In December 2019 I wrote an article describing the alternative asset management industry and analyzed NYSE:KKR as my top pick here. I also did an interview discussing further questions about the company and its business model here.

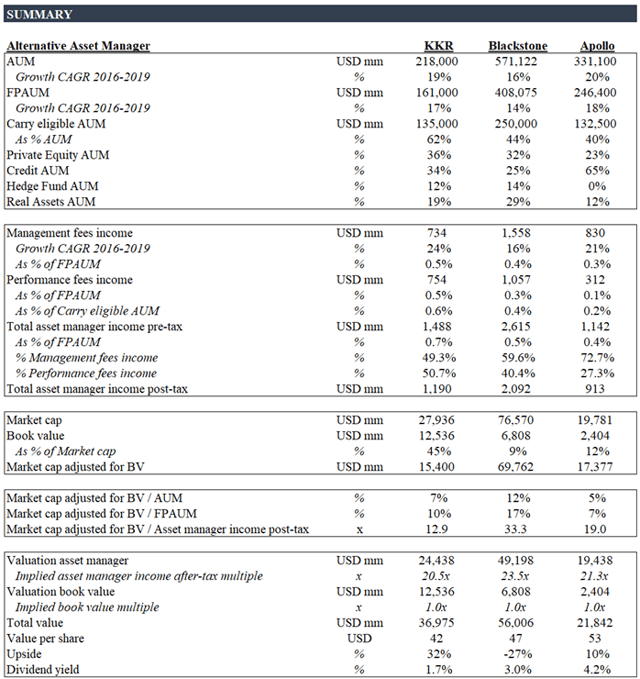

When I discuss this idea with other investors, most of the time I receive the following question: Why KKR instead of Blackstone (BX) or Apollo (APO)?. I will try to answer this question in this article. As a basis to help to follow my argument, I made the following table comparing KKR, Blackstone and Apollo.

Source: Image by author, using data from company filings and his own estimates

In terms of asset management strategies, KKR and BX are very well diversified. Private equity represents one-third of AUM and Credit, HF and Real Assets strategies account for the other two thirds. In the case of Apollo, 65% is Credit, 23% is Private Equity and 12% Real Assets. Consider the anti-cyclical nature of the Credit strategy. That does not mean that current capital deployed in credit would not suffer in a downturn. However, opportunities to deploy capital in Credit in a downturn will be massive. For example, Oaktree, doubled its AUM from 2008 to 2010 when other asset managers grew AUM ~40% in the same period. That is the reason why Brookfield acquired Oaktree in march 2019, “The complement of Brookfield’s pro-cyclical business to our more counter-cyclical business”.

From our research talking to people in the industry, it seems that BX and APO are slightly above in terms of execution and returns. However, KKR achieved very good historical returns as well. Actually, in 2019 KKR achieved 29% gross returns in PE, 24% in Real Estate, 13% in Infra and 8% in Credit. I would say all three have a very strong brand, although maybe BX’s brand is just above KKR and APO’s.