Note: This article was released to CEF/ETF Income Laboratory members on Jan. 27, 2020.

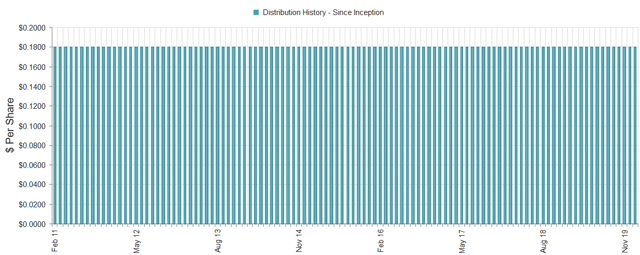

On January 22, Stone Harbor Emerging Markets Income Fund (NYSE:EDF) announced a -5.6% reduction to their monthly distribution, from $0.18 per share to $0.17 per share. The next ex-date is February 13, 2020. This distribution cut was surprising to some participants because the fund had been paying the same level of distribution since inception nearly 10 years ago.

At first glance, this unbroken streak of distributions may seem quite impressive for a fund yielding ~22% at NAV (16% on market price), but when you realize that the fund was simply paying out more and more out of return of capital ("ROC"), it's not that impressive at all. After all, the fund is simply selling its assets and return your original capital back to you. Except, you only get returned $1 of assets for every $1.50 that you paid into the fund due to its 50% premium!

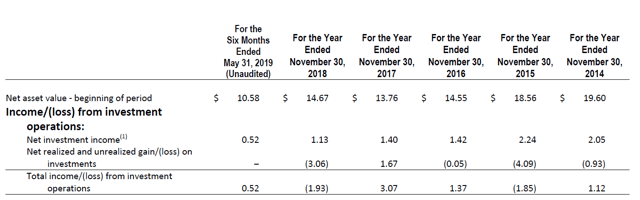

As you can see from the financial highlights below, EDF's net investment income had been dwindling over the last 5 years. For the year ended November 30, 2014, the fund earned $2.05 of NII per common share. Four years later, that number had fallen to $1.13, a decrease of 45% (in fact, this is a decrease of nearly 50% from 2015's NII of $2.24/share). Annualizing the latest 6-month period gives $1.04, the lowest income in the history of the fund.

(Source: EDF latest semi-annual report)

(Source: EDF latest semi-annual report)

The illusion of distribution safety and the high yield are probably the reasons why the fund has been bid up to a massive premium of +50%. I mentioned earlier that the cut was surprising to many investors in the fund because it had been paying at the same rate for the last 10 years. But then, again, what

Profitable CEF and ETF income and arbitrage ideas

Closed-end funds news and recommendations are now exclusive to members of CEF/ETF Income Laboratory. We also manage market-beating closed-end fund (CEF) and exchange-traded fund (ETF) portfolios targeting safe and reliable ~8% yields to make income investing easy for you. Check out what our members have to say about our service.