As an introduction...

I must confess that in the past I wrote several articles that negatively characterized the prospects for Microsoft’s (NASDAQ:MSFT) capitalization. I admit that I did not expect the impressive growth that the company has shown over the past months. But at the same time, I am worried: Was I completely mistaken or just rushed to conclusions?

1. Technical parameters

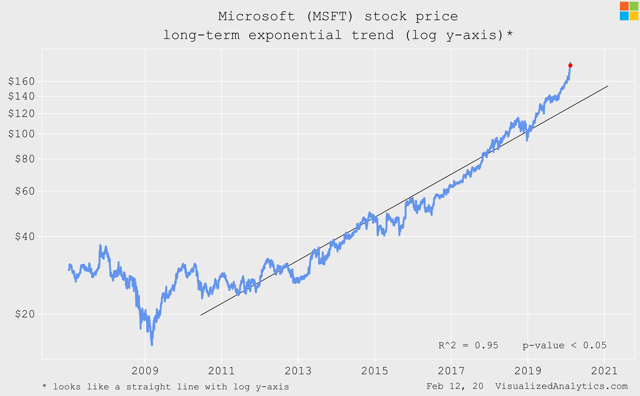

Starting from 2010, Microsoft stock price has been following its long-term exponential trend that always looks like a straight line on the graphs with log y-axis.

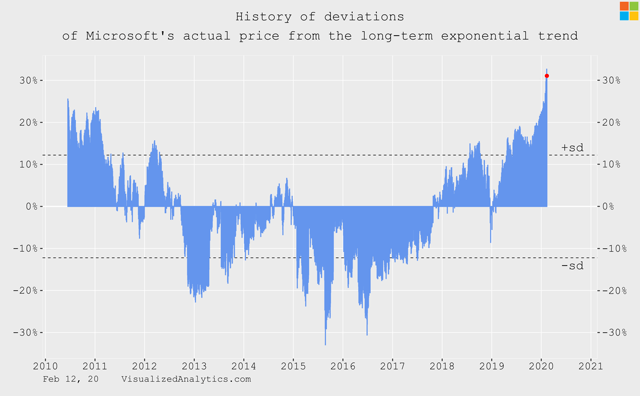

Now, the company's stock price is above this trend by more than two standard deviations. In other words, this means that Microsoft stock price has been growing at a super-exponential rate. And this is very similar to how the bubble grows.

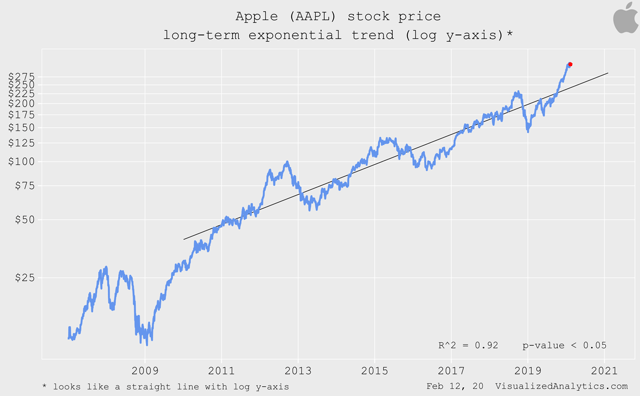

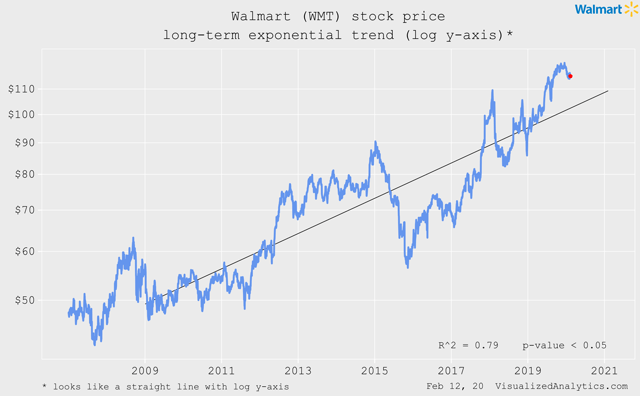

But do you know what scares the most? The fact that a similar situation is observed with other large companies:

Apple (AAPL):

Walmart (WMT):

Not to mention Tesla (TSLA):

It ought to be recalled that super-exponential growth is rarely observed in nature, and when it appears, it indicates a temporary and unstable state.

2. Growth drivers

I often hear the statement that Microsoft is now completely different from what it was six years ago. You know, I totally agree with that. In my opinion, Microsoft has become an excellent example of a company's ability to grow again. By focusing on cloud computing, the company was able to find its new niche as a global technology provider. And therefore, in this section, I will analyze only the last five years.

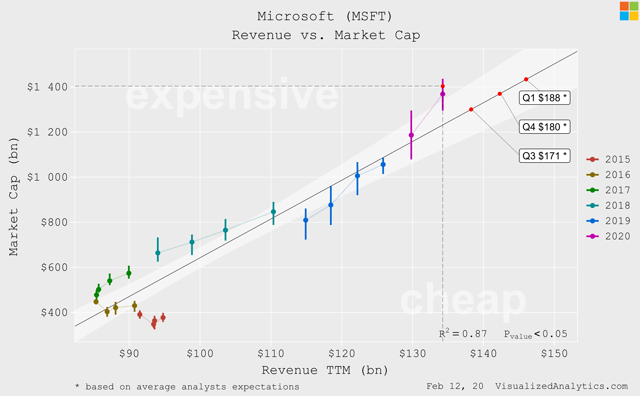

So, over the last five years, Microsoft's capitalization has been in a qualitative linear relationship with its revenue TTM absolute size:

This relationship identifies its current capitalization as overvalued.

But even more interesting, over the last years, Microsoft's capitalization, as reflected by the P/S multiple, has