Dividend investors often view Realty Income (NYSE:O) as a benchmark in the real estate investment trust (REIT) space with its monthly dividends and steady performance, but Unibail-Rodamco-Westfield (OTCPK:UNBLF) currently offers a more attractive investment proposition for investors who can handle EUR currency risk. Both companies are among the largest and highest-quality retail REITs in the world, but Realty Income's recent outperformance leaves URW offering a dramatically more attractive dividend yield and more upside to the share price. URW also offers preferred geographic diversification with a majority of assets in Europe where retail overcapacity is not as acute as in the US. URW's long-time strategy to focus on premier locations with high footfall in key urban environments also arguably leaves it more protected than Realty Income when it comes to the most critical risks in retail, such as growth in online shopping.

This article details why dividend investors should consider a switch from Realty Income to URW and also serves as an introduction to URW for US-based investors that may be less familiar with the company.

Both companies are impressive and well diversified

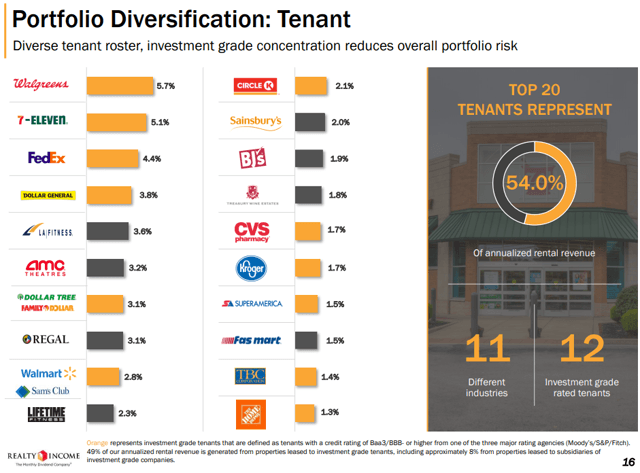

We have long owned a position in Realty Income, and it's hard to argue with the company's success considering the 16.8% Compound Average Annual Total Shareholder Return since its 1994 NYSE listing, which is significantly better than benchmark indices over the period. The company has many of the attributes we seek in a REIT, including size and diversification across tenants, industries and geographies as well as a focus on high-quality locations and clients.

Source: 3Q 2019 Retail Investor Presentation

But Realty Income is not the only high-quality retail REIT available to investors, with Unibail-Rodamco-Westfield offering a comparable profile. URW owns EUR 65 billion of commercial property (as of June 30, 2019), split 86% in shopping centers, 7% in offices, 5% in convention centers and 2% in services. Following the mid-2018