This article was highlighted for PRO subscribers, Seeking Alpha’s service for professional investors. Find out how you can get the best content on Seeking Alpha here.

The world’s most profitable airline available at a single-digit earnings multiple.

1. Key facts, figures and background

Price ($) | 135 | P/E '20 | 7.5 x |

Ticker | ALGT | EV/EBITDA '20 | 5.2x |

Market Cap (BUSD) | 2.2 | Dividend yield | 2.1% |

EV (BUSD) | 3.2 | Normalized ROE | 20-30% |

Daily liquidity (MUSD) | 20 | Net debt/EBITDA | 1.6x |

Allegiant Travel (NASDAQ:ALGT) operates one of the 3 US ultra-low cost carriers (ULCCs).

As opposed to its ULCC peers Frontier and Spirit (SAVE), the company has a unique “cockroach” business model which has been GAAP profitable each single quarter since 2004.

Maurice Gallagher (69) gained control of WestJet in bankruptcy court as a creditor in 2001 and built ALGT’s 100-jet fleet by focusing on low-frequency leisure routes with zero competition. Gallagher owns a stable 18% stake.

ALGT’s reported EV / EBIT multiple has compressed steadily since ’16, from the mid-teens to 7.6X today. On a P/E multiple basis, compression is even more dramatic due to 2018 tax cuts and the recent debt load. Since ALGT announced it is building a Florida resort 4 years ago (opening in June ‘21), the pure airline investor base and airline sell-side alike have shunned the stock. Despite this, ALGT has returned a total 10X - or 20.0% CAGR – for ’06 IPO investors: the result of profitably growing revenue double digits.

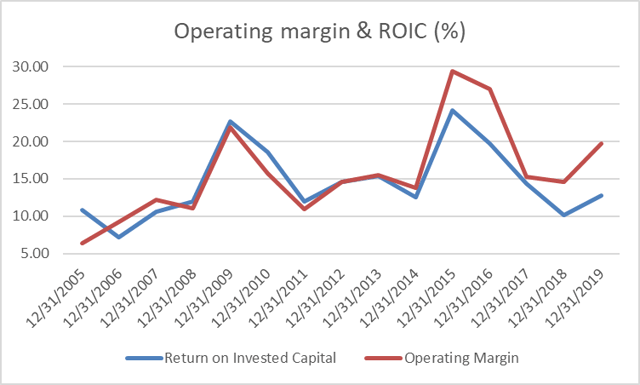

Figure 1: Data from Bloomberg. Allegiant has the world’s highest operating margin (and ROIC). Metrics were temporarily depressed during the complete fleet reshuffle in ’17 amd ’18 (next one in 2 decades)

Why has ALGT been consistently profitable?

- Unusually low fixed costs that go with its unique business model

- Gross profit margin is high