Western Digital (NYSE:WDC) put up strong results. WDC is more exposed to NAND while Micron (NASDAQ:MU) is one-third exposed to NAND. WDC cited strong industry dynamics helping their numbers improve. Similar trends should benefit Micron.

Recent History

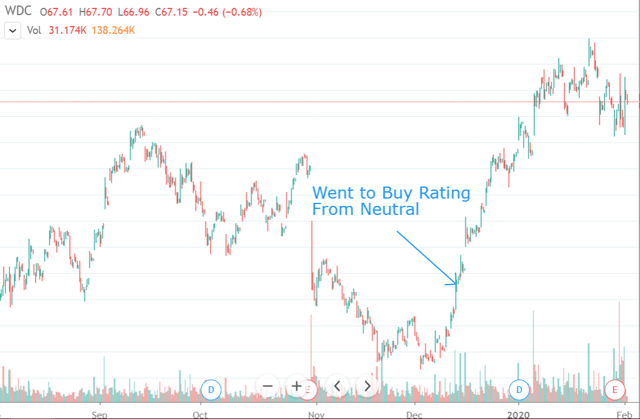

We went to a Buy Rating from Neutral on WDC on Dec. 12 (

paywall

).Above you can see where we got more bullish. Here's what we said at the time:

"With NAND pricing moving up I think this stock has bottomed. I think 5G and Apple moving along with pricing moving up and the stock near its lows is a great risk reward.

Really pricing is so important for memory exposed stocks. NAND pricing is now up after being down for a while. Let's keep it simple, that's good.

You saw me enter to WDC in our model portfolio. I want to go to a Buy Rating. It's not as strong as a Strong Buy because I don't have everything line up but I think this is something that can go."

This story has been playing out. 5G and Apple are coming on along with other drivers I'll talk about below. You saw me above get excited about pricing which you'll see below was a core driver to their earnings taking the stock higher.

I do think short term it's a little more fully valued but I think that medium term there's still upside. I'll explain.

Strong Memory Pricing

Western Digital had strong comments on pricing. Since memory companies are cyclical, pricing matters very much. In fact pricing is the single most important datapoint for me when doing work on WDC and Micron.

Here's what Western Digital said on pricing:

"As we enter the March quarter, flash pricing continues to improve."

"Relative to mix, I would say both product and

High Hit Ratio Tech Stock Picks: #1 On Seeking Alpha.

Two Week Free Trial Click Here

Subscribers are saying;

"increased profits greatly"

"Remarkable work. Pretty high hit ratio."

"pro with a great hit rate."

"paid for itself many times over."

Earnings season is here. This is our prime time. We recently spoke to a ton of companies. QCOM, SQ, TER, MSI, TTWO, ATVI, ROKU, AAPL, TTD, TWTR, SWKS, TSLA, FTNT, ANET, INTC, TWLO, WDC, JNPR, SPLK, MSFT, LRCX, FB.