Bull markets are born on pessimism, grown on skepticism, mature on optimism, and die on euphoria. – John Templeton

High-quality earnings, growing profit margin, and stable dividend yield are solid reasons to consider adding CUBE in your watchlist. CubeSmart is a self-administered and self-managed real estate company focused on the ownership, operation, acquisition, and development of self-storage facilities in the United States. The storage options range from personal storage to commercial to military. CubeSmart is one of the top six largest self-storage operators who collectively account for 18% of the facilities, while smaller operators own 82 %. As of December 31, 2019, the company owns 523 self-storage properties totaling approximately 36.6 million rentable square feet.

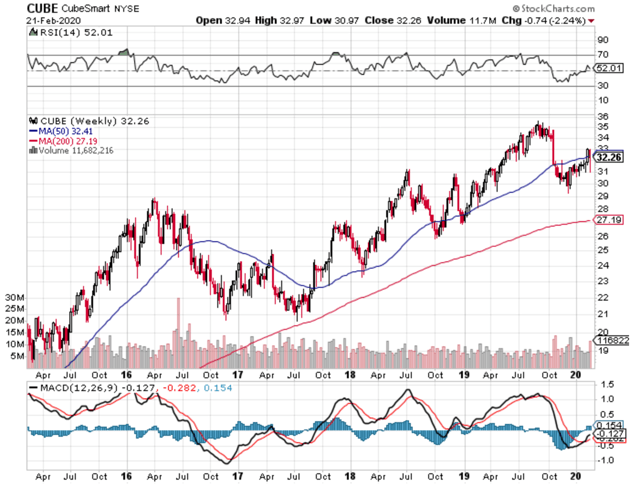

Figure 1: CUBE Share Price

Other than growing revenue, CubeSmart exhibited impressive profitability, with average earnings growth at 33% in the past five years. This earnings growth is more than twice the industry and market average. In today’s competitive business landscape, companies often race against each other for market share to the detriment of profits. This results in massive losses, which gets harder to recover through time. Financially sustainable companies, on the other hand, generate value in the long run.

Dividend Yield

CUBE paid hefty dividends to its shareholders for the past ten years. At 4.2% dividend rate, CUBE paid more dividends than the average of the top 25% of dividend payers in the United States. This dividend yield has been stable and growing.

Valuation

In tumultuous times, it is often worth paying a premium for stability. CUBE's current share price, however, asks for a discount. Analysts estimate CUBE stock to be undervalued, trading more than 20% below the estimated fair value. Although the 12-month price forecast is not as optimistic as the fair value estimate, which ranges from a high of $36 and a low of $28. The median forecast is around the current

How To Avoid the Most Common Trading Mistakes

How To Avoid the Most Common Trading Mistakes

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you'll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.