PDS To Consolidate Operations

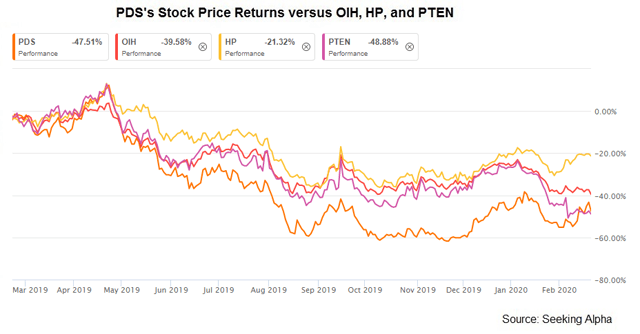

The downturn in the completion markets forced Precision Drilling Corporation (NYSE:PDS) to downsize its rig fleet significantly in the past year. Although pricing can remain stable, the drilling activity won't improve in the first half of 2020. I do not think the company's returns will improve in the short-term.

Just before the start of 2020, the natural gas liquids plays of Montney and Duvernay in Canada started to see some activity coming back. The company will look to generate additional revenue through the commercialization of the technology-based apps. It has started to drive down debt aggressively and is pursuing a lofty deleveraging target. If pricing in the pressure pumping business recovers in 2H 2020, its financial performances, as well as returns from the stock, are likely to improve in the medium-term.

Technology Initiatives

In my previous article, I discussed the commercialization of the Process Automation Control (or PAC) platform and the PD-Apps under development that can be commercialized. The company's AlphaAutomation system has multiple revenue-generating points in drilling functions, tripping functions, and survey functions. The system helps in reducing risk and drilling time and cost. These apps are priced in the range of between $250 and $1,000 per day. PDS has a total of 13 more apps under development that would be commercialized during 2020. So, technology can augment the company's top-line in 2020.

Analyzing The Strategies: U.S. And Canada

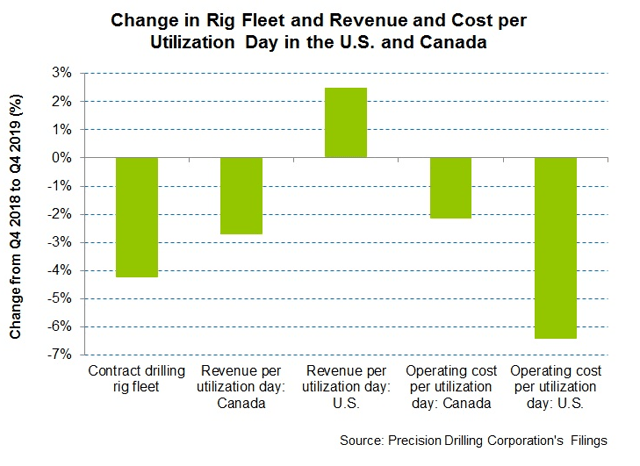

Although the onshore drilling rigs declined significantly (21% down), the company's average revenue per utilization day increased by 2% year-over-year in Q4 2019. On top of that, the operating cost per utilization day decreased (6% down), which helped increase per day operating margin by 19% year-over-year.

As we have been observing in the energy sector, the E&P operators have been reducing the active rig count due to

The Daily Drilling Report

The Daily Drilling Report

We hope you have enjoyed this Free article from the Daily Drilling Report Marketplace service. If you have been thinking about subscribing after reading past articles, it may be time for you to act. The oilfield has been at a low ebb, but has recently gained steam.

We have been recommending these companies since late summer. Locking in a gain of about 20% in a single month, and we think there’s more to come in 2020. Give it some thought, and act soon if you are interested. A 2-week free trial is applicable, so you risk nothing.