I have been looking forward to covering Ross Stores (NASDAQ:ROST). This Dublin CA-based retailer is one of the many stocks that did very well but rapidly dropped when coronavirus fears hit the market. The just-released fourth-quarter earnings show further sales and comparable store sales acceleration and stable margins. Even the outlook is promising. Unfortunately, the company is unable to give detailed information regarding the impact of the coronavirus on its sales and supply chain operations. Regardless, while uncertainties persist, the company outperformed the stock market and continues to be a go-to stock for retail-exposure seeking investors.

Source: Ross Stores

Q4 Was An Excellent Quarter

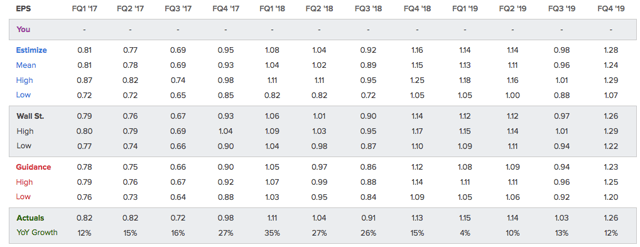

Ross Stores had a tremendous fourth-quarter. The company with one of the shortest earnings calls in its industry reported adjusted EPS of $1.26. This is exactly what analysts were looking for and yet another quarter of double-digit growth as fourth-quarter 2019 EPS is 12% higher compared to the prior-year quarter. It even looks like the 4% growth rate in the first quarter of 2019 was an outlier instead of a move lower after years of accelerating bottom-line growth.

Source: Estimize

Source: Estimize

As usual, strength started all the way at the top as sales totaled $4.4 billion in the fourth quarter. This is an improvement of 7% and fairly in line with growth rates of the past few years. Comparable store sales (hereafter referred to as 'comps') rose by 4% on top of 4% in the prior-year quarter. This is important to mention as it is quite common that retailers struggle to raise comps after reporting outstanding results in the comparable quarter(s). On a full-year basis, comps were up after growing by 4% on a full-year 2018 basis.

In the fourth quarter, the strongest sales were achieved in children's clothing. The strongest region was the Midwest. The company's merchandise assortment was