ETF Overview

Vanguard Communication Services ETF (NYSEARCA:VOX) owns a portfolio of U.S. communication services stocks. The ETF tracks the MSCI U.S. Investable Market Communication Services Index. The fund includes a combination of traditional communication services providers as well as a few higher growth technology stocks such as Alphabet (GOOGL), Facebook (FB), and Netflix (NFLX). These are stocks that generate consistent cash flows. VOX is currently slightly undervalued against its historical average. Therefore, we think it is still okay for investors to own this fund right now.

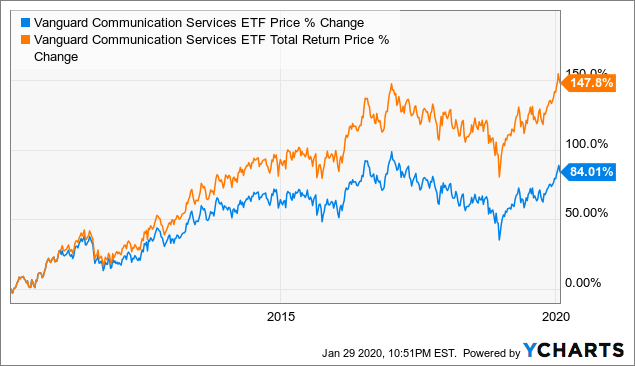

Data by YCharts

Data by YCharts

ETF Analysis

These are moaty stocks that generate consistent cash flow

Although VOX’s portfolio include about 114 stocks, its top 10 holdings represent nearly 69% of its entire portfolio (see table below). Fortunately, its top 10 stocks are stocks that have competitive positions over their smaller peers. Its top two holdings are high-profile large-cap technology stocks, Alphabet and Facebook. While technology stocks can be pricey and often trade at high valuations without generating much cash flow, this is not true for VOX’s top two holdings. In fact, Alphabet and Facebook generate consistent cash flow from advertising. We expect advertisers will continue to put money into these two companies’ platforms as they have a loyal subscribers and users. Facebook’s social network continues have billions of active users every month and is growing its advertising revenue at a rapid pace. Similarly, Google’s multiple services such as Youtube, Gmail, Google Drive, continues to provide multiple services for its active users. Since these companies do not need to invest in a lot of capital to maintain these services, they are able to maintain strong financial positions.

Ticker | Name | Morningstar Moat Status | Financial Health Rating | Weighting |

GOOGL | Alphabet | Wide | Strong | 22.2% |

FB | Wide | Strong | 14.8% | |

T | AT&T | Narrow | Moderate | 7.8% |

NFLX |