which has definitely its pros and cons:

- Pros: No vehicle emissions other than water vapor. Fuel economy equivalent to about twice that of gasoline vehicles. Hydrogen is abundant, and can be made from renewable energy.

- Cons: This space-age technology is expensive. Acceptable range requires extremely-high-pressure, on-board hydrogen storage. Few places to refuel. Hydrogen is very expensive to transport and there is no infrastructure in place yet. Currently hydrogen fuel is made from nonrenewable natural gas in a process that creates enormous CO2 emissions.

However, APD's largest-ever US investment is a strong sign that the company wants to tap into this significant growth opportunity, as stated above in this thesis.

Conclusion

APD's business is thriving despite soft economic growth and the trade war chatter hurting business sentiment. CEO Ghasemi made it clear that these elements haven't had a meaningful impact on future growth and profitability. For FY2020, management guides for a substantial amount of capex spending to take advantage of growth opportunities (such as the CGA Project). Volume and price momentum are robust in Asia and I expect the region's contribution to APD's overall cash flow to continue to increase going forward. The recent above-average dividend increase of 15.5% underpins APD's excellent shape.

From now on, APD should be able to produce recurring free cash flows in excess of 2.7B USD before dividends and growth capex (including M&A). This represents a FCF/EBITDA conversion rate of 71.9%, a percentage which most other chemical companies barely achieve. After deducting the dividend payments of 1.01B USD, there's still a sizable 1.7B USD left to re-invest directly into the core business.

In my base case scenario, I bank on 2020E adjusted FCFs (based on maintenance capex) of $2.7B evolving to $4.95B in 2029E. With a reasonable discount rate of 8%, a perpetual growth rate of 2% and 935.1M USD in net debt last year, APD's fair value is near $283.91. This translates into 17.6% upside potential from today's price. My conservative assumptions are based on a starting annual growth rate of 9.3% (less than management's guidance of 13%-15%) which slows down to 5.3% by year 10.

In my bear case scenario, annual cash flow growth comes in at 2.5% - 3%, which is highly unlikely given management's recent projections and track record of consistently delivering on its guidance. Even if this scenario comes true, shares are still worth $218.09. This represents 9.7% downside risk potential from today's level.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.